147c Letter Sample For Tax Return

Description

How to fill out Sample Letter Regarding Application For Employer Identification Number?

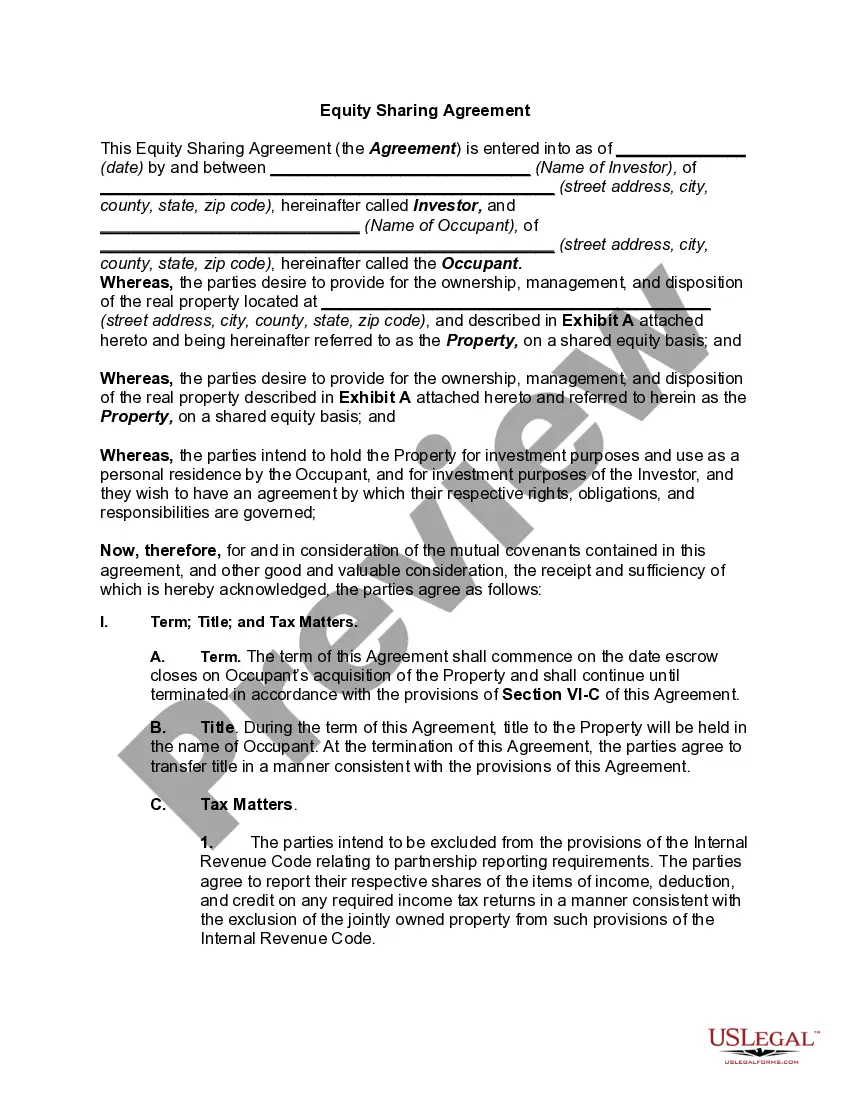

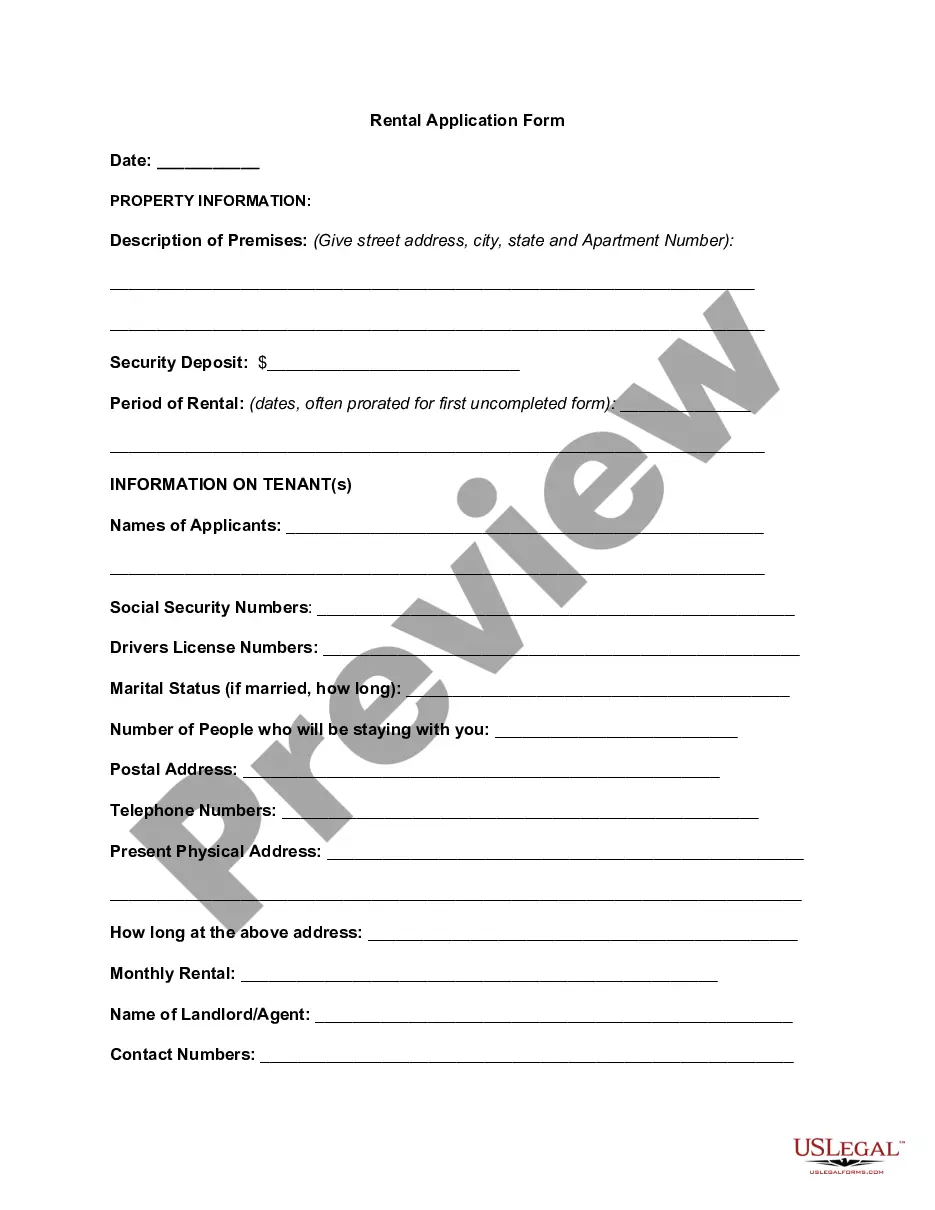

The 147c Letter Example For Tax Filing you observe on this page is a versatile official template created by licensed attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal professionals with more than 85,000 authenticated, state-specific documents for any business and personal situation. It’s the fastest, simplest, and most reliable method to access the documentation you require, as the service ensures the highest level of data privacy and anti-malware safeguards.

Subscribe to US Legal Forms to have authentic legal templates for every aspect of life available at your fingertips.

- Search for the document required and review it.

- Browse through the template you looked for and preview it or examine the form description to confirm it meets your requirements. If it doesn’t, use the search feature to locate the correct one. Click Buy Now once you’ve identified the template you want.

- Register and Log Into your account.

- Choose the payment plan that fits your needs and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and review your subscription to continue.

- Access the editable template.

- Select the format you prefer for your 147c Letter Example For Tax Filing (PDF, DOCX, RTF) and download the sample onto your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with an electronic signature.

- Re-download your documents later.

- Utilize the same document again whenever in need. Go to the My documents tab in your profile to redownload any previously purchased templates.

Form popularity

FAQ

The IRS letter 147C, also known as the SS-4 confirmation letter, serves as official proof of your Employer Identification Number (EIN). This letter is crucial for various business activities, including filing tax returns, opening bank accounts, and applying for licenses. The 147c letter sample for tax return can help ensure that your tax filings are accurate and compliant. For easy access and guidance, you may want to explore the resources available on US Legal Forms.

You can obtain a 147c letter from the IRS by calling their Business and Specialty Tax Line. When you contact them, ask specifically for the 147c letter sample for tax return, which confirms your EIN. Be prepared to provide your business details, such as the legal name and address. If you prefer a more streamlined approach, consider using US Legal Forms for assistance in acquiring your letter.

