Unitrust Trust With Employees

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Managing legal documents can be daunting, even for seasoned professionals.

If you're interested in a Unitrust Trust With Employees but lack the time to spend finding the correct and current version, the process can be challenging.

US Legal Forms meets all your needs, whether personal or business-related, all in one centralized location.

Leverage sophisticated tools to fill out and manage your Unitrust Trust With Employees.

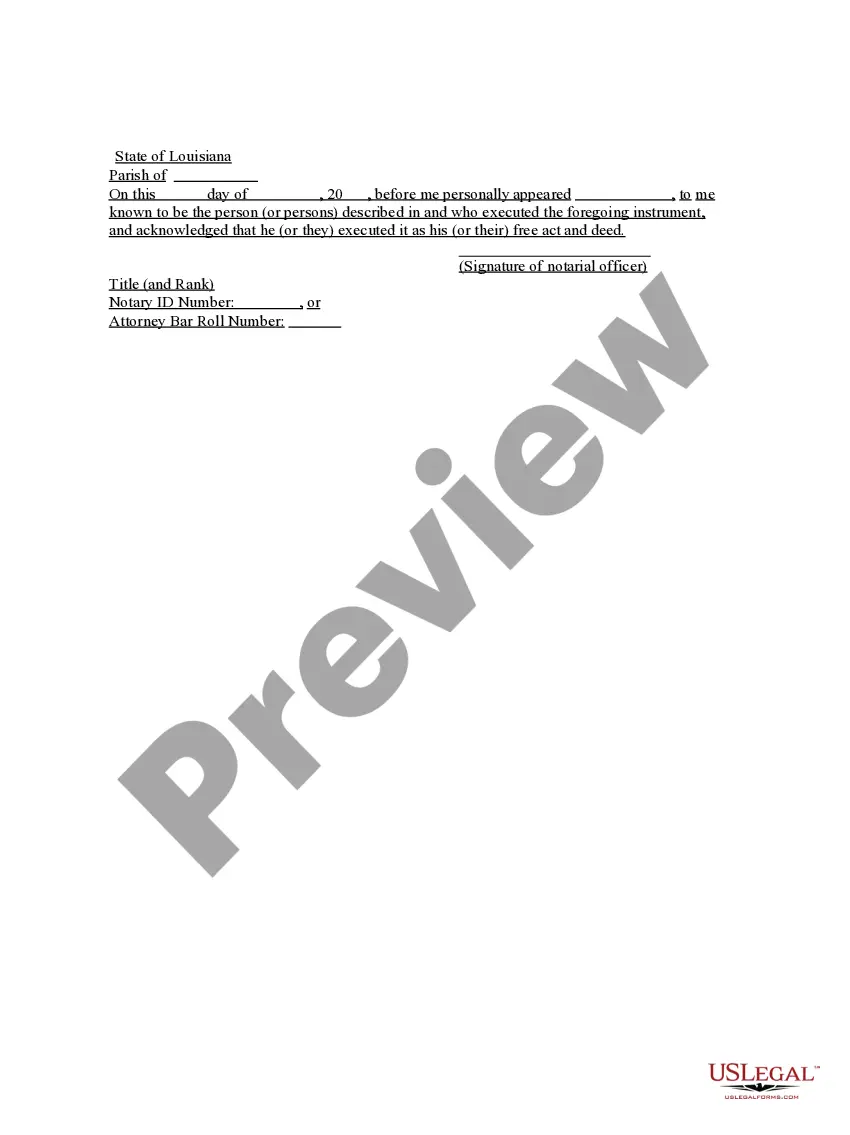

Here are the steps to follow after locating the form you desire: Validate that it is the correct form by previewing it and reviewing its details. Ensure that the document is approved in your state or county. Click Buy Now when you are ready. Select a monthly subscription option. Choose your preferred format, and Download, complete, eSign, print, and submit your documents. Utilize the US Legal Forms online library, backed by 25 years of experience and dependability. Streamline your daily document management into a simple and user-friendly process today.

- Access a valuable repository of articles, guides, manuals, and resources relevant to your needs.

- Save time and energy searching for the forms you require by utilizing US Legal Forms’ advanced search and Review feature to find your Unitrust Trust With Employees and acquire it.

- If you have a subscription, Log Into your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view documents you have previously downloaded and manage your collections as needed.

- If this is your first experience with US Legal Forms, create an account for unlimited access to all platform features.

- A robust digital form library could drastically improve efficiency for those looking to manage these tasks proficiently.

- US Legal Forms stands as a frontrunner in the online legal form sector, providing over 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you can access tailored legal and business documents for your state or county.

Form popularity

FAQ

Complete required training. Complete Background Checks and Fingerprinting (forms included in your registration packet). Complete the registration packet with a CCR&R Child Care Consultant. Pre-Inspection of your home by the Department of Human Services (DHS).

If a person owes back child support, the back support is collected through an income withholding order. If a person only owes back child support, the person can ask for a smaller amount of money to be taken out.

How Far Back Does Retroactive Child Support Go? In Iowa, retroactive child support is limited to three months, up to the date the opposing party received notification. This makes it perfectly clear that the longer one parent waits to notify the other parent the less child support has to be paid on legal grounds.

Visit the Child Support Recovery Unit website, .childsupport.ia.gov. Call our automated information line, 1-888-229-9223. Information is available 24 hours a day, seven days a week. Contact your local office.

Iowa law provides a number of measures for enforcing compliance with a child support order, including income withholding, garnishment, liens, and contempt of court. If a parent has not complied with a support order, it is the responsibility of the other parent to initiate steps to enforce.

If a party violates those orders, the court can hold the offending party in contempt of court. The consequences of being in contempt of court can involve monetary fines and jail time. A party can request the court to hold a party in contempt of court for missing child support payments.

Iowa law provides a number of measures for enforcing compliance with a child support order, including income withholding, garnishment, liens, and contempt of court. If a parent has not complied with a support order, it is the responsibility of the other parent to initiate steps to enforce.

This 90-day waiting period applies even if you and your spouse are seeking a no-contest divorce in Iowa and have agreed on all terms. In very limited circumstances (such as emergencies) a judge may waive the 90-day period and grant your divorce sooner.