Commercial Property To Purchase In Florida

Description

Form popularity

FAQ

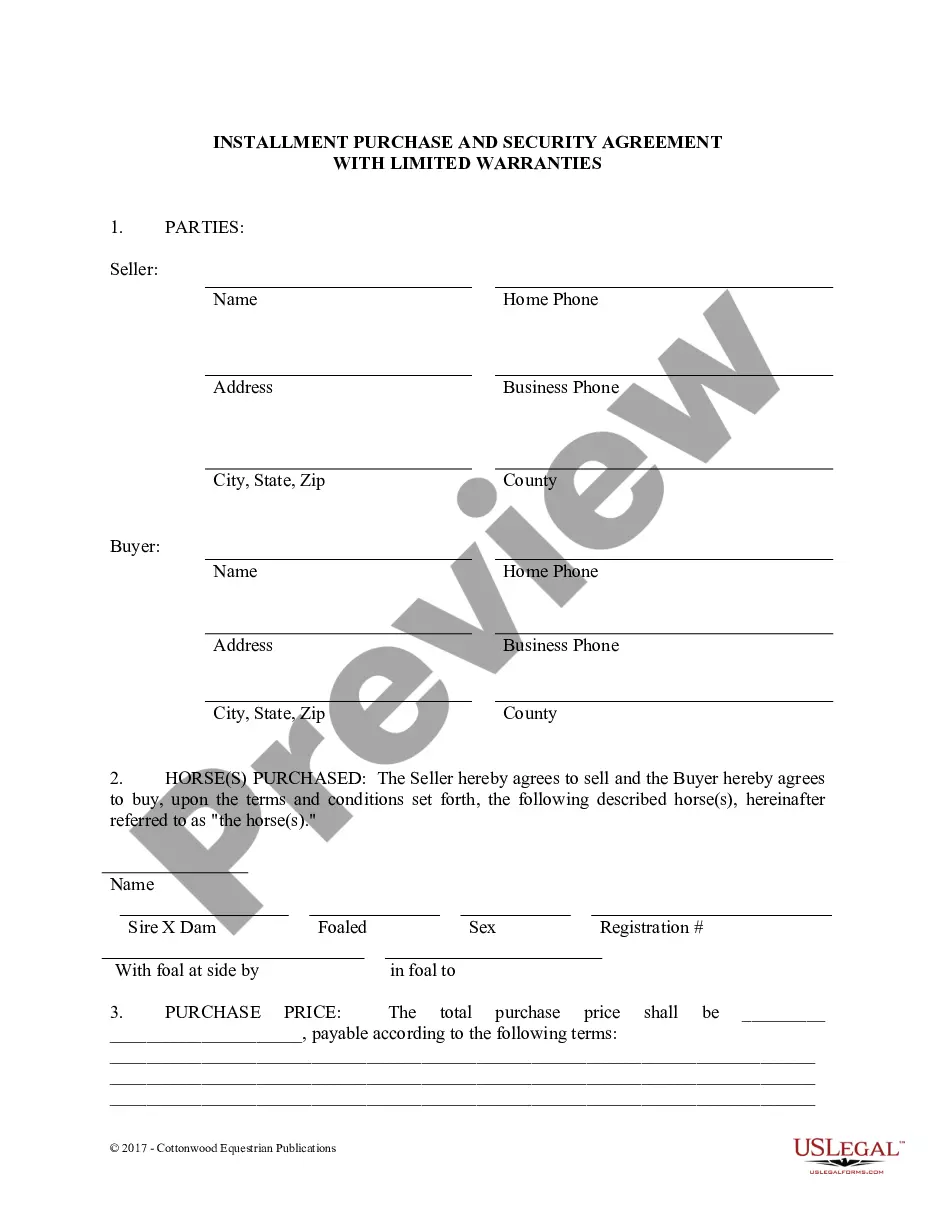

Types of Profitable Commercial Real Estate Investments Industrial Properties. Industrial Properties have strong and stable demand, especially with industries like manufacturing and e-commerce needing properties like warehouses to store and distribute their goods. Multifamily Properties. Shopping Centers.

