Bylaws Of The Corporation With The Irs In Phoenix

Description

Form popularity

FAQ

Providing information on corporate governance: An annual report can provide information on the company's board of directors, leadership team, and corporate governance practices, helping to ensure that the company is being run in an accountable and transparent manner.

Certificate of Good Standing for Professional Corporations: $10 for mail or fax or $45 for online. Notes: Log in to ecorp and click on online services. On the online services page click on service requests and then select certificate of good standing.

12 Steps to Starting a Nonprofit in Arizona Name Your Organization. Name Incorporators and Directors. Appoint a Registered Agent. File Arizona Articles of Incorporation. Publish Incorporation. Apply for an Employer Identification Number (EIN) Hold Organization Meeting and Establish Nonprofit Bylaws.

The corporation is required by law to adopt bylaws. Bylaws are written rules that govern how the corporation operates internally, such as how the Board of Directors will be elected and what votes are required for a particular action. Bylaws can have any provision in them that is not prohibited by law. See A.R.S.

Corporate Income Tax Filing Requirements Every corporation subject to the Arizona Income Tax Act of 1978 must file an Arizona corporate income tax return. A limited liability company that makes a valid federal election to be taxed as a corporation must file an Arizona corporate income tax return.

You'll need to include the following information on your Arizona Annual Report: The name of your business. Your Arizona entity number. The type of business you own (corporation or nonprofit). A brief statement describing your business's purpose. Authorized/issued shares: include the class and series (if applicable).

If you want to file an annual report, please log into or create an eCorp account and file online. All documents must be submitted with a Cover Sheet. The Cover Sheet is a Miscellaneous form. All forms are in PDF format and are fillable (you can type in them).