To get a 147C letter from the IRS online, you must use the IRS's online services. You may need to create an account or log in to your existing account to access your tax records. The 147c letter sample for tax return is vital for confirming your Employer Identification Number (EIN). If you need help navigating this process, US Legal Forms offers guidance to simplify your request.

You can request a copy of your IRS EIN letter through the IRS website or by calling their customer service. If you are looking for a 147c letter sample for tax return, the EIN letter is essential for proving your business's tax identification. Ensure you have your business information handy, as it will help expedite the process. If you prefer a more user-friendly option, consider using US Legal Forms for assistance.

To obtain an IRS verification letter online, you need to visit the IRS website and use their online tool. This tool allows you to request a copy of your IRS letter, including the 147c letter sample for tax return. Make sure you have your personal information, such as your Social Security number and tax filing status, ready. Once your request is processed, you will receive your verification letter electronically.

To obtain a 147C letter from the IRS, you can call the IRS directly or submit a written request. Ensure you have your EIN and any other necessary details at hand. For a comprehensive approach, consider using USLegalForms, which offers templates and support for acquiring the 147C letter sample for tax return, making the process more manageable.

Reading the IRS letter 147C involves understanding its key components, including your tax status and any tax identification information. This letter confirms your Employer Identification Number (EIN) and may include instructions for your tax return. If you have questions about specific sections, resources like USLegalForms can provide clarity and examples of 147C letter samples for tax return.

To get your IRS letter 147C online, you should visit the IRS website and check the available options for tax-related requests. However, this specific letter often requires a direct request via phone or mail. Consider using USLegalForms to access a 147C letter sample for tax return, which can guide you on how to properly request it.

Yes, you can obtain a copy of your IRS letter online, but it may depend on the type of letter. For a 147C letter, you typically need to request it through the IRS website or by calling them directly. Utilizing resources like USLegalForms can simplify this process, as they provide templates and guidance for obtaining necessary documents for your tax return.

To call the IRS about a 147C letter, first gather your relevant information, including your Social Security number and any tax documents related to your inquiry. Dial the IRS customer service number at 1-800-829-1040. Be prepared for potentially long wait times, and clearly explain your situation regarding the 147C letter sample for tax return.