Promissory Note For Buying A House

Description

How to fill out Sale Of Business - Promissory Note - Asset Purchase Transaction?

Bureaucracy demands exactness and correctness.

If you do not handle completing forms such as Promissory Note For Buying A House regularly, it may lead to certain misinterpretations.

Choosing the right sample from the beginning will guarantee that your document submission proceeds without issues and avert any problems of having to resend a file or redo the same work from the beginning.

Finding the correct and updated samples for your paperwork is a swift process with an account at US Legal Forms. Eliminate the bureaucracy challenges and simplify your work with documents.

- Locate the form utilizing the search bar.

- Confirm the Promissory Note For Buying A House you’ve discovered is appropriate for your state or county.

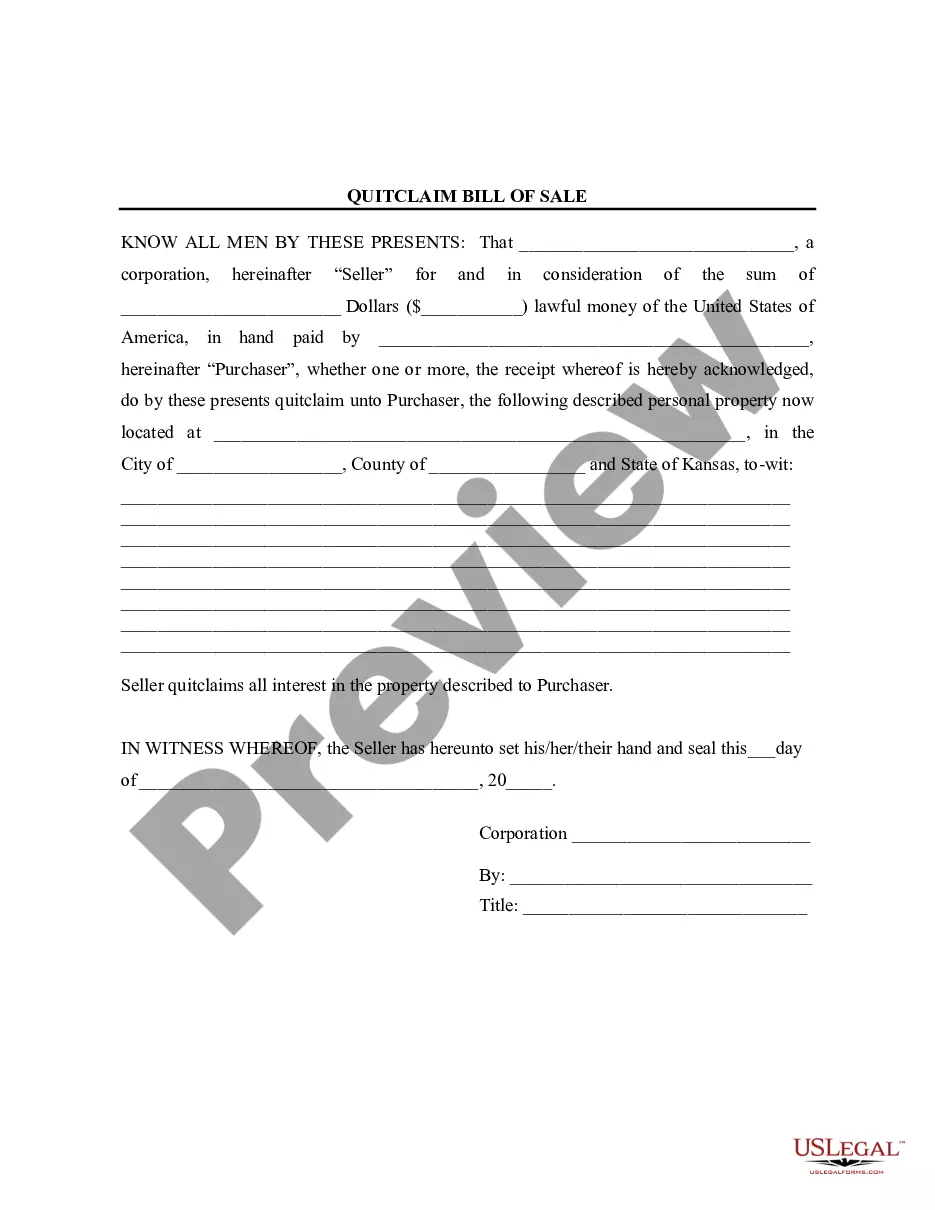

- View the preview or examine the description that details the usage of the template.

