Fixed Fee For In Riverside

Description

Form popularity

FAQ

Riverside sales tax details The minimum combined 2025 sales tax rate for Riverside, California is 8.75%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%. The Riverside sales tax rate is 1.0%.

The Homeowners' Exemption reduces your property taxes by deducting $7,000 from your property's assessed value before applying the tax rate, and given the one percent statewide property tax rate, this generally equates to $70 in property tax savings.

In California, all properties are subject to a basic tax rate of 1% based on their assessed value. This value is set by the county assessor when the property is bought or newly built. For example, if your assessment is $500,000, the basic property tax you owe would be $5,000 annually.

Can I upgrade, downgrade, or cancel my subscription at any time? Yes. You can do all of this in your dashboard.

Standard plan - $15/month Full 4k video quality and 48 kHz audio quality. 5 hours of separate track recording per month. Image and text overlays during your recordings. Riverside watermark only during livestreams.

Here's why Riverside is a favorite of podcasters and many other video content creators: It's reliable: Riverside records locally on each participant's computer, so your video and audio recordings always come out perfect. The recordings are then uploaded to the cloud, where you can access them at any time.

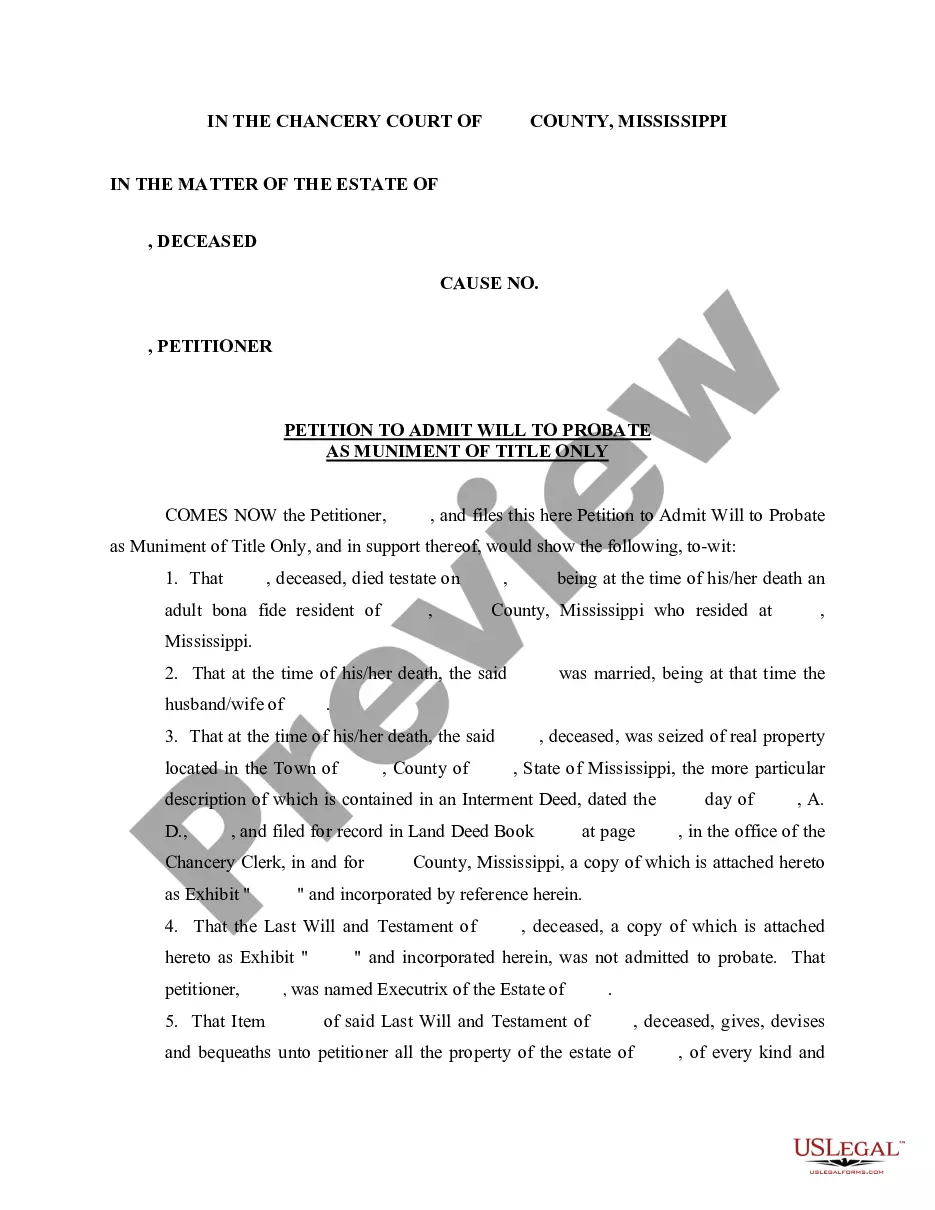

Probate cases in Riverside County are usually heard at the Riverside Historic Courthouse at 4050 Main Street.

Because of time delays between the time of filing documents with the court and the hearing related to the subject matter of those documents (usually 60 to 90 days in the Riverside and San Bernardino County Probate Courts – much longer in the Probate Courts of Orange and Los Angeles Counties), as well as the mandatory ...