Credit Card Form Statement With Validation In San Diego

Description

Form popularity

FAQ

Yes, it is mandatory to submit specific documents when applying for a Credit Card. These documents are necessary to verify your proof of income, residential address, and identity.

Log in to Online Banking and navigate to your credit card Account details page, then select the Statements & Documents tab. You'll have access to your credit card statements and also be able to request paper statements.

10 Things To Check In Your Credit Card Statement Statement date. Understanding your statement date is like getting the key to your financial diary. Payment due date. Billing cycle. Grace period. Transaction details. Total amount due. Minimum amount due. Credit limit availability.

The main types of card verification methods include: – Online PIN: The cardholder enters their PIN, which is encrypted and sent to the bank for verification. – Offline PIN: The PIN is verified locally between the card and the terminal. – Signature: The cardholder signs a receipt or a digital screen.

You can request a physical copy of the statement from the bank by calling the customer care department or by visiting the nearest branch.

A credit check builds a picture of your financial history. Credit checks or searches are used by lenders and companies when you apply for credit. They will usually check your credit report to help build a snapshot of your financial history, as part of their assessment of your credit application.

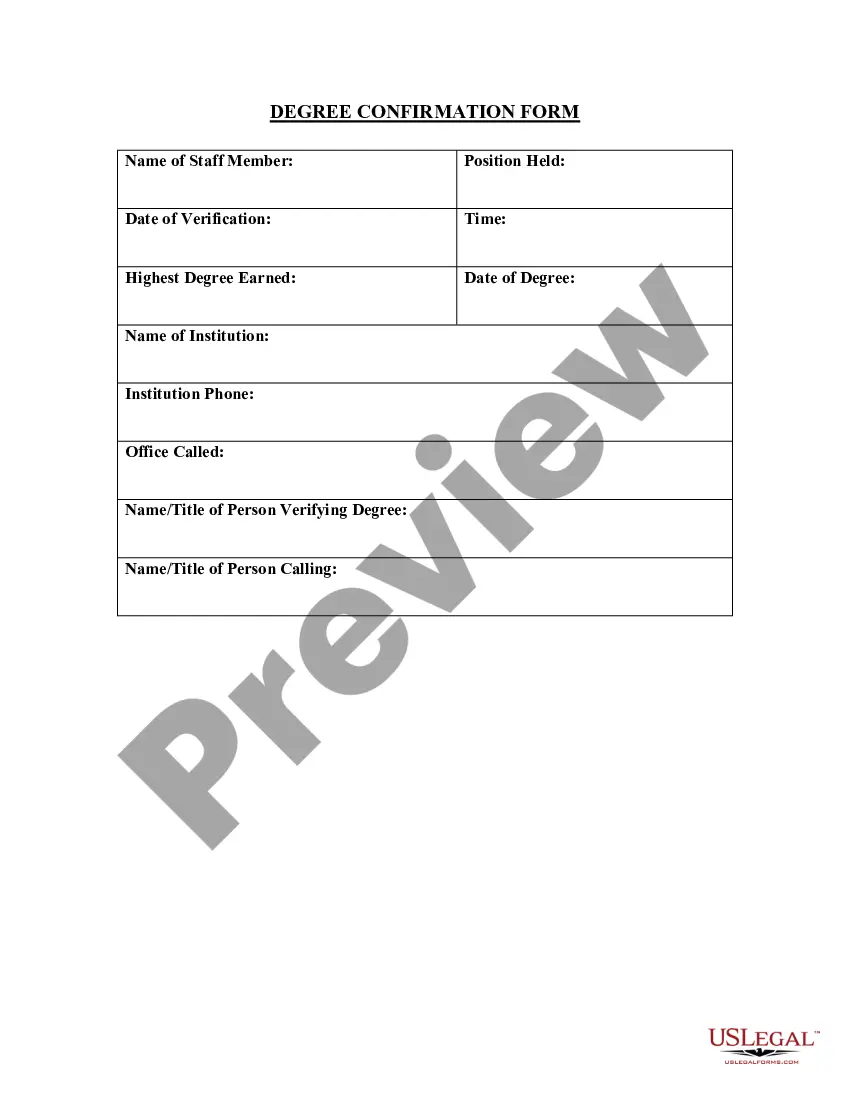

The information on such a form must include: Cardholder's name. Card number. Card network (Visa, Mastercard, American Express, Discover, etc.) Card expiration date. Cardholder's billing zip code. Business name. Statement authorizing charges. Cardholder's signature and the date they signed.

What is Card Verification? Simply put, card verification is the step in the payment process where a combination of features in ATM, debit, and credit cards are used to confirm the owner's identity.

This form is typically used when the card is not present (such as for payments over the phone or via email) or recurring charges. It helps businesses get the necessary information to process the payment securely. Credit card authorization forms can be paper or electronic.

There are situations where you want to store credit card numbers to keep, for example, proof of written authorizations for mail-order payments or recurring payment authorizations. Keep paper documents with credit card numbers locked in a secure place (like a safe) when not in use.