Charitable Agreement Trust Withholding

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Managing legal documents can be exasperating, even for experienced professionals.

If you’re looking for a Charitable Agreement Trust Withholding and lack the time to seek out the correct and current version, the process can be stressful.

US Legal Forms caters to all your needs, whether they are personal or business-related, all consolidated in one location.

Utilize cutting-edge tools to fill out and manage your Charitable Agreement Trust Withholding.

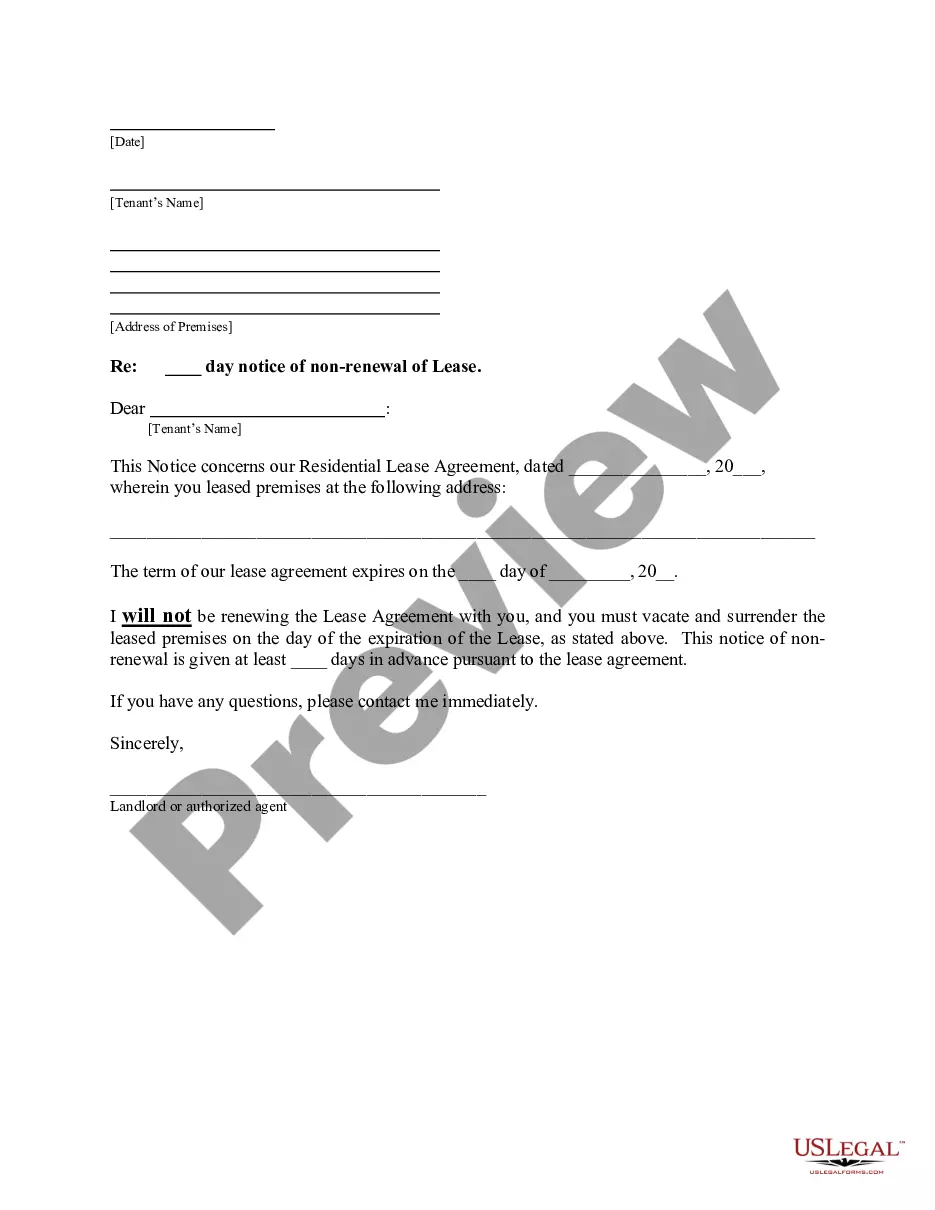

Follow these steps post-downloading the desired form: Ensure this is the right form by previewing and reviewing its summary.

- Access an invaluable repository of articles, guides, and manuals pertinent to your situation and requirements.

- Conserve time and energy in searching for necessary documents, and leverage US Legal Forms’ sophisticated search and Preview option to acquire and download Charitable Agreement Trust Withholding.

- If you possess a monthly subscription, Log In to your US Legal Forms account, look for the required form, and download it.

- Check the My documents tab to review the documents you have previously saved and manage your folders as desired.

- If it's your initial time using US Legal Forms, create a free account and gain unrestricted access to the entire library's benefits.

- A comprehensive online form directory can be transformative for anyone wanting to handle these matters effectively.

- US Legal Forms is a leader in online legal documentation, offering over 85,000 state-specific documents available whenever you need them.

- With US Legal Forms, you have the ability to access tailored legal and business documents as per your specific state or county requirements.

Form popularity

FAQ

Tax Filings for Charitable Remainder Trusts Charitable remainder trusts must annually file Form 5227, Split-Interest Trust Information Return. Form 5227: Reports financial activities, including the disposition of the trust's assets. Accounts for current-year and accumulated trust income.

In either type of CRT (unitrust or annuity trust), the Internal Revenue Service (IRS) requires that the payout rate stated in the trust cannot be less than 5 percent or more than 50 percent of the initial fair market value of the trust's assets.

In other words, the remainder value of the trust must be equal to 10 percent of the amount that was funded. This is absolutely essential if you want to take advantage of the tax benefits that a CRT can offer. If you do not adhere to the 10 percent rule, there are some pretty serious consequences.

The taxation of CRUTs is prescribed by the Internal Revenue Code and accompanying U.S. Treasury regulations. The trust itself is a tax-exempt entity, but the trust distributions to an income beneficiary will be taxable to that beneficiary ing to a four-tiered system.

At the end of the term, the trust terminates and the non-charitable beneficiaries receive whatever assets remain in the trust. A CLAT files both a Form 1041 and a Form 5227.