Employee Stock Incentive Plan Formula

Description

How to fill out Executive Employee Stock Incentive Plan?

Dealing with legal documentation and processes can be a tedious addition to the day.

Employee Stock Incentive Plan Formula and similar forms usually necessitate you to search for them and find the way to fill them out correctly.

For that reason, if you are managing financial, legal, or personal issues, using a comprehensive and user-friendly online directory of forms readily available will be beneficial.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and a range of tools to assist you in completing your documentation effortlessly.

Is this your first time using US Legal Forms? Register and set up your account within a few minutes, and you will gain access to the form catalog and Employee Stock Incentive Plan Formula. Then, follow the steps outlined below to complete your document.

- Explore the assortment of relevant documents accessible to you with just a click.

- US Legal Forms provides you with state- and county-specific documents available at any time for download.

- Protect your document management processes with a premier service that allows you to prepare any form in minutes without extra or concealed fees.

- Simply Log In to your account, locate Employee Stock Incentive Plan Formula, and obtain it directly from the My documents section.

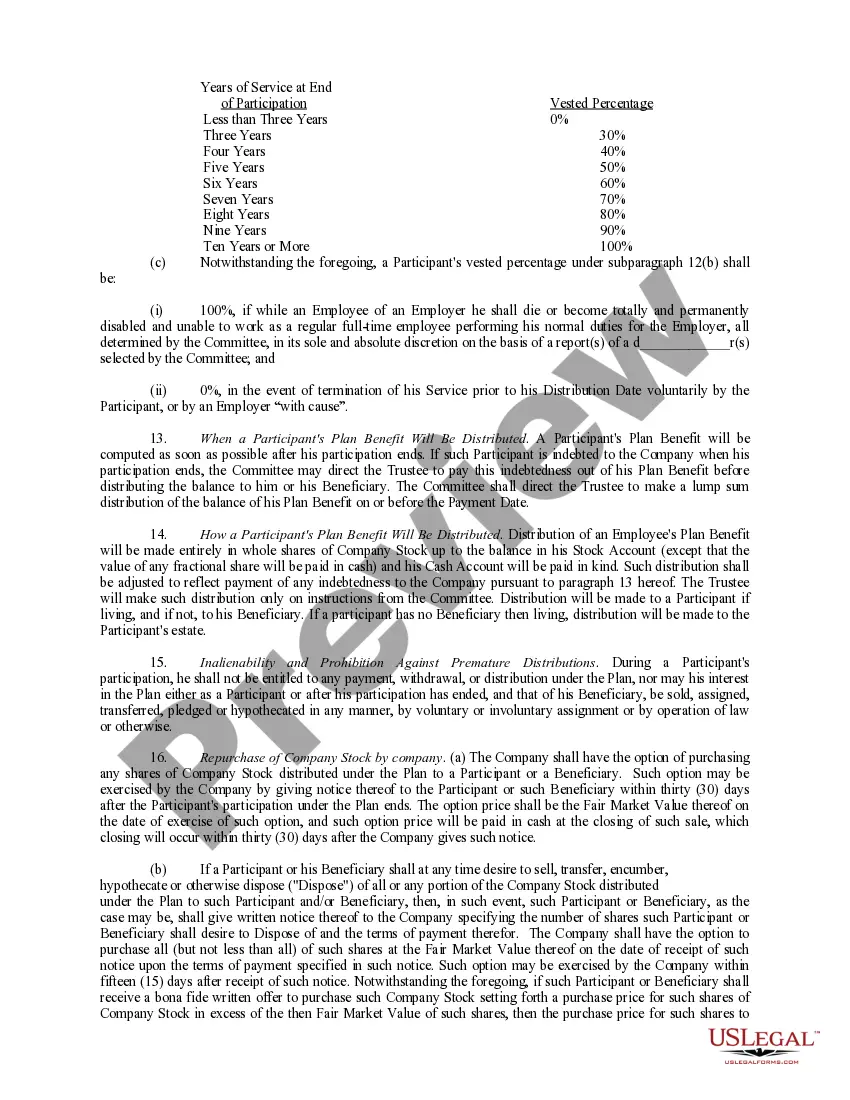

- You may also retrieve previously saved documents.

Form popularity

FAQ

The accounting treatment of an employee stock option plan involves recognizing the value of the options granted as a compensation expense over their vesting period. The employee stock incentive plan formula plays a crucial role in determining the fair value of these options, which influences the reported expenses. Companies must ensure they comply with relevant accounting standards to maintain transparency in financial statements.

The $100,000 limit refers to the maximum value of stock options an employee can exercise in a single year under specific tax-advantaged plans. This limit is essential in the context of the Employee stock incentive plan formula, as it influences how options are structured and awarded. By understanding this limit, companies can navigate the complexities of stock options effectively, ensuring compliance and maximizing benefits.

Using the ESOP Capital Gain formula = (Selling Price - Cost Basis), you can quickly determine your capital gain. ESOP Tax Calculators are available to simplify this process, offering accurate estimates of your tax liability based on your capital gain.

Employee's stock option plan will be treated as a perquisite, with a value equal to (Fair Market Value per share ? Exercise price per share) x number of shares allocated (on the date of allotment). Perquisite = (FMV per share ? Exercise price per share) x number of shares allotted.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

An ESOP Valuation is the process by which the Fair Market Value (FMV) of a company's ESOP shares is determined by an independent appraiser and confirmed by the company's ESOP trustee. Ultimately, under the recommendation of the appraiser, the fiduciary (trustee) makes the final ESOP valuation.

Here's an example: You can purchase 1,000 shares of company stock at $20 a share with your vested ISO. Shares are trading for $40 in the market. If you already own 500 company shares, you can swap those shares (500 shares x $40 market price = $20,000) for the 1,000 new shares, rather than paying $20,000 in cash.