Special Needs Trust Form 1041 For 2022

Description

How to fill out Trust Agreement - Family Special Needs?

Locating a reliable source for the most current and pertinent legal templates is half the challenge of navigating bureaucracy. Securing the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of Special Needs Trust Form 1041 For 2022 exclusively from reputable sources, like US Legal Forms. An incorrect template will squander your time and delay your situation. With US Legal Forms, you have minimal concerns. You can access and review all the information regarding the document’s application and significance for your case and in your jurisdiction.

Follow the outlined steps to complete your Special Needs Trust Form 1041 For 2022.

Eliminate the complications associated with your legal paperwork. Explore the extensive US Legal Forms collection to discover legal templates, assess their relevance to your circumstances, and download them instantly.

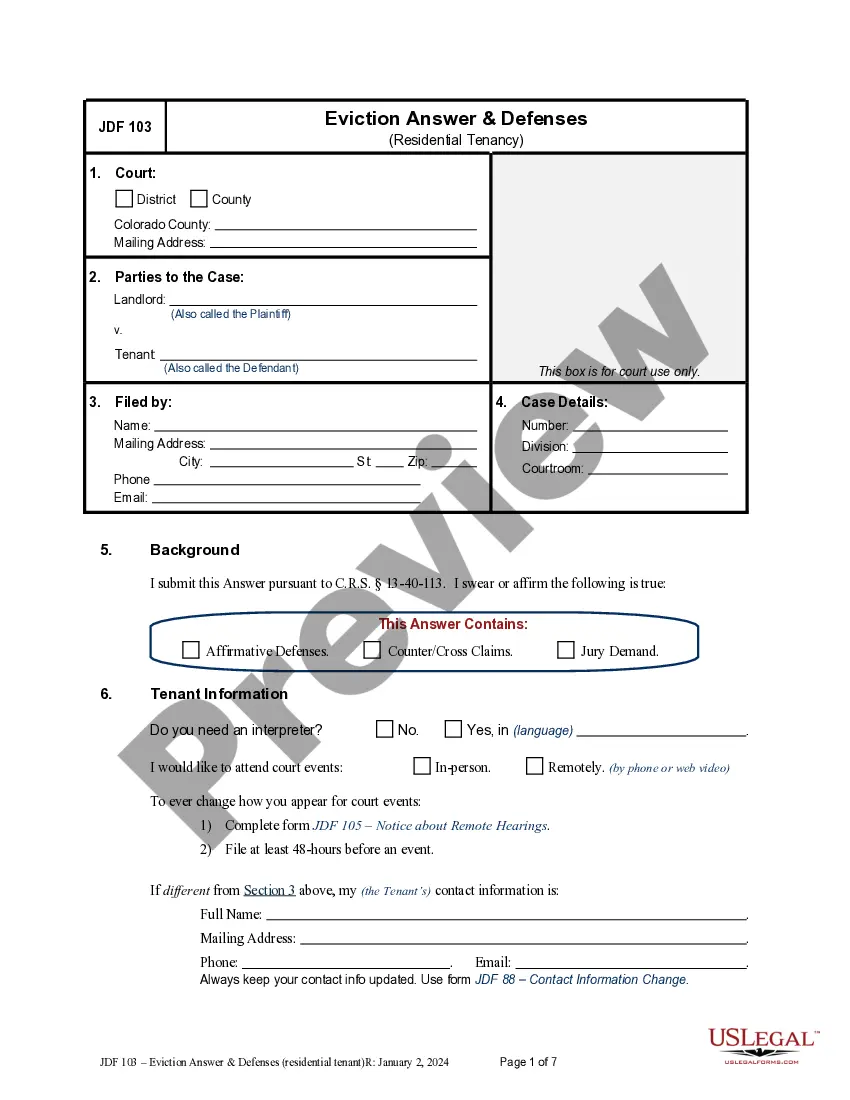

- Use the catalog navigation or search bar to locate your sample.

- Examine the form’s description to determine if it aligns with the requirements of your state and county.

- Check the form preview, if available, to verify the form is the one you seek.

- Return to the search if the Special Needs Trust Form 1041 For 2022 does not meet your needs.

- If you are confident about the form’s applicability, download it.

- When you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing option that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Special Needs Trust Form 1041 For 2022.

- Once you have the form on your device, you may edit it with the editor or print it and complete it by hand.

Form popularity

FAQ

The distribution amount will be reported on Form 1041 Schedule B, Line 10 - Other Amounts paid, credited, or otherwise required to be distributed.

The primary expenses include trustee's fees, investment advice, accounting fees, and taxes. Trustees' fees. A trustee's fee is the amount the trust pays to compensate the trustee for his or her time. ... Investment advice in a trust. ... Trust's accounting fees. ... Taxes in a trust.

What expenses are deductible? State and local taxes paid. Executor and trustee fees. Fees paid to attorneys, accountants, and tax preparers. Charitable contributions. Prepaid mortgage interest and qualified mortgage insurance premiums. Qualified business income. Trust income distributed to beneficiaries (attach Schedule K-1)

Income that is required to be distributed currently includes any amount required to be distributed that may be paid out of income or corpus, such as an annuity, to the extent that it is paid out of income for the tax year (Reg.

In most cases, an accessible ramp repair fits the bill. Some other examples of common trust purchases are a new TV for the Beneficiary's room, a hotel room rental on vacation, a class at a local community college, or non-government funded medical expenses such as massage therapy.