3rd Party Special Needs Trust Form For Pennsylvania

Description

How to fill out Trust Agreement - Family Special Needs?

It’s no secret that you can’t become a legal professional immediately, nor can you learn how to quickly draft 3rd Party Special Needs Trust Form For Pennsylvania without the need of a specialized background. Putting together legal forms is a time-consuming venture requiring a certain education and skills. So why not leave the creation of the 3rd Party Special Needs Trust Form For Pennsylvania to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for internal corporate communication. We understand how important compliance and adherence to federal and local laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and obtain the document you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

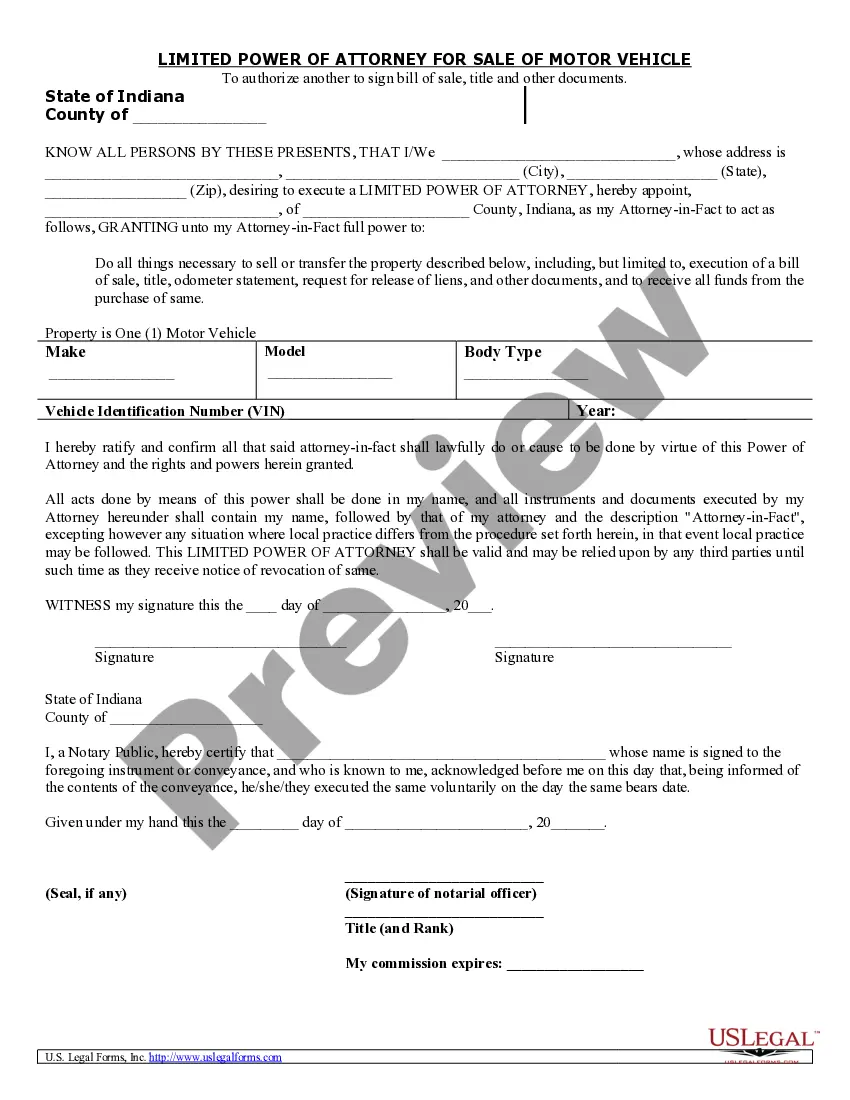

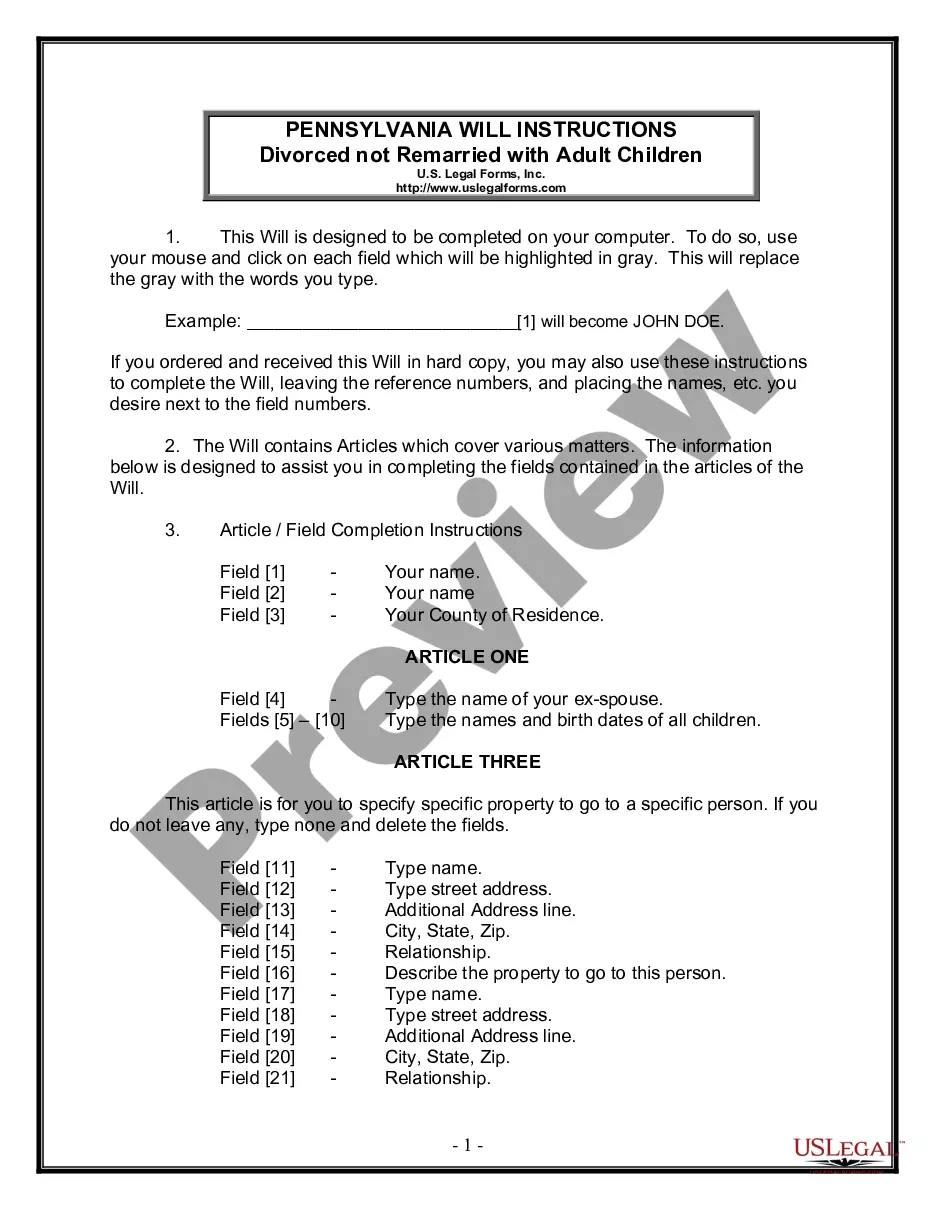

- Preview it (if this option provided) and check the supporting description to determine whether 3rd Party Special Needs Trust Form For Pennsylvania is what you’re searching for.

- Begin your search again if you need a different template.

- Register for a free account and select a subscription plan to purchase the form.

- Pick Buy now. As soon as the payment is through, you can get the 3rd Party Special Needs Trust Form For Pennsylvania, fill it out, print it, and send or send it by post to the designated people or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

A trust allows a third party?called a trustee?to manage assets in a trust fund on behalf of a beneficiary, which is the party who receives the assets. A trust agreement is a document that allows a trustor to describe how they want their assets managed.

What is a Third Party Trust? A Third Party Trust (also known as a Common Law Trust) is funded by the beneficiary's family and/or friends, rather than the beneficiary themselves. It can be funded either during their lifetime and/or through an estate plan.

Special Needs Trusts (SNT) are designed to permit financial resources to remain available to assist an individual with disabilities who receives, or may receive in the future, Medical Assistance (also known as Medicaid or MA) and/or Supplemental Security Income (SSI) benefits, and/or Mental Health and Intellectual ...

The executor or trustee functions to act on behalf of the estate, which would be if it's a will, or on behalf of the trust if it's a trust document, to administer the assets, handle any claims, and then distribute the assets as those documents state.