Escrow Statement Example

Description

How to fill out Escrow Agreement - Long Form?

Managing legal documents can be daunting, even for the most seasoned professionals.

If you're looking for an Escrow Statement Example but lack the time to search for the proper and current version, the experience can be stressful.

US Legal Forms meets all your needs, ranging from personal to business documents, all in one location.

Utilize cutting-edge tools to complete and organize your Escrow Statement Example.

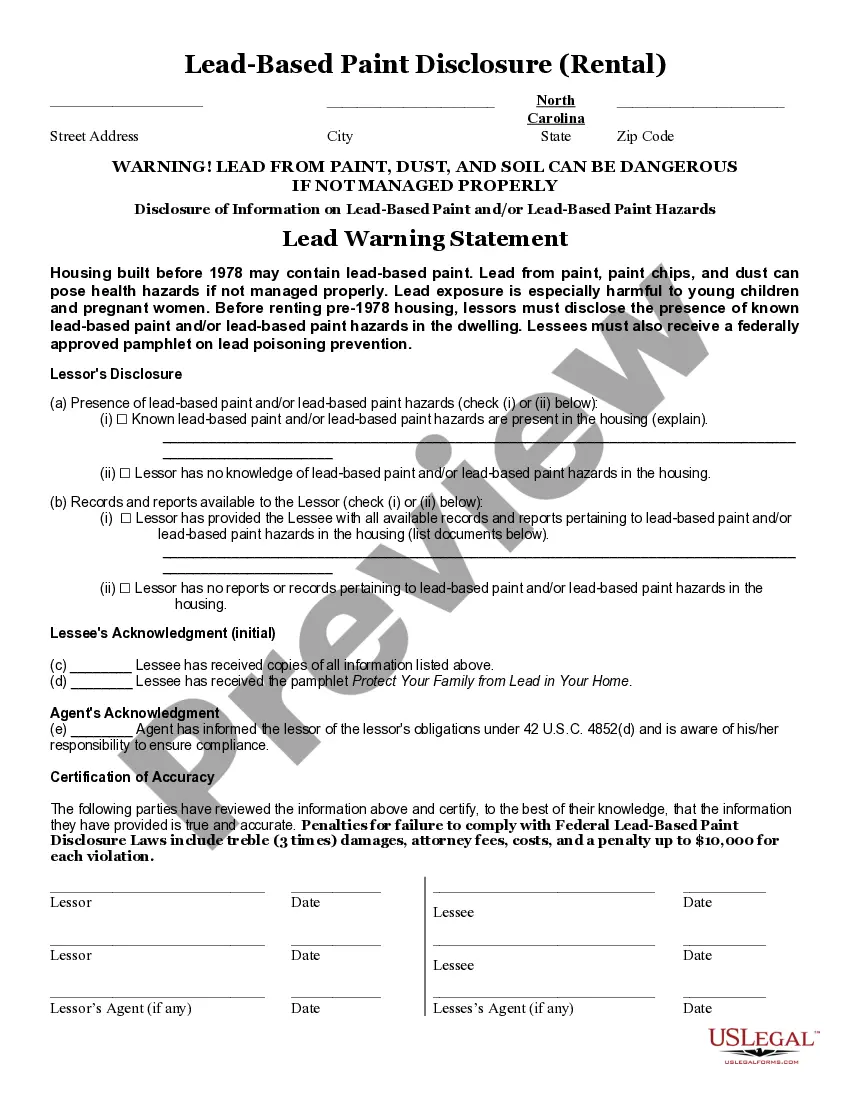

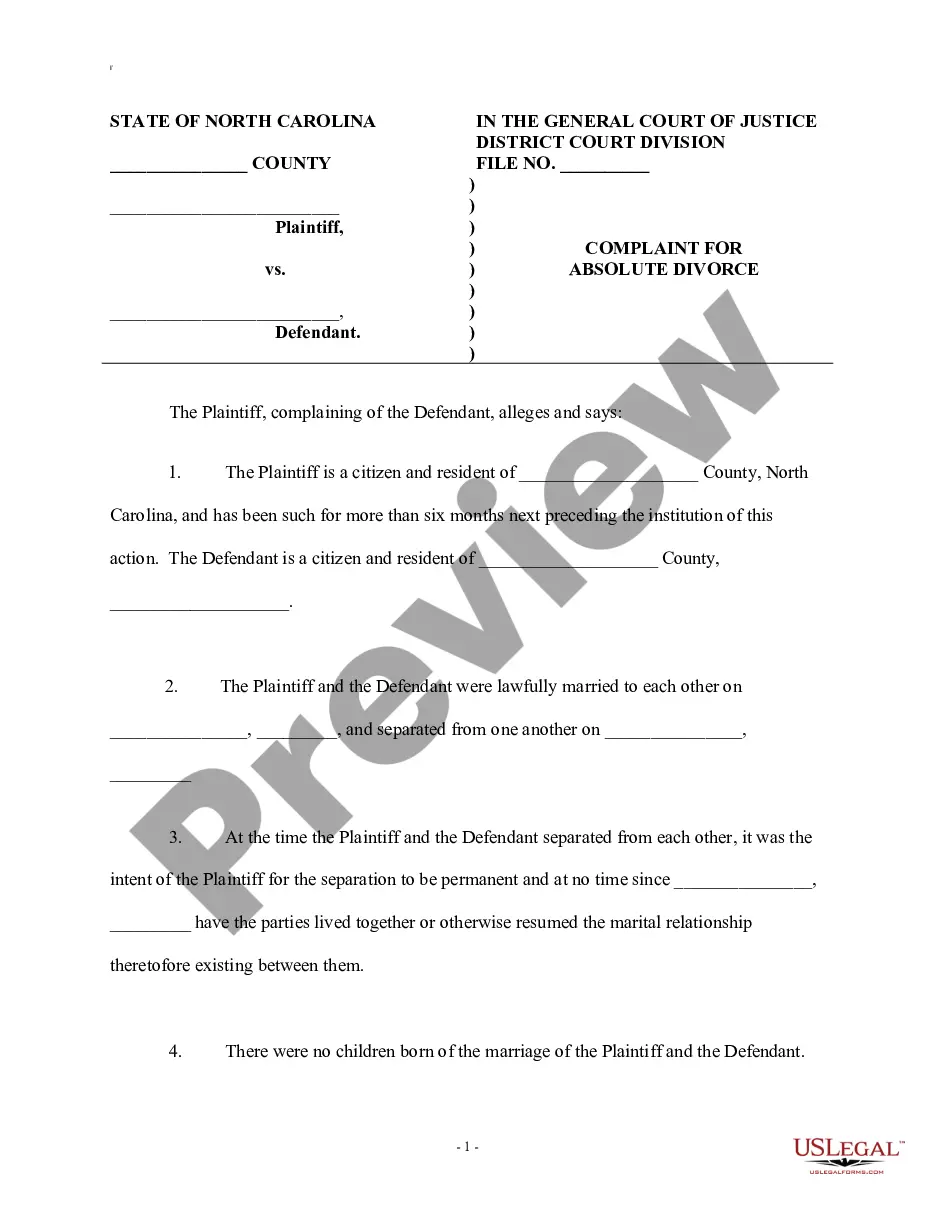

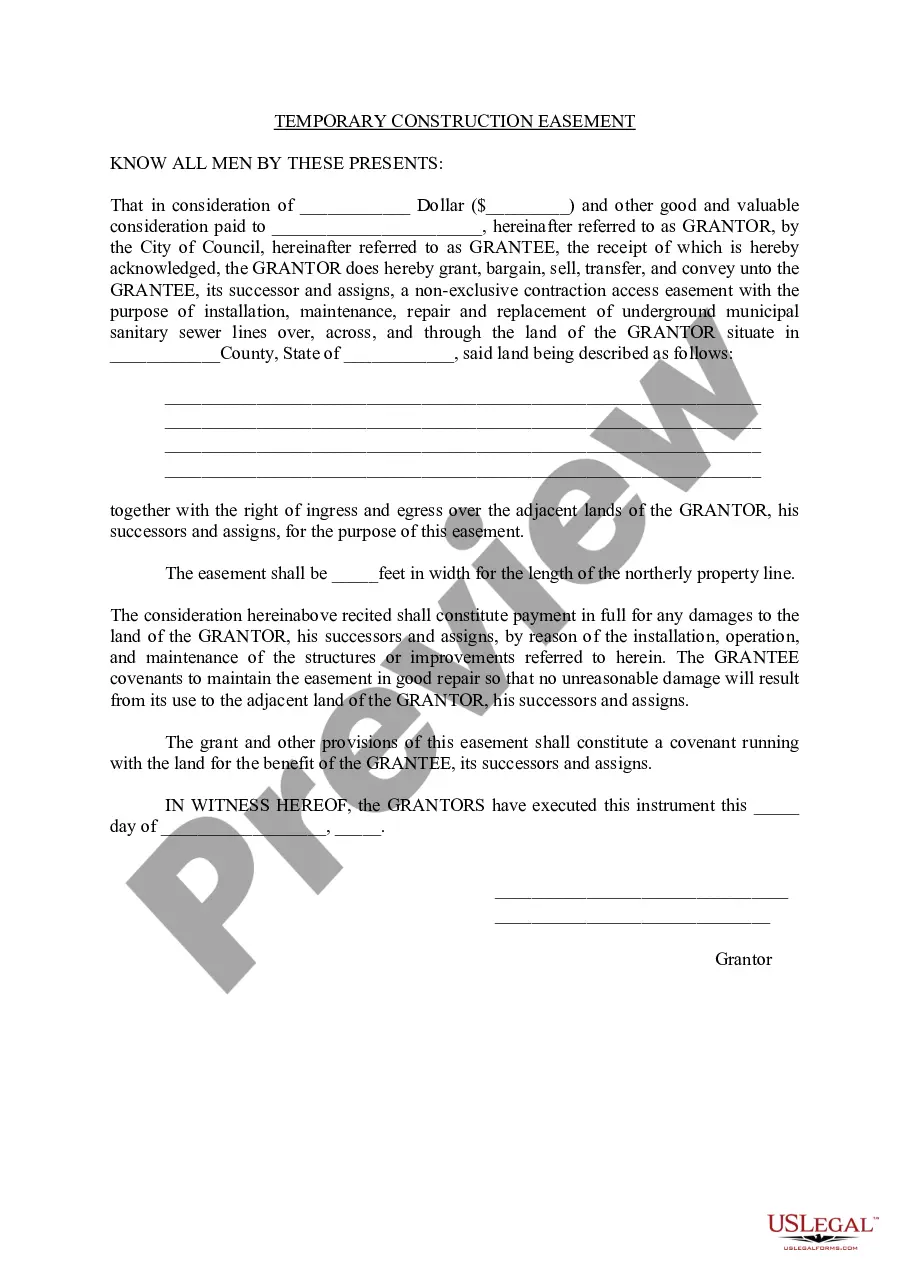

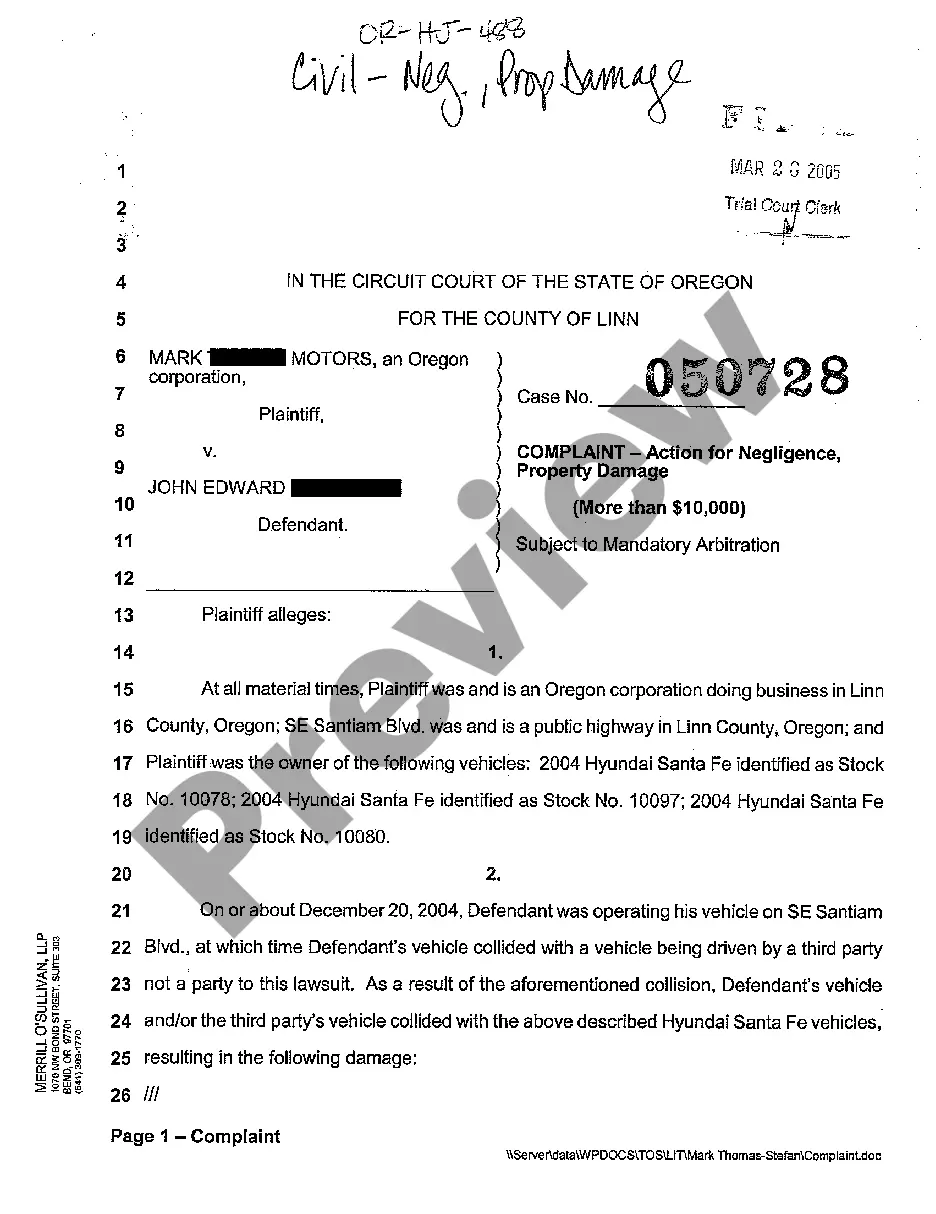

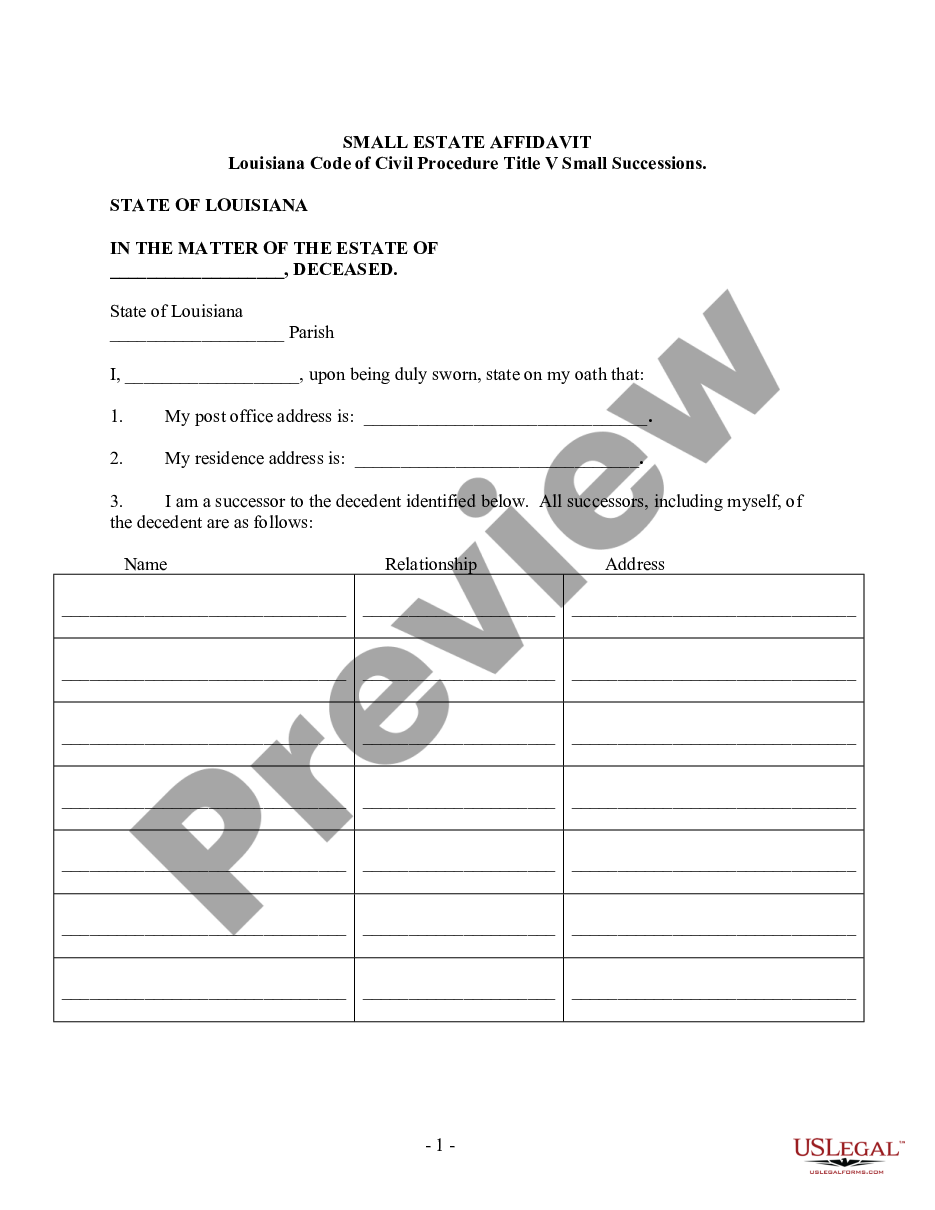

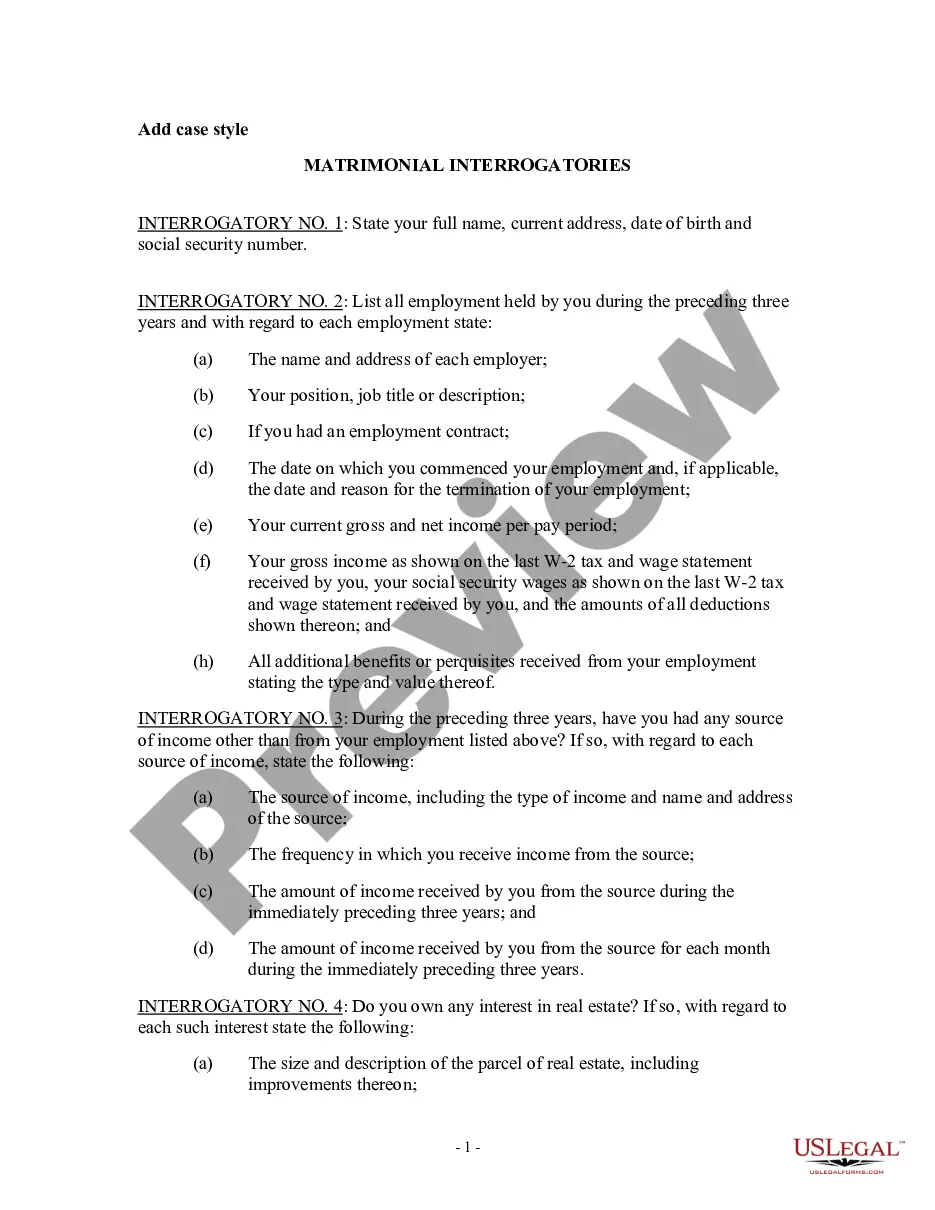

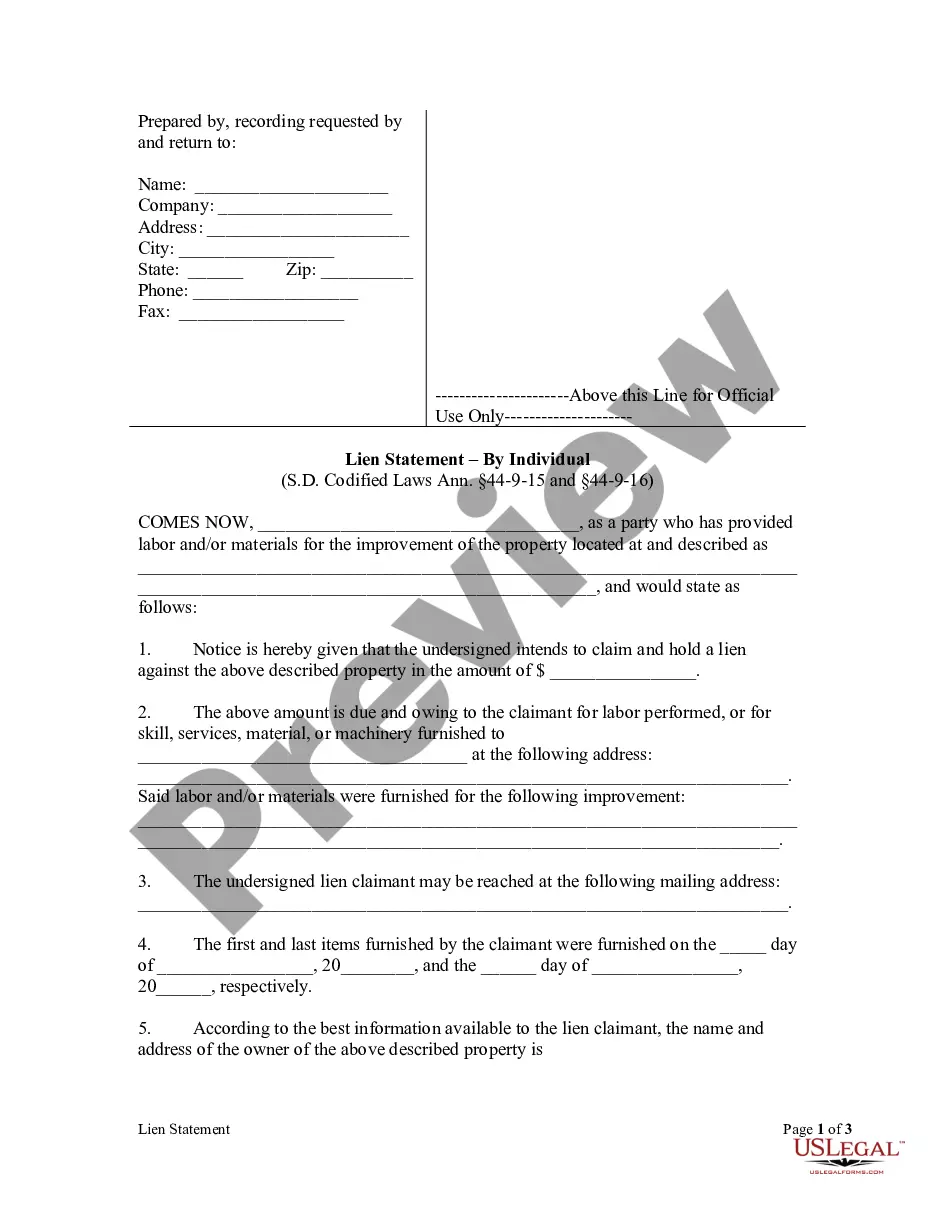

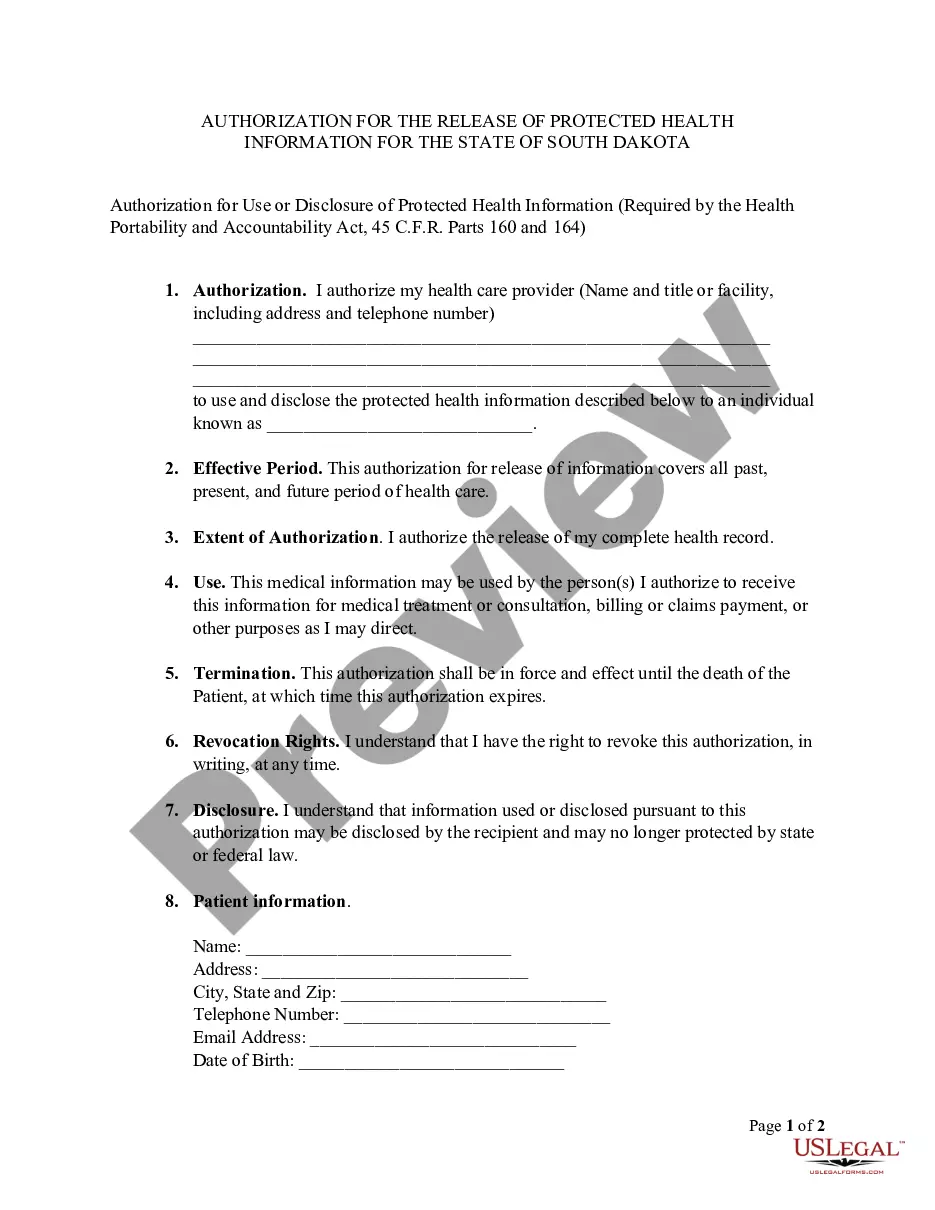

