For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

Note Unsecured Document With Signature Required

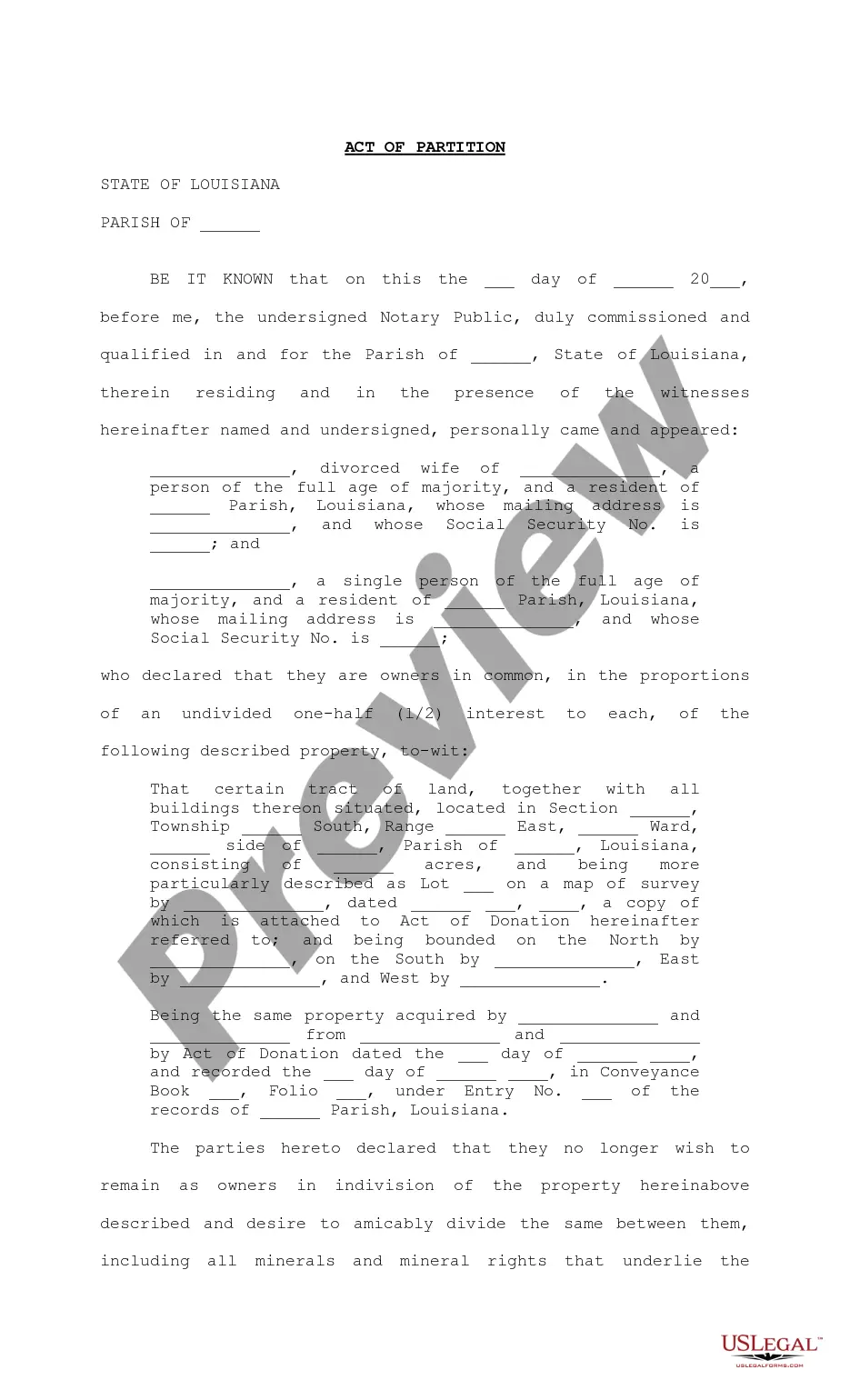

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Obtaining legal templates that meet the federal and local regulations is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the right Note Unsecured Document With Signature Required sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and personal scenario. They are simple to browse with all documents organized by state and purpose of use. Our experts stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when getting a Note Unsecured Document With Signature Required from our website.

Obtaining a Note Unsecured Document With Signature Required is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Take a look at the template using the Preview option or through the text description to ensure it meets your needs.

- Locate another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Note Unsecured Document With Signature Required and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

A promissory note means a signed document containing a written promise to pay a stated sum to a specified person at a specified date or on demand. It should be signed by the promiser.

Only the borrower signs a promissory note, whereas both the lender and the borrower sign a loan agreement.

A promissory note must be signed by the borrower to be valid. You may want the borrower to sign in front of a notary to ensure the signature is authentic. The lender keeps the original promissory note and the borrower should receive a copy.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.