Completion Report For In Ohio

Description

Form popularity

FAQ

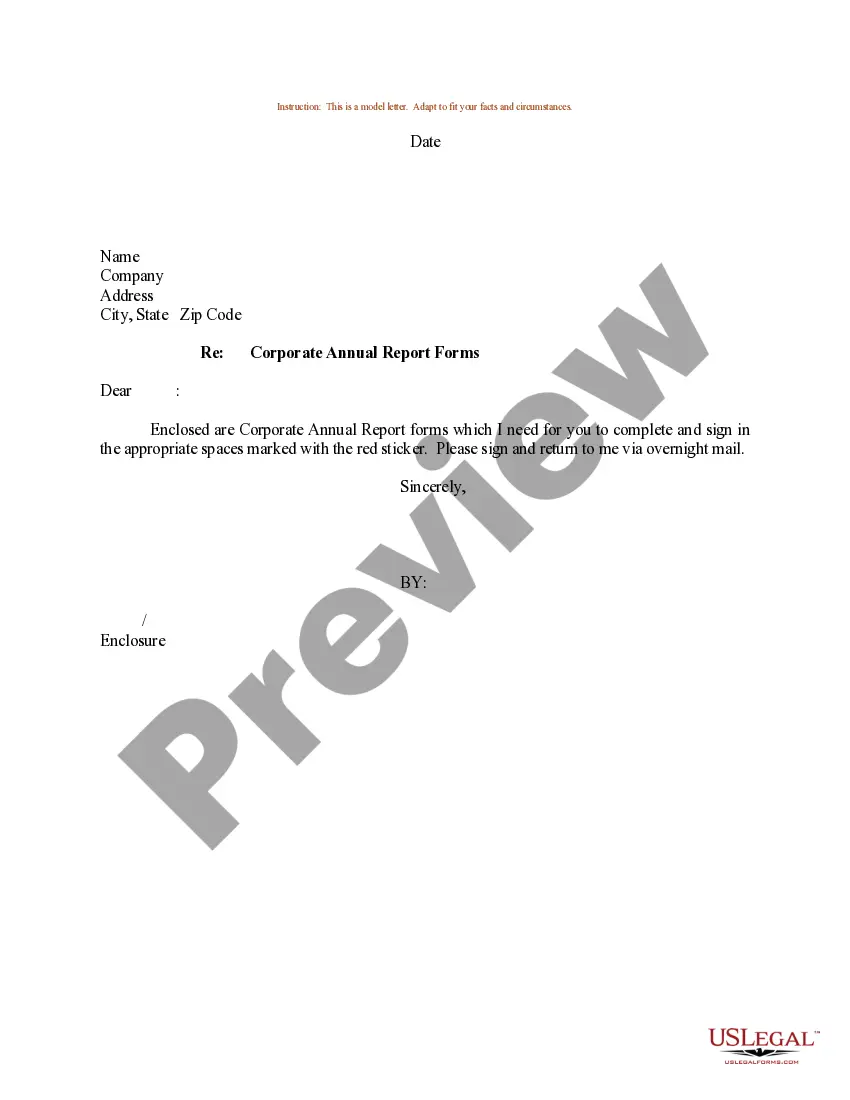

Statutory business entities — which include business corporations, nonprofit corporations, limited liability companies (LLCs), limited partnerships (LPs), and limited liability partnerships (LLPs) — are generally required to file an information report with the business entity filing office of their formation state and ...

Every resident and part-year resident of Ohio is subject to state income tax. Nonresidents with Ohio-source income also must file returns.

Do I have to file an annual report? Business entities in Ohio are not required to file an annual report. However, certain types of entities and registrations are required to file reports at different intervals.

