Unitrust.com

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- Start by logging into your account at Unitrust.com. If you're new, create an account for free access.

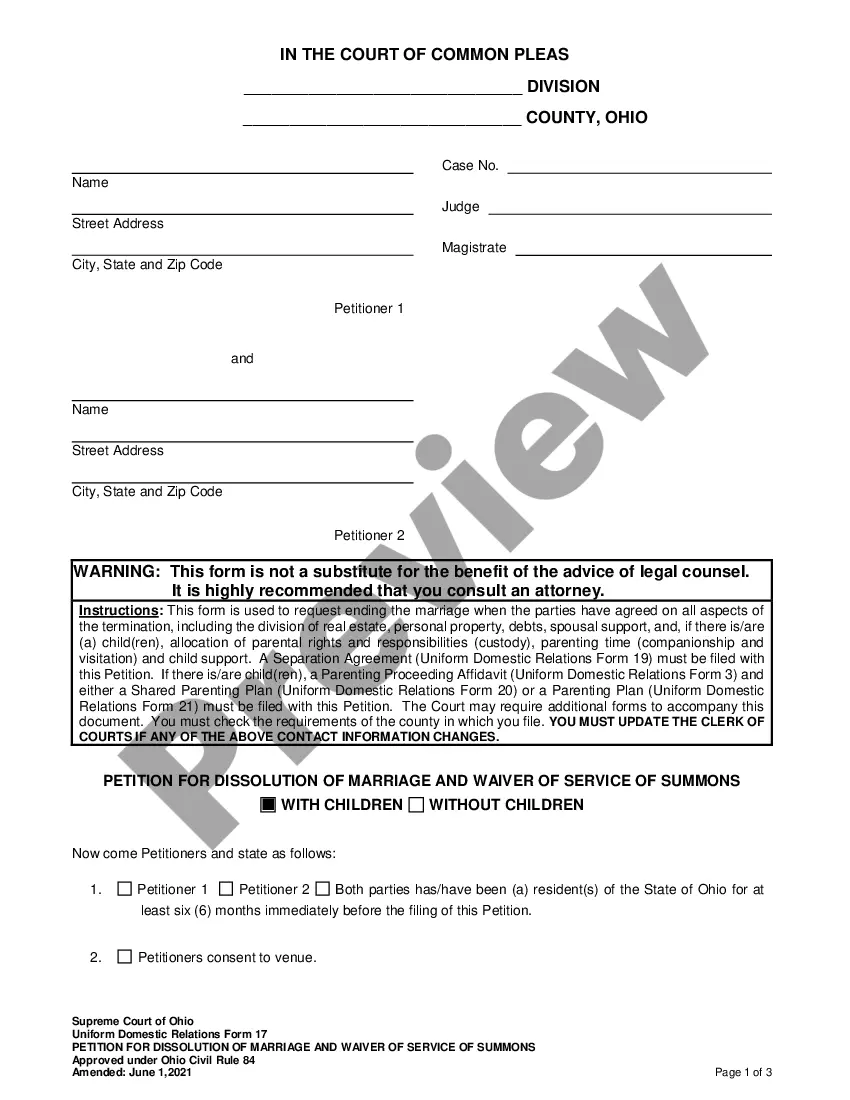

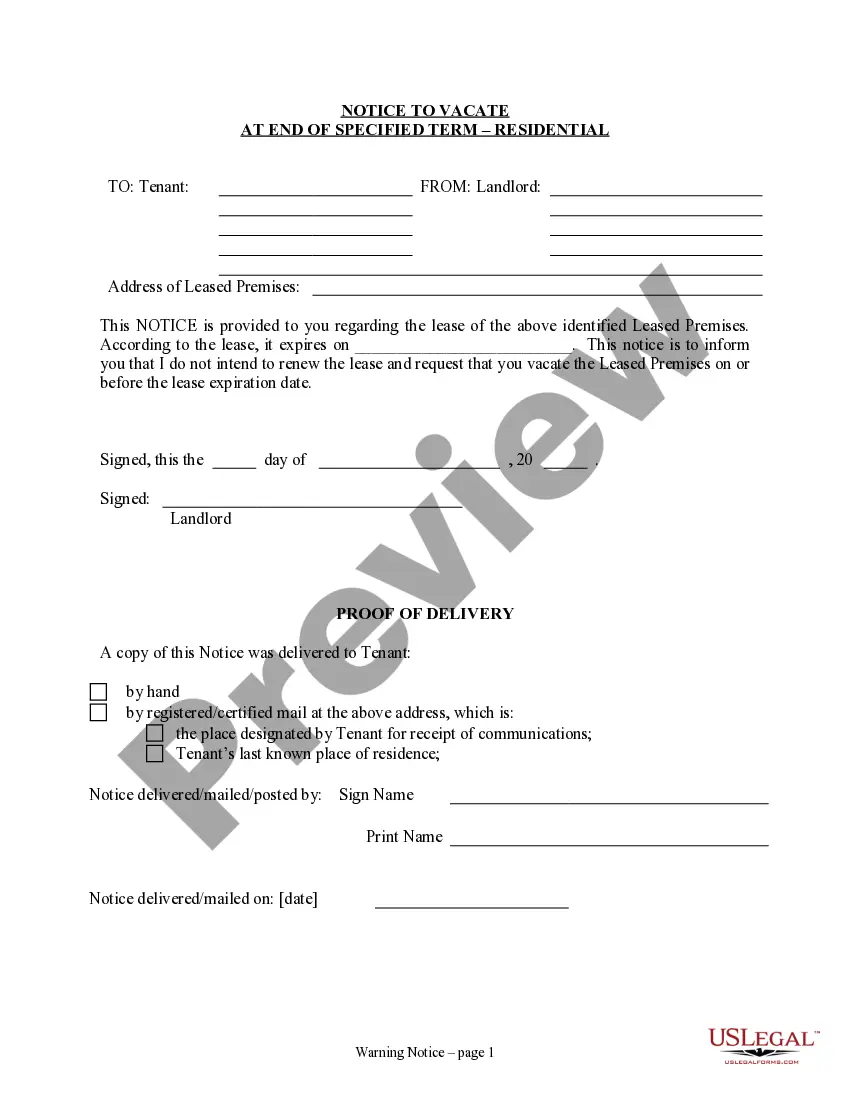

- Browse through the preview mode and descriptions of the legal forms. Confirm that you choose the right one for your needs.

- If necessary, utilize the search function to locate any additional forms that might better suit your requirements.

- Select the form and click on 'Buy Now' to choose your preferred subscription plan.

- Complete your purchase by entering payment details using a credit card or your PayPal account.

- Download the legal form to your device and access it anytime from the 'My Forms' section of your account.

By following these straightforward steps, you can confidently access the robust features offered by US Legal Forms

Empower yourself with the right legal documents today and explore the full potential at Unitrust.com!

Form popularity

FAQ

Yes, a charitable trust is required to file a tax return, often using IRS Form 5227. This form helps report the trust's financial activities and ensures compliance with IRS regulations. Visit Unitrust for insights on managing your charitable trust and fulfilling its tax obligations.

Setting up a unitrust involves drafting a trust document that outlines the terms and conditions of the trust. You'll typically include information about the trust's purpose, trustee responsibilities, and beneficiary details. For a comprehensive guide on establishing your unitrust, Unitrust offers valuable resources to assist you.

Yes, you can use TurboTax to file for a trust, provided you select the correct version suitable for trust and estate filings. The software simplifies the process by guiding you through each necessary step. If you need more extensive resources about trusts, consider exploring Unitrust for additional information.

