Unitrust Amount Year With Interest Rate

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

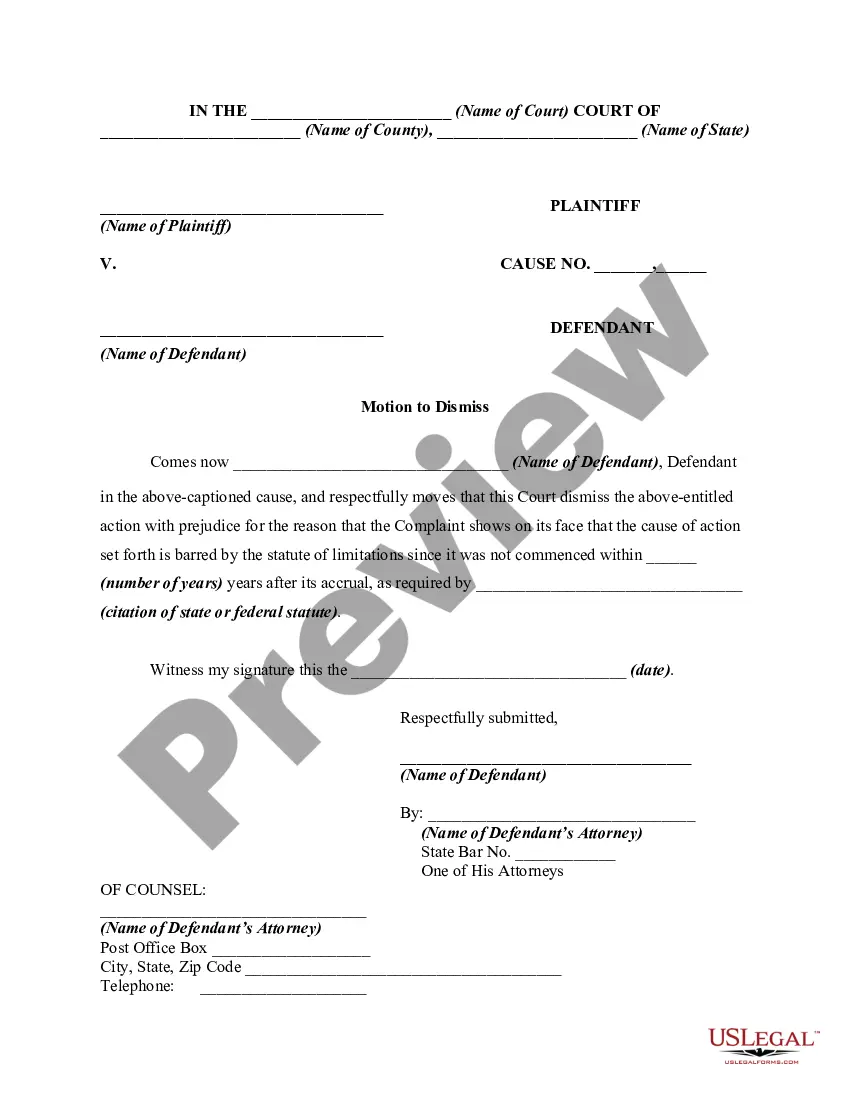

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription remains valid or renew it if necessary.

- For first-time users, begin by assessing the Preview mode and description of the form to verify it suits your requirements and meets local jurisdiction standards.

- If the selected form is incorrect, utilize the Search tab to find the appropriate template that fits your needs.

- Once you've found the right document, click on the Buy Now button and select your subscription plan, registering for an account if you haven't already.

- Proceed to make your payment securely using your credit card or PayPal account to complete the purchase.

- Finally, download the form to your device, allowing easy access through the My Forms menu whenever needed.

In conclusion, US Legal Forms offers a user-friendly platform with a vast array of legal templates, empowering users to create legally sound documents with confidence. Whether you need a straightforward form or expert assistance, US Legal Forms is here to help.

Get started today and simplify your legal documentation process with US Legal Forms!

Form popularity

FAQ

Unitrust distributions are typically taxed as income, similar to regular payments from a trust. The exact tax rate will depend on the type of income distributed, which can vary from interest to capital gains. Understanding how unitrust distributions are taxed is key to managing your financial situation effectively, especially in terms of the unitrust amount year with interest rate.

Charitable remainder unitrust (CRUT) payments are generally taxed as ordinary income for recipients. Beneficiaries may face different taxation depending on the types of income coming from the trust. It's important to comprehend how crut payments are taxed to avoid unexpected tax burdens and to plan your finances wisely.

Calculating the present value of the remainder interest requires discounting the future value back to its present worth. Factors such as the expected term of the trust, applicable interest rate, and timing of future payments come into play. This calculation is essential for evaluating the overall value of a unitrust and understanding its impact on the unitrust amount year with interest rate.

Trust fund payouts are subject to specific tax rules, varying by the trust's structure and types of income generated. Generally, beneficiaries face income tax on distributions, which can include interest or capital gains. Understanding the tax obligations related to trust fund payouts, including how they affect the unitrust amount year with interest rate, helps beneficiaries plan accordingly.

Unitrust payments are considered taxable income for the beneficiaries receiving them. Tax implications depend on the nature of the income; for example, interest, dividends, or capital gains. Knowing how unitrust payments are taxed can help beneficiaries manage their finances more effectively.

To calculate the unitrust amount, you need to apply the specified interest rate to the fair market value of the trust's assets. This calculation is usually done annually, ensuring it reflects any changes in asset value. Accurate calculations are crucial for beneficiaries to understand their unitrust amount year with interest rate.

A unitrust interest refers to the percentage of income generated by a unitrust each year. This income is typically based on the trust's assets' value and the applicable interest rate. Understanding the unitrust amount year with interest rate is essential for beneficiaries, as it determines how much they can expect to receive annually.

A charitable remainder unitrust (CRUT) typically pays out a percentage of its value on an annual basis, which is based on the value at the beginning of each year. The actual payout can vary depending on the trust's performance and rate set by the trustees. Having insight into the Unitrust amount year with interest rate allows beneficiaries to plan effectively for their financial needs while supporting charitable causes.

The rate for a charitable remainder trust (CRT) often varies based on the trust type and the donor's preferences. Generally, it can range from 5 to 50 percent, determined by the trust’s governing document. Understanding the Unitrust amount year with interest rate is crucial for anyone considering setting up a CRT and maximizing their charitable impact.

The unitrust percentage refers to the portion of the trust assets that are distributed to the income beneficiary each year. This percentage is usually expressed as a fixed rate between 5 and 50 percent. By learning about the Unitrust amount year with interest rate, investors can better anticipate their annual income and the effectiveness of their charitable giving.