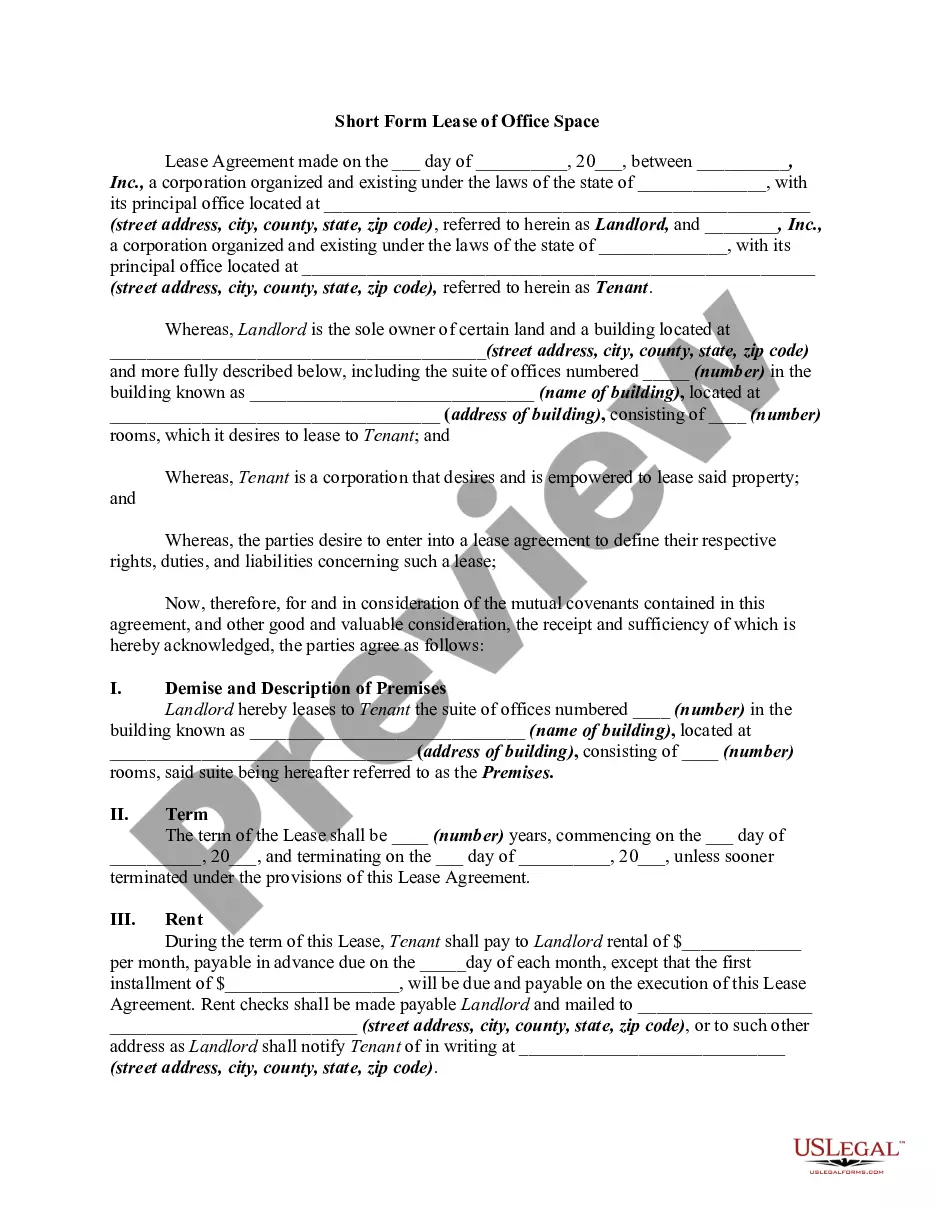

This process involves the confrontation of the negotiators' expectations, interests, positions and points of view. There are two forms of commercial negotiation: Short sales cycle negotiation: the commercial offer is simple and it is possible to conclude the sale at the first contact.

How to Renegotiate a Commercial Lease Ask for a partial rent abatement. Consider subleasing. Revisit the terms of your lease agreement. Consider a temporary income sharing arrangement. Hire someone to represent you during the renegotiation.

It takes 63 hours of real estate coursework to become an agent, while a broker license takes 72 hours and two years of practical experience. Both licenses require passing a final exam and undergoing a background check.

What is commercial property? -Annual increases in property rental rates range from 5 to 7%. -Net yields can come down to typically 2 to 3% percent per annum after insurance, property taxes, and maintenance. -The overall return estimation over a span of 10 years is around 8 to 9% per annum.

However, if you're seeking higher returns and have the financial capacity, commercial properties, such as retail spaces or industrial sites, may offer stronger yields and secure long-term leases. Ultimately, the best choice is one that aligns with your personal financial situation and investment strategy.

Rental properties, commercial real estate and fix-and-flip projects are some of the best options for investors seeking high profit potential.

With a strong demand for residential and vacation properties, Florida's real estate landscape remains one of the most lucrative in the country. Cities like Sarasota, Sunny Isles Beach, and Naples have seen increased demand, especially among affluent buyers seeking luxury properties.

Office spaces, retail shops, warehouses, and coworking spaces are the best types of commercial properties worth investing in India.

Commercial properties generally don't meet the habitation standards for residential use. As such, you may not legally reside there.