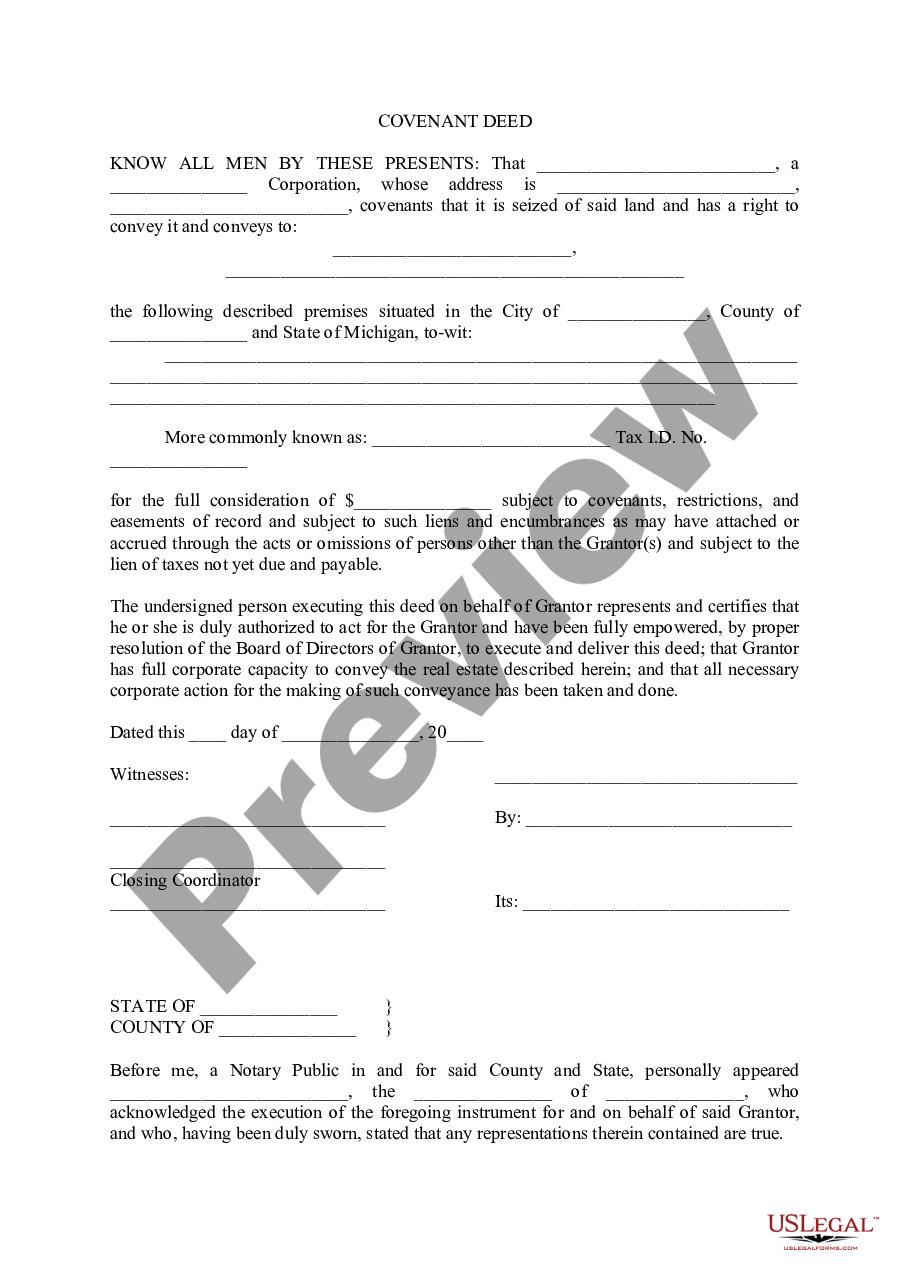

Ohio requires that a Notice of Commencement be filed: “in the office of the county recorder for each county in which the real property to be improved is located,” that “the owner, part owner, lessee, or designee shall post and maintain posted a copy of the notice of commencement in a conspicuous place on the real ...

Ohio does not require LLCs to file an annual report. Taxes. For complete details on state taxes for Ohio LLCs, visit Business Owner's Toolkit or the State of Ohio . Federal tax identification number (EIN).

Over the life of a limited liability company, additional filings with the Ohio Secretary of State may be required. Although limited liability companies are not required to submit annual or biennial filings, certain actions taken by the limited liability company may trigger a filing requirement.