Yes, Form 5227 can be filed electronically. Many tax software programs, including those featured on Unitrust, support the electronic filing of this form, streamlining the submission process. This method can save time and minimize errors, making the tax filing experience more efficient.

Failing to file taxes on a trust can lead to penalties and interest on unpaid taxes. The IRS may impose fines for non-compliance, and it can complicate the distribution of assets to beneficiaries. For guidance on filing and avoiding issues, visit Unitrust to access helpful tax filing information.

Yes, most trusts are required to file a tax return. Trusts that earn income or have taxable transactions must file IRS Form 1041. If you’re managing a trust and need assistance, Unitrust can connect you with the necessary tools and resources for compliance.

Filing taxes for a trust involves completing IRS Form 1041, which is specifically designed for trusts. You'll report the income generated by the trust and allocate any distributions made to beneficiaries. To simplify the process, consider using Unitrust, as it provides helpful guidance and resources tailored to trust tax filing.

Unitrust Financial Group offers a wide range of services, including estate planning, charitable giving strategies, and investment management. Our aim is to provide tailored solutions that meet your specific financial needs. For a comprehensive overview of our services, explore Unitrust.

Unitrust was founded in the early 2000s, with a vision to provide innovative financial solutions. Over the years, we have built a reputation for excellence in serving clients' financial needs. For more information about our history and mission, visit Unitrust.

The CEO of Unitrust Financial Group is a dedicated leader with extensive experience in financial services. Our CEO emphasizes a client-focused approach and works to ensure that Unitrust delivers quality financial solutions. For more updates about our leadership team, check our official website.