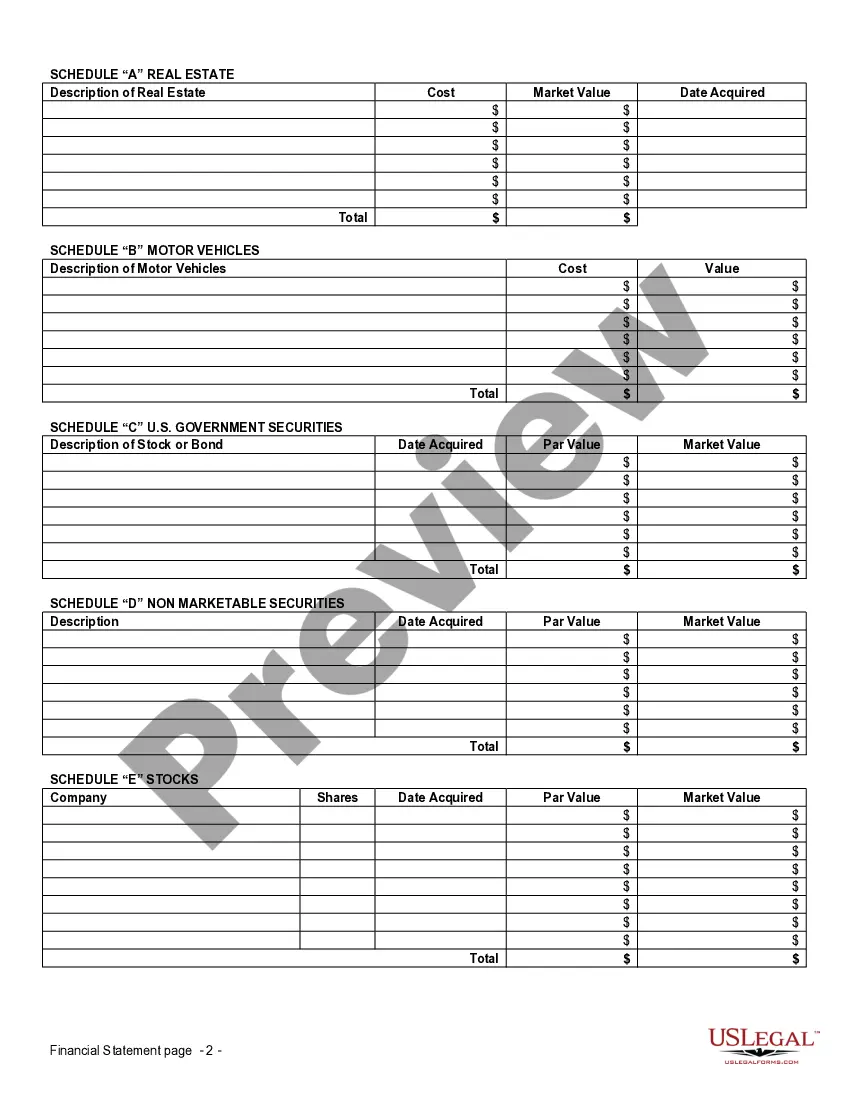

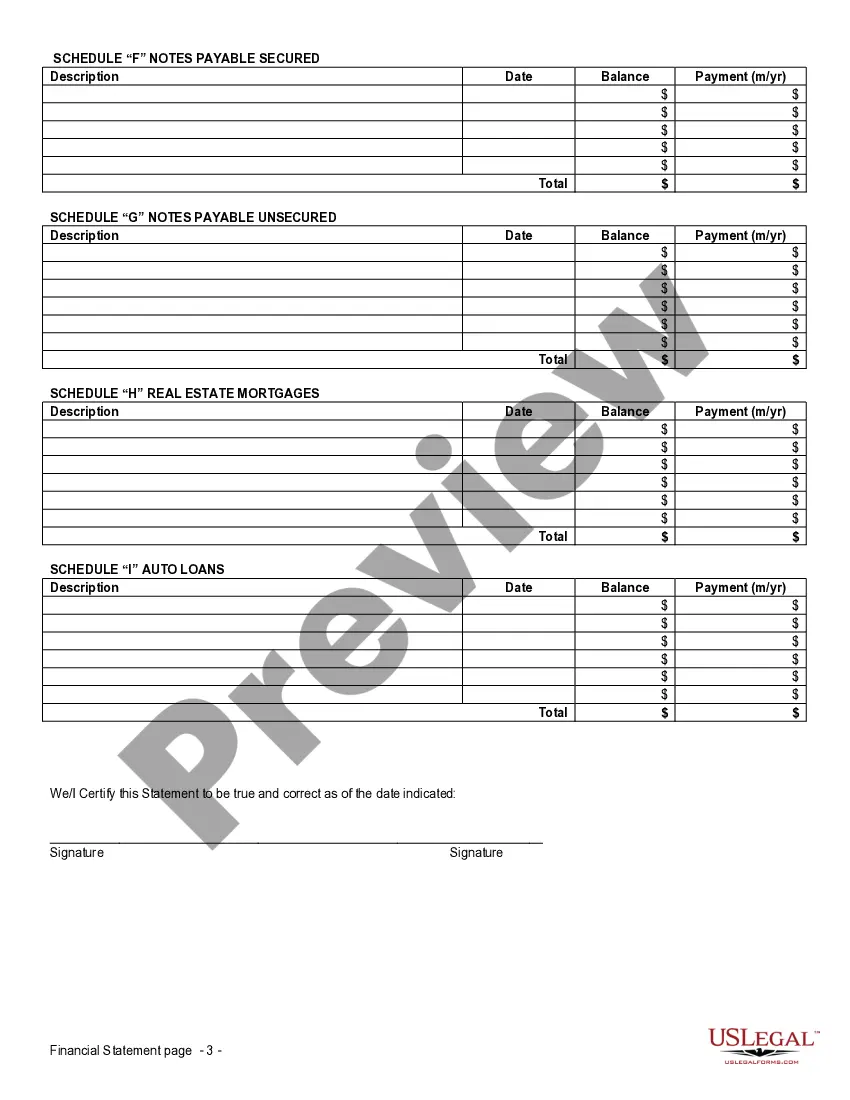

Financial Statement Form Blank For Non-profit Organization

Description

How to fill out Financial Statement Form - Husband And Wife Joint?

Drafting legal paperwork from scratch can sometimes be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more cost-effective way of creating Financial Statement Form Blank For Non-profit Organization or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of more than 85,000 up-to-date legal forms covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-specific templates diligently prepared for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Financial Statement Form Blank For Non-profit Organization. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and explore the library. But before jumping directly to downloading Financial Statement Form Blank For Non-profit Organization, follow these recommendations:

- Check the form preview and descriptions to ensure that you are on the the form you are searching for.

- Check if template you select complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Financial Statement Form Blank For Non-profit Organization.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us today and transform form completion into something easy and streamlined!

Form popularity

FAQ

Lay out your income statement. Put the net sales on one line. Underneath that, put the cost of sales. ... Put the operating costs in general categories underneath the gross profit. ... Next, have a line each for the interest and the taxes. ... The final line should be the net income.

Nonprofit accounting relies on using the statement of financial position (balance sheet), statement of activities (income statement), and cash flow statement. The statement of financial position gives you a screenshot of the health of your nonprofit during a period of time.

Your nonprofit's liabilities and assets must balance. Net assets are any assets left over after subtracting your liabilities. Your net assets can be from the current and previous operating years and include anything that holds value. Nonprofits don't have to list net assets line by line.

Your nonprofit's liabilities and assets must balance. Net assets are any assets left over after subtracting your liabilities. Your net assets can be from the current and previous operating years and include anything that holds value. Nonprofits don't have to list net assets line by line.

Nonprofit balance sheets include an organization's assets, liabilities, and net assets. You get your organization's net assets when you subtract your nonprofit's liabilities, or what you owe, from your assets.