Construction Fee Plus Form For Maintenance Fee In Michigan

Description

Form popularity

FAQ

In Michigan, a contractor directly engaged in the business of constructing, altering, repairing or improving real estate is considered the consumer of the materials used by them. All sales to or purchases by contractors of tangible personal property are subject to tax.

To be eligible for either a residential builders license or a maintenance and alterations license, you'll need to take 60 hours of pre-license education courses. During those hours, you need at least six hours on each of the following: Business management, estimating, and job costing. Design and building science.

Delivery or installation charges can now be exempt from Michigan sales and use tax. Michigan's legislature changed the Michigan sales and use tax treatment of most delivery and installation charges effective April 26, 2023. When a seller follows two simple steps, the fees are now exempt from the sales tax calculation.

Generally, services are not subject to Michigan sales tax. However, the types of services listed here are subject to Michigan sales tax: Amusement Services. Automotive Services.

Professional services that require specialized knowledge or expertise are exempt from Michigan sales tax. These services include but are not limited to: Accounting and bookkeeping services. Legal services.

The Michigan Licensing Law gives a homeowner an exemption to act as his or her own general contractor. This means in the case of his or her own single-family residence, that they will occupy, the homeowner may obtain a building permit for construction at his or her own home.

How To Write A Construction Contract With 7 Steps Step 1: Define the Parties Involved. Step 2: Outline the Scope of Work. Step 3: Establish the Timeline. Step 4: Determine the Payment Terms. Step 5: Include Necessary Legal Clauses. Step 6: Address Change Orders and Modifications. Step 7: Sign and Execute the Contract.

Per contract law, a contract is only considered to be legally binding if it is mutually beneficial for all parties involved. This is also known as consideration. When one party does something without getting anything in return, the contract is typically considered unenforceable by the courts.

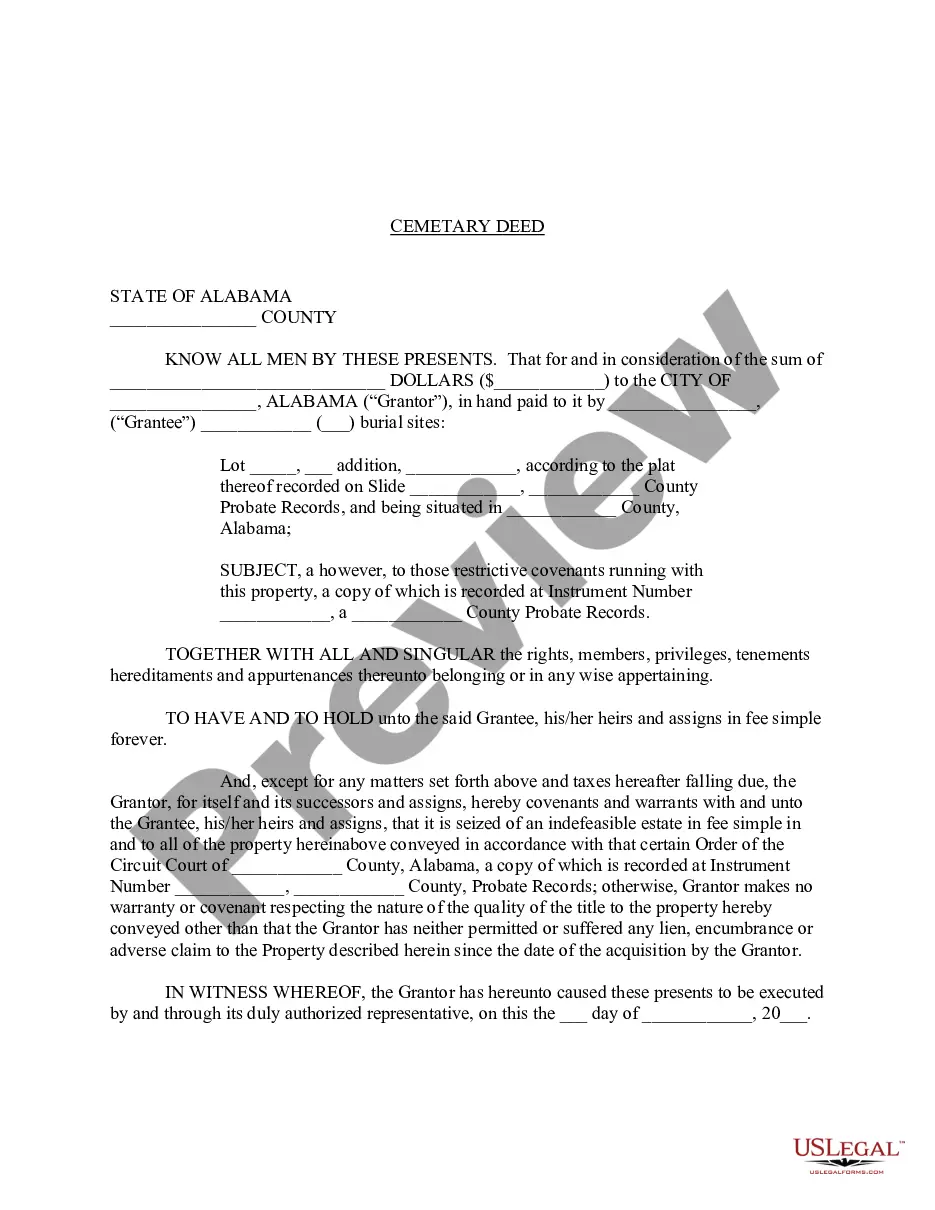

Michigan construction contract requirements Only residential construction contracts are regulated in Michigan. Such contracts must be in writing, include the contractor's license number (if a license is required), and cite the statute that requires the contractor to be licensed for their particular trade.

Repairs and maintenance: Minor repair work, including the replacement of lamps or the connection of approved portable electrical equipment to approved permanently installed receptacles.