Follow these steps after finding the form you need: verify its accuracy by previewing it and checking its description, ensure it is valid in your state or county, select Buy Now when ready, choose a subscription plan, and pick your desired format to Download, fill out, sign, print, and send your documents.

- Access a knowledge base filled with articles, guides, and materials related to your needs.

- Save time and energy searching for the necessary documents by using US Legal Forms' advanced search and Preview feature to find and download the Escrow Statement Example.

- If you hold a monthly subscription, Log In to your US Legal Forms account, look for the form, and download it.

- Visit the My documents tab to view the documents you've saved and manage your folders as needed.

- If it's your first visit to US Legal Forms, create an account to gain unlimited access to all platform features.

- An effective web form directory could revolutionize the way individuals handle these challenges.

- US Legal Forms is a frontrunner in online legal forms, providing more than 85,000 state-specific legal forms at your convenience.

- With US Legal Forms, you can access various legal and business forms tailored to your state or county.

Form popularity

FAQ

This account is used to pay property-related expenses like property taxes, mortgage insurance and homeowners insurance, all of which are wrapped into your monthly mortgage payment. As the end of the year approaches, you'll probably be receiving an annual statement about this account from your lender.

To set up your mortgage escrow account, the lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement.

Increases or decreases to the escrow portion of your monthly mortgage payment are typically the result of changes in your real estate taxes and/or insurance. The Escrow Account Statement details your escrow account changes and how it will impact your monthly mortgage payment for the next 12 months.

The Initial Escrow Disclosure Statement details the specific charges that you will pay into escrow each month as part of a mortgage agreement. PLEASE KEEP THIS STATEMENT TO COMPARE WITH THE ACTUAL ACTIVITY THAT WILL OCCUR IN YOUR ESCROW ACCOUNT DURING THE UPCOMING YEAR.

A buyer might agree to purchase a property with the condition that the home passes a home inspection. The funds for the purchase would be held in escrow until the inspection has been completed. Once the conditions of the offer are satisfied, the buyer or seller will then be obligated to purchase or sell the property.