Charitable Remainder Trust Form 5227

Description

How to fill out Charitable Inter Vivos Lead Annuity Trust?

Acquiring legal forms that adhere to federal and local statutes is essential, and the web provides numerous selections to consider.

However, what is the purpose of squandering time hunting for the correct Charitable Remainder Trust Form 5227 example online if the US Legal Forms digital repository already has such documents compiled in one location.

US Legal Forms is the largest digital legal repository with over 85,000 editable templates created by attorneys for any business or personal situation. They are simple to navigate, with all documents categorized by state and intended use. Our experts remain informed on legal updates, so you can always trust that your form is current and compliant when acquiring a Charitable Remainder Trust Form 5227 from our site.

Click Buy Now when you’ve found the correct form and choose a subscription option. Create an account or sign in and process a payment via PayPal or credit card. Select the format for your Charitable Remainder Trust Form 5227 and download it. All documents you discover through US Legal Forms are reusable. To re-download and fill out previously saved forms, access the My documents tab in your profile. Experience the most comprehensive and user-friendly legal documentation service!

- Acquiring a Charitable Remainder Trust Form 5227 is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, sign in and download the document example you need in the appropriate format.

- If you are unfamiliar with our website, adhere to the instructions below.

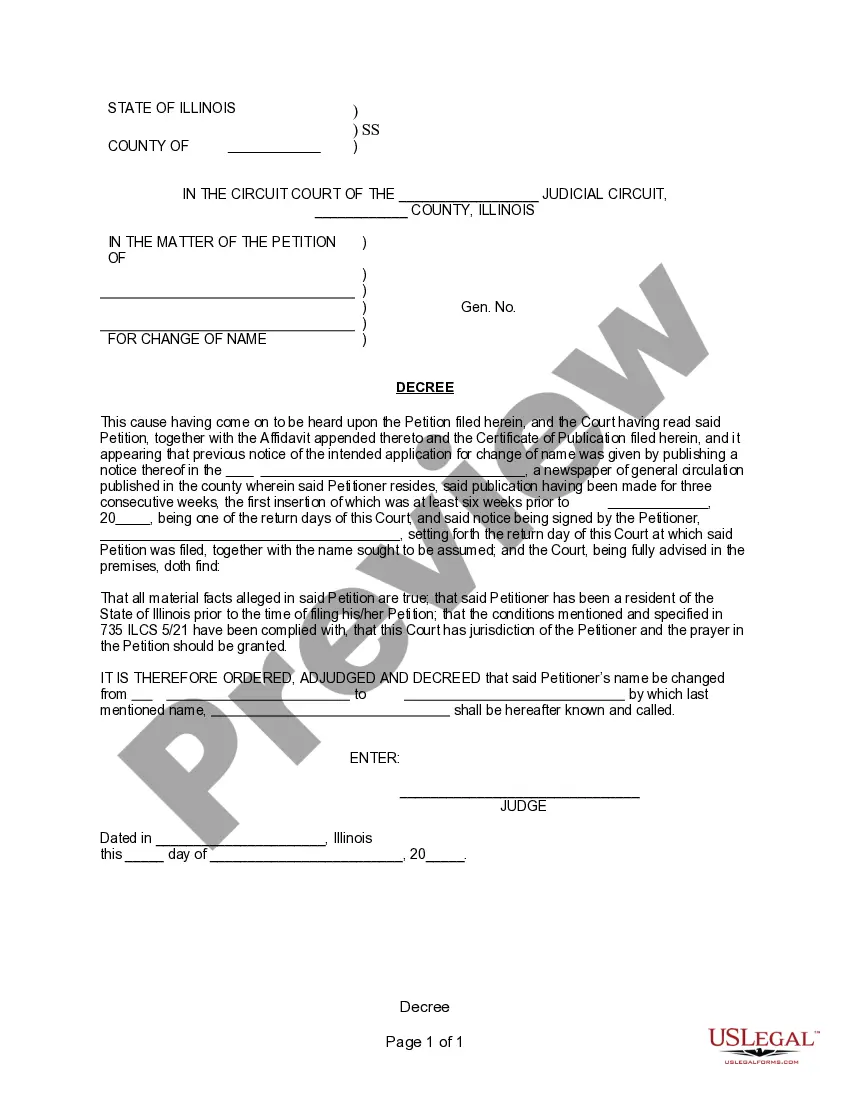

- Review the template using the Preview option or via the text description to ensure it meets your requirements.

- Utilize the search feature at the top of the page to find an alternative sample if needed.

Form popularity

FAQ

If you do not pay child support, the other parent or the West Virginia Bureau for Child Support Enforcement (BCSE) may file paperwork to bring you back to court. This is called a Petition for Contempt. After hearing the evidence, the Family Court may find you in contempt of court.

There are several requirements for Amnesty: Both parents must agree what percentage of interest owed on arrears is to be forgiven; Amnesty only covers interest on arrears (current support remains due); and. The obligor? must agree to pay the entire arrears balance owed within five years.

The age of emancipation in West Virginia is 18 years of age. Courts may order support extended up to 20 years as long as the child remains in secondary school and is making substantial progress toward a diploma.

§48-13-201. Use of both parents' income in determining child support. A child support order is determined by dividing the total child support obligation between the parents in proportion to their income. Both parents' adjusted gross income is used to determine the amount of child support.

Child support payments can't extend past the date the child reaches the age of 20 per WV Code § 48-11-103(a) ( ).

If a noncustodial parent has become delinquent and isn't making payments or following the child support order, the custodial parent has the right to go back to court and file an enforcement action.

(2) A person who repeatedly and willfully fails to pay his or her court-ordered support which he or she can reasonably provide and which he or she knows he or she has a duty to provide to a minor by virtue of a court or administrative order and the failure results in twelve months without payment of support that ...

The child support obligation continues in ance with the court order regardless of where the child lives. Failure by the obligor to pay the child support obligation can result in contempt actions and the obligor could be put in jail (depending on the circumstances and amount of arrears).