Charitable Lead Annuity Trust Withdrawal

Description

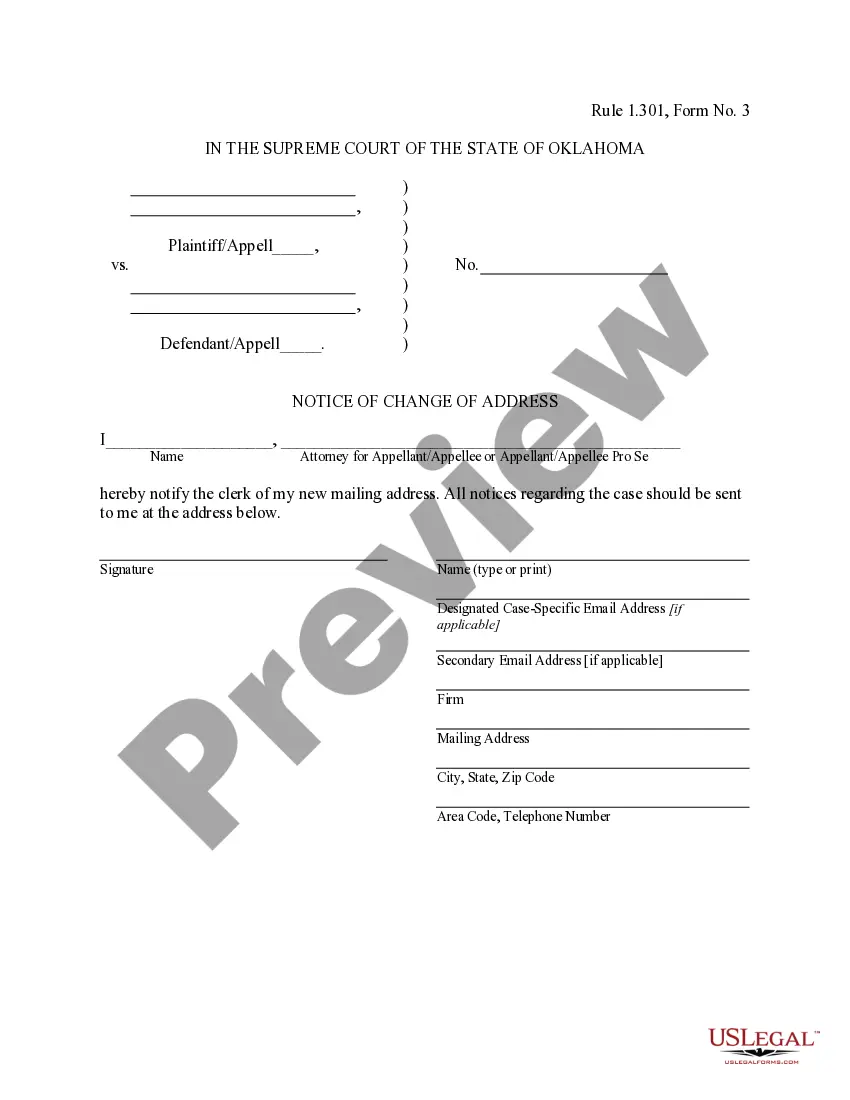

How to fill out Charitable Inter Vivos Lead Annuity Trust?

Managing legal paperwork and activities can be a lengthy addition to your daily tasks.

Charitable Lead Annuity Trust Withdrawal and similar forms generally require you to locate them and comprehend how to fill them out correctly.

Therefore, whether you are addressing financial, legal, or personal issues, possessing a comprehensive and user-friendly online directory of forms will significantly help.

US Legal Forms is the premier online service for legal documents, offering over 85,000 state-specific templates and various tools to help you complete your paperwork with ease.

Is it your first time using US Legal Forms? Sign up and create an account in just a few moments and you'll gain access to the form collection and Charitable Lead Annuity Trust Withdrawal. After that, follow the steps below to finalize your document.

- Browse the collection of relevant documents available with just one click.

- US Legal Forms provides state- and county-specific templates accessible for download at any time.

- Protect your document management processes with exceptional support that allows you to create any form in a matter of minutes without any extra or hidden fees.

- Simply Log In to your account, find Charitable Lead Annuity Trust Withdrawal and download it instantly from the My documents section.

- You can also access previously downloaded templates.

Form popularity

FAQ

Yes, a charitable lead trust generally files its own tax return using Form 1041. It reports income earned and any distributions made to charitable organizations. If you are considering strategies around a charitable lead annuity trust withdrawal, understanding the tax implications becomes crucial. Platforms like US Legal Forms offer comprehensive services to help you navigate these requirements effectively.

To report trust distributions on your tax return, you will typically need to use Schedule K-1, provided by the trust. This document shows your share of income, deductions, and credits. When managing distributions from a charitable lead annuity trust withdrawal, accurate reporting is crucial to avoid penalties. US Legal Forms can guide you through this process with helpful templates and instructions.

Form 5227, which is used to report information for charitable lead trusts, currently cannot be electronically filed with the IRS. You must submit it as a paper return. If you are dealing with trust distributions, including those associated with the charitable lead annuity trust withdrawal, it’s essential to ensure accuracy when filing. US Legal Forms provides resources to help you prepare and submit this form correctly.

Yes, a charitable remainder trust must file a tax return annually, typically using Form 1041. This includes reporting any income, deductions, and distributions made from the trust. It's important to keep track of any distributions related to the charitable lead annuity trust withdrawal as these can impact your tax situation. For assistance in managing this, consider using the US Legal Forms platform.

A charitable lead trust is generally subject to income tax on its earnings. However, the trust also provides a charitable income tax deduction based on the present value of the charitable interests. This tax structure can benefit both the trust and the donor. For more tailored information on taxes related to a charitable lead annuity trust withdrawal, consider resources from US Legal Forms.

When considering a charitable lead annuity trust withdrawal, it is essential to understand that the amount you can withdraw depends on the terms specified in the trust agreement. Typically, these terms dictate the percentage of the trust's assets that can be distributed annually. You should regularly assess the trust's performance and consult with a financial advisor to make informed decisions. Tools like US Legal Forms can help you navigate these complexities.

Yes, charitable trusts can be subject to taxation under specific conditions. While some distributions may qualify for tax benefits, unqualified distributions may be taxed. Thus, when planning for a charitable lead annuity trust withdrawal, it’s essential to understand the tax implications. A consultation with a tax advisor can help clarify how your withdrawals may be taxed.

To complete Form 5227, you need to provide accurate information about the charitable lead annuity trust, including the names of beneficiaries and the trust's income. Ensure you understand the reporting requirements associated with charitable lead annuity trust withdrawals. The form can be complex, and using a platform like uslegalforms can simplify the process with clear guidelines and templates.

Charitable remainder trusts are not typically exempt from federal income tax. They provide a stream of income to beneficiaries before transferring the remaining assets to a charity. When considering a charitable lead annuity trust withdrawal, it is helpful to understand how these tax rules apply. Consulting with a knowledgeable advisor can clarify your obligations.

Certain types of trusts, such as irrevocable charitable trusts, may be exempt from federal income tax. These trusts can offer tax benefits when you make charitable lead annuity trust withdrawals. However, the specific tax exemptions can vary based on the trust's structure and purpose. It’s wise to review your trust with a qualified tax professional.