Charitable Trust Online With Friends

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a simpler and more economical method of preparing Charitable Trust Online With Friends or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

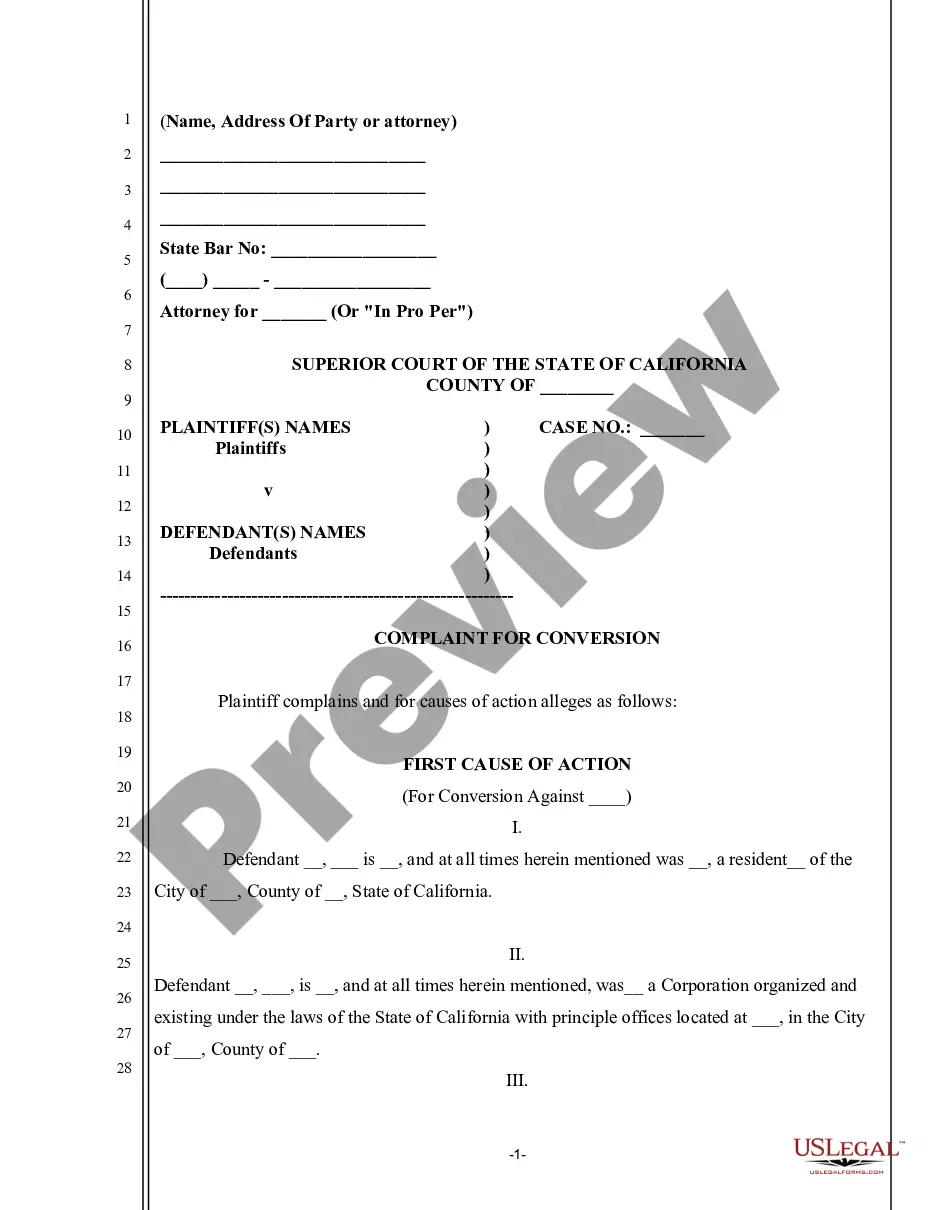

Review the form preview and descriptions to ensure you are on the correct document. Ensure the template you select meets the standards of your state and county. Choose the most appropriate subscription option to acquire the Charitable Trust Online With Friends. Download the file. Then complete, authenticate, and print it out. US Legal Forms has a solid reputation and more than 25 years of experience. Join us today and make form completion an effortless and organized process!

- With just a few clicks, you can readily obtain state- and county-compliant templates carefully crafted for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can swiftly find and download the Charitable Trust Online With Friends.

- If you’re familiar with our site and have previously registered an account with us, simply Log In to your account, choose the form and download it or re-download it anytime later in the My documents section.

- Don’t have an account? No problem. It takes just a few minutes to create one and browse the library.

- But before proceeding to download Charitable Trust Online With Friends, adhere to these suggestions.

Form popularity

FAQ

8 Steps to Accept Donations Online Create a Donation Page and Form. ... Embed Your Donation Form on Your Website. ... Choose a Reliable Payment Processor. ... Automate Tax Receipts and Donor Acknowledgement. ... Segment Your Donor Email List. ... Use Email to Promote Your Donation Form. ... Identify Your Non-Digital Donors.

The most popular platforms for accepting online donations are Paypal and Stripe. Both PayPal and Stripe offer nonprofit discounts, and as such, compared to other payment processors, they make it easier for you to recoup a more significant percentage of your donations.

You can usually complete the donation online with a credit or debit card. Remember to insert the name of the person you're donating on behalf of in the appropriate section. There may also be an area where you can put their or their family's contact information so that they can receive updates on the donation.

Create Recurring Donation Forms on Donorbox! Enable peer-to-peer fundraising for online campaigns. ... Create a donation matching campaign. ... Utilize a goal meter to reach your goal faster. ... Use text-to-give during events. ... Make online giving fast and convenient for donors. ... Share your donation page in fundraising letters.

How to create a charitable trust Determine what assets you want to add to the trust. Remember that your donations are irrevocable. Decide on your beneficiaries and whether you want the trust income to pay them or the organization first. ... Work with a professional to draw up a trust document.