Construction Contracts Oregon Withholding In Wake

Description

Form popularity

FAQ

Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if an Internal Revenue Code Section provides for a lower rate, or there is a tax treaty between the foreign person's country of residence and the United States.

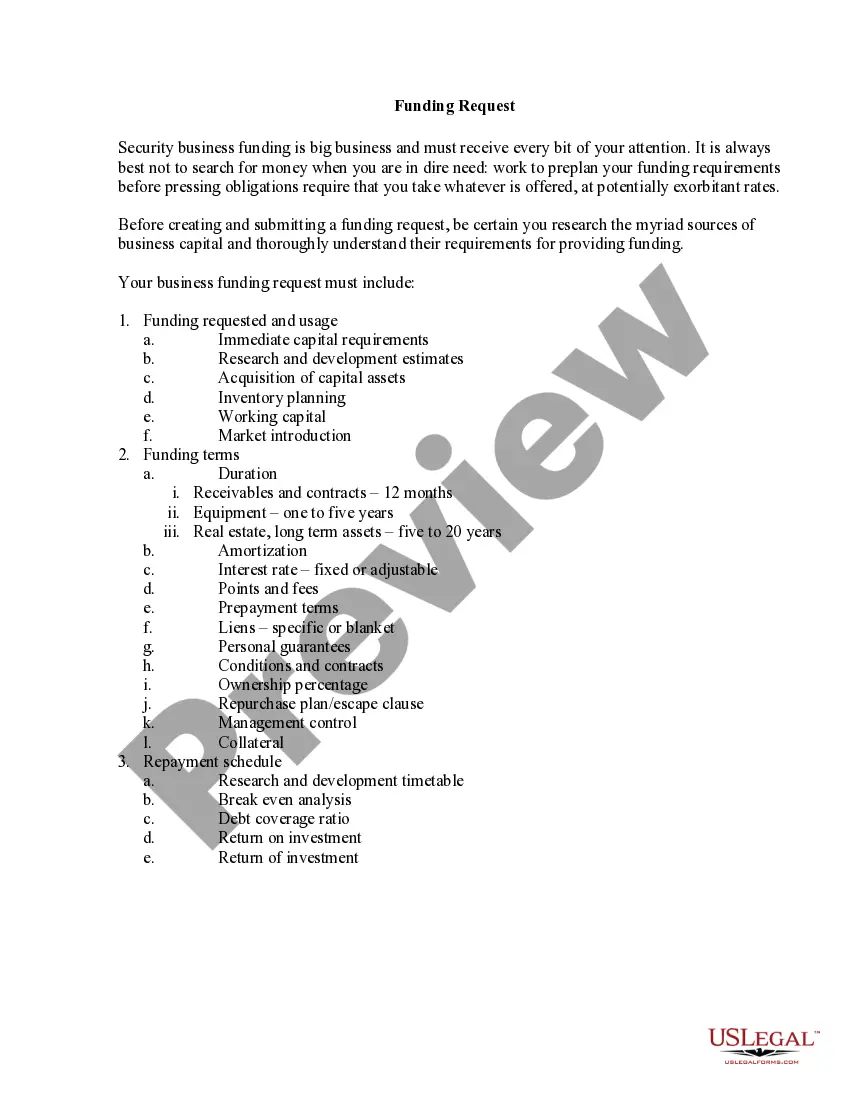

How to fill out the Oregon Withholding Statement Exemption Certificate? Read the instructions carefully before starting. Fill in your personal information at the top of the form. Use the worksheets provided to determine your allowances. Submit the form to your employer or payer. Keep a copy for your records.

If you're claiming exemption from withholding, you must meet one of these requirements: Your wages must be exempt from Oregon taxation, or • You must meet the qualification for having no tax liability.

A withholding allowance represents a portion of your income that isn't taxed. The more allowances you claim, the less tax will be withheld. For Oregon, one allowance is equal to one personal exemption credit's worth of tax for the year.

The State of Oregon does not have its own Form W-4 so if you want your filing status, allowances, or additional withholding amount to be different then your federal, submit another Form W-4 with those changes and "For Oregon Only" written at the bottom of the form.

Oregon income tax withholding refers to the amount of Oregon personal income taxes that are withheld from your paychecks to cover your anticipated Oregon tax liability for the year. By law, your employer must withhold a portion of your wages based on your allowances and send the funds to the Department of Revenue.

The Oregon Form OR-W-4 should be used when starting a new job, when you experience a change in financial situation, or when there is a need to declare exemptions. 1. Starting a New Job: Complete this form to declare your withholding preferences when beginning employment.

Your employer needs to withhold from your wages and you. want to lower your withholding, you must have a personal. or financial change affecting your tax situation. If you do, mark the “Redetermination” check box.

Single (With Less Than Three Exemptions) Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be: Over $0 but not over $10,750 $0.00 Over $10,750 but not over $125,000 $639.00 plus 8.75% of excess over $10,750 Over $125,000 $10,636.00 plus 9.90% of excess over $125,000