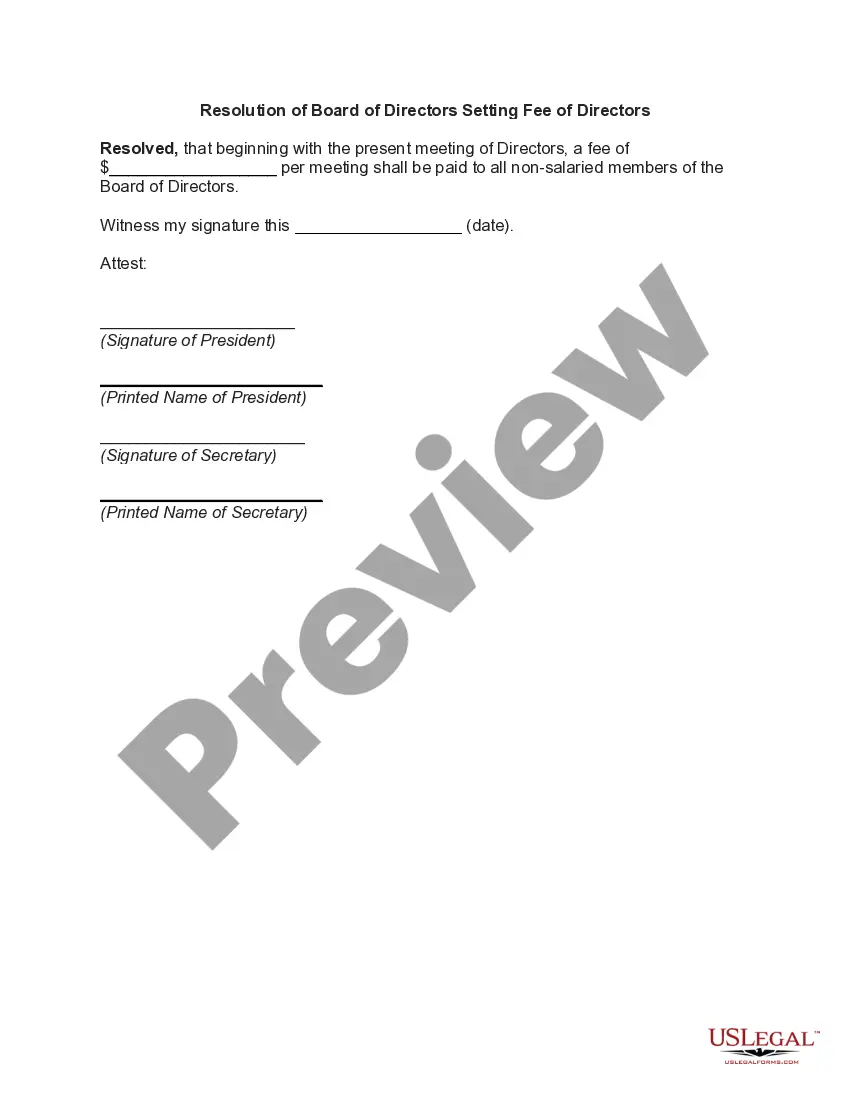

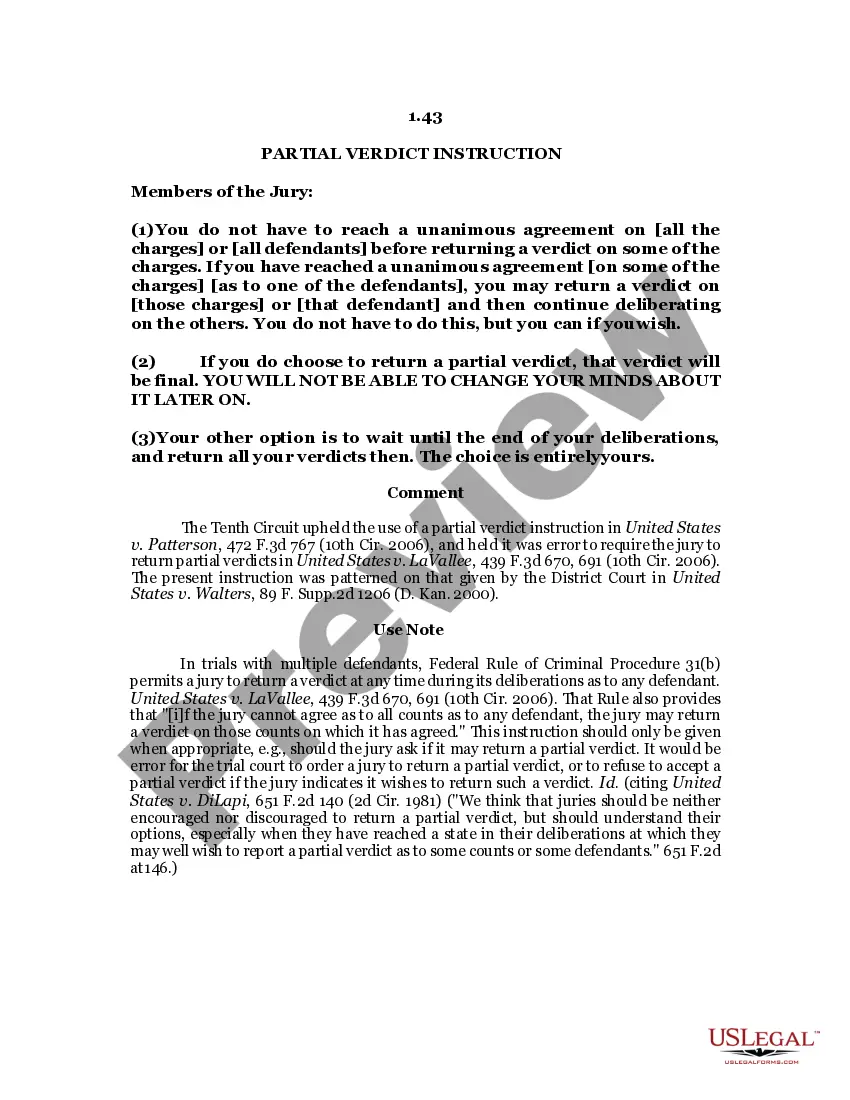

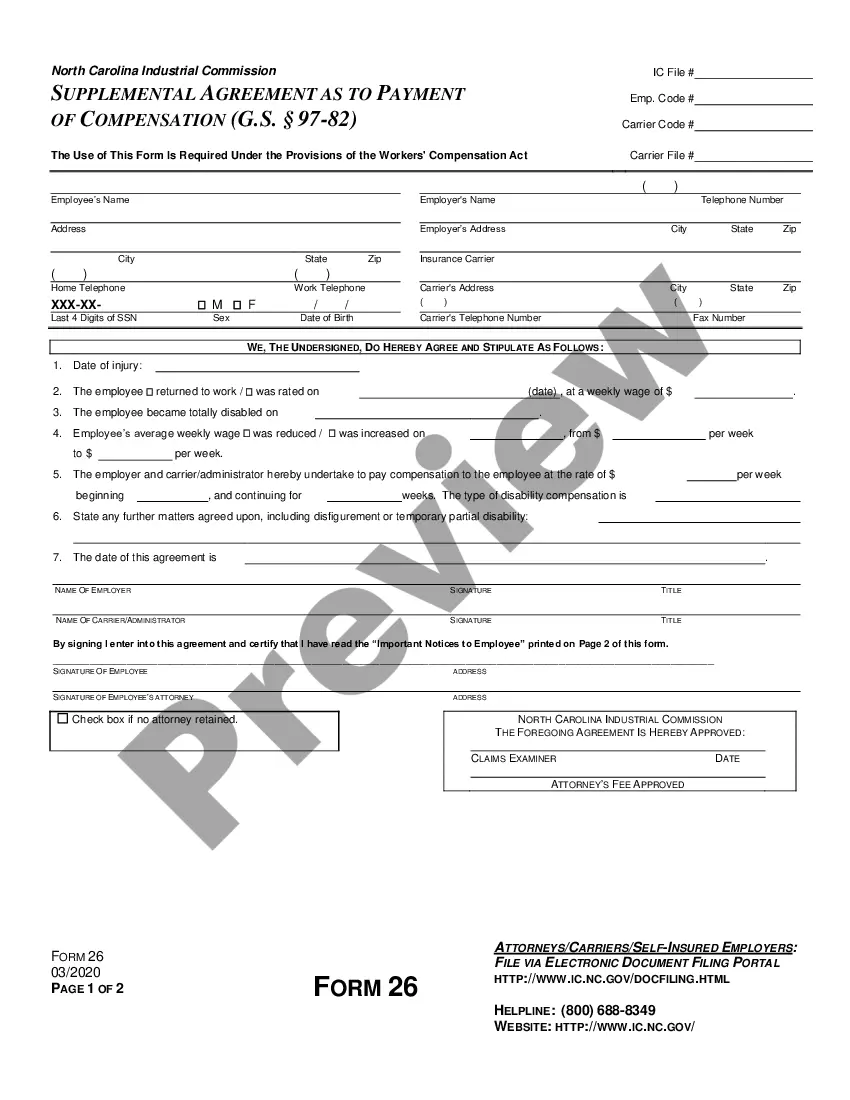

Corporations require annual meetings, directors meetings, recorded meeting minutes, and a notable amount of paperwork, while LLCs have little to no maintenance of this type. LLCs not only require less resolutions, but can make executive decisions without the need to hold an official meeting.

How to Download Articles of Incorporation from the Arizona Secretary of State Website Navigate to ( ) Insert your organization's legal entity name in the "Entity Name" field. Click "Search" Click on your organization's "Entity Name"