- If the result corresponds with your search, select the Buy Now option.

- Choose the suitable choice from the suggested pricing plans.

- Log In to your account or create a new one.

- Finalize the purchase using a credit card or PayPal account.

- Download the document in the format of your preference.

Form popularity

FAQ

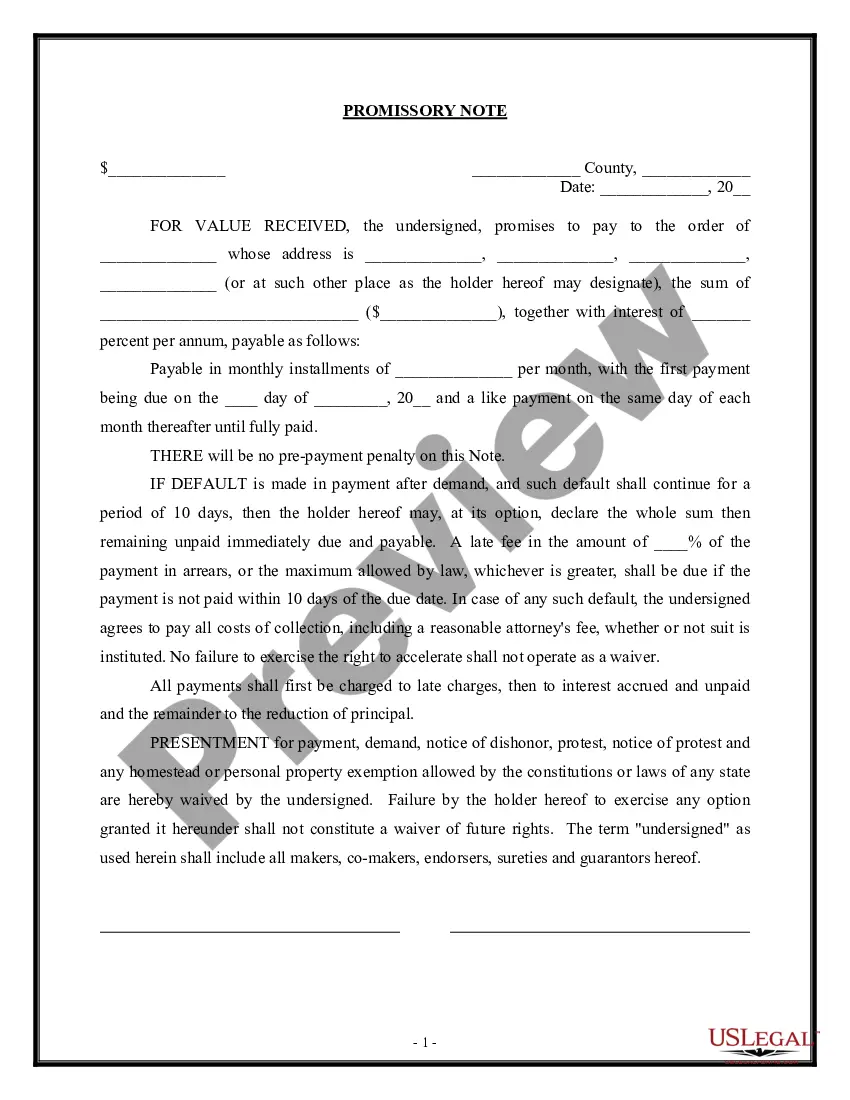

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

The buyer gives a down payment to the seller that acts as a gesture of good faith as well as security for the repayment of the note. The home's deed also acts as collateral on the note and should the buyer default, the deed and the down payment are kept by the seller.