Notice Payment Form For Bir

Description

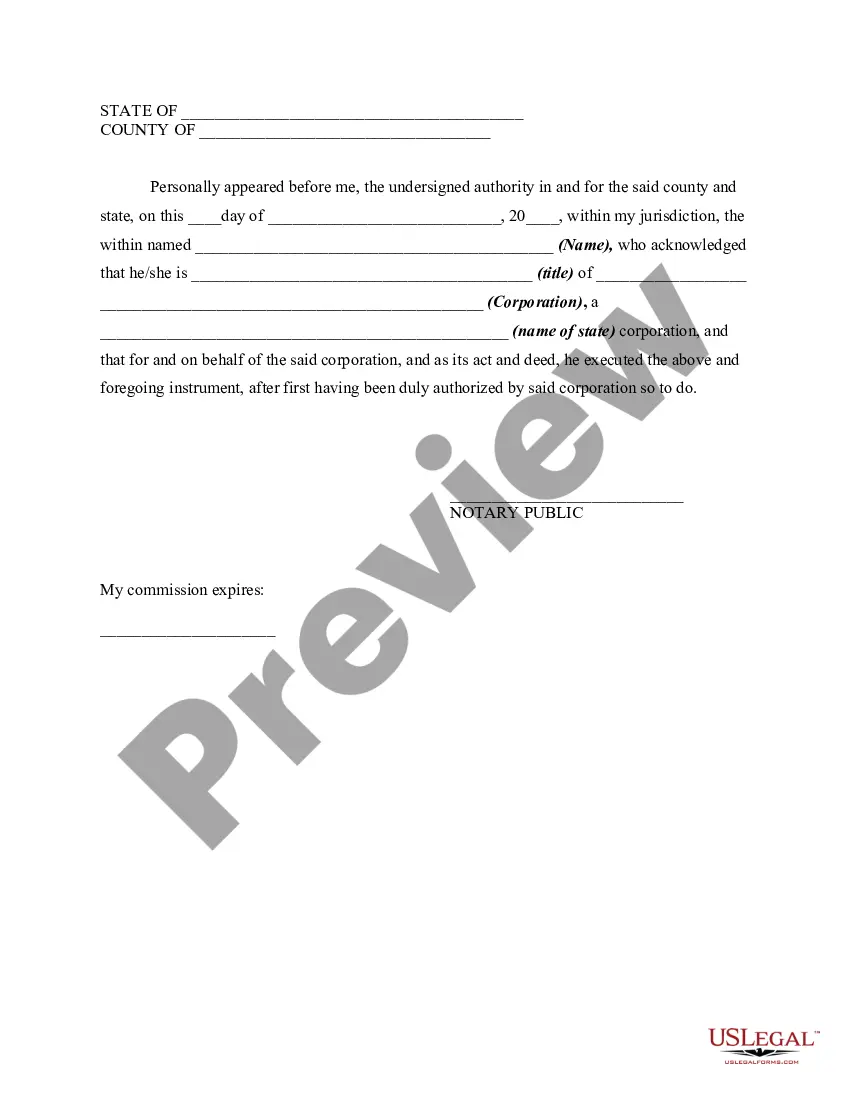

How to fill out Notice To Debtor Of Authority Of Agent To Receive Payment?

What is the most trustworthy platform to obtain the Notice Payment Form for Bir and other recent versions of legal documents? US Legal Forms is the solution!

It boasts the largest assortment of legal forms for any situation. Each template is professionally prepared and confirmed for adherence to federal and local statutes. They are categorized by industry and state of application, making it easy to find the one you require.

US Legal Forms is an excellent choice for anyone who needs to manage legal documents. Premium users can access even more features, including the ability to complete and endorse previously saved forms electronically anytime via the built-in PDF editing tool. Give it a try now!

- Seasoned users of the site only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Notice Payment Form for Bir to obtain it.

- Once saved, the template remains accessible for future use under the My documents section of your account.

- If you don’t possess an account with us yet, here are the steps to create one.

- Template compliance review. Before you acquire any form, you must ensure it aligns with your usage criteria and your state or county’s regulations. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

BIR forms are downloadable from the official BIR website under the 'Forms' section. This platform provides the most recent versions of all forms, including essential documents like the notice payment form for BIR. Accessing these forms online ensures you have the right paperwork to facilitate your tax compliance.

You can obtain BIR form 2305 from the BIR's official website or at any local BIR office. This form is pivotal for updating your tax information efficiently. Utilizing the notice payment form for BIR with your submission can ensure all requirements are met seamlessly.

You can obtain the BIR sworn declaration form from the official BIR website or authorized tax offices. This form is essential for various tax compliance purposes, ensuring taxpayers affirm their provided data. Pairing this form with the notice payment form for BIR can simplify your filing process.

The eBIRForms aims to streamline tax filing for businesses and individuals in the Philippines. This digital approach simplifies the process by automating calculations and providing an easy way to submit forms. The connection to the notice payment form for BIR enhances the efficiency of managing tax obligations.

BIR Form 0619 E is intended for the remittance of final taxes on certain incomes. It serves as a reporting tool for go through final withholding taxes from several sources, ensuring compliance with tax regulations. This form is vital for taxpayers who need to accurately manage their final tax liabilities. When you think of managing all your forms, utilizing the Notice payment form for BIR can provide you with a clearer path to fulfilling your tax obligations.

BIR Form 0613 is the official form for remitting expanded withholding tax. Taxpayers must fill this form when making payments to ensure proper documentation and compliance with tax laws. This form serves as a vital instrument to help individuals and businesses track their tax obligations accurately. Completing your BIR Form 0613 alongside the Notice payment form for BIR simplifies your payment process.

BIR Form 2305 is primarily used to update your withholding tax status. This form is crucial for those who have recently changed their tax status or exemptions. Completing this form ensures that your tax withholding aligns with your current financial situation. By integrating this with the Notice payment form for BIR, you can effectively manage your withholdings and payments.

Tax form 0613 is specifically designed for the remittance of expanded withholding tax. It is essential for individuals and entities who are required to report these specific taxes to the Bureau of Internal Revenue. This form aids taxpayers in ensuring compliance with reporting requirements. To enhance your tax processing, you can easily access the Notice payment form for BIR when completing form 0613.

The purpose of expanded withholding tax is to ensure that the government collects tax obligations at the source of income. This tax system helps in effectively gathering revenue and minimizing tax evasion. By implementing an expanded withholding tax, the Bureau of Internal Revenue (BIR) makes compliance easier. In this context, you can utilize the Notice payment form for BIR to streamline your tax payments.

Form 1700 is designed for individuals earning purely compensation income, while Form 1701 is for those with mixed income sources, including self-employment income. Choosing the correct form ensures compliance with BIR regulations. When managing tax responsibilities, consider using the Notice payment form for BIR to navigate forms conveniently.