Corporate Bylaws For Shareholders In Maricopa

Description

Form popularity

FAQ

The state of Arizona requires all Arizona corporations, nonprofits, LLPs, and LLLPs to file an annual report each year. Arizona LLCs are not required to file an annual report. Corporations and nonprofits file their Arizona Annual Reports with the Arizona Corporation Commission (ACC).

If you want to file an annual report, please log into or create an eCorp account and file online. All documents must be submitted with a Cover Sheet. The Cover Sheet is a Miscellaneous form. All forms are in PDF format and are fillable (you can type in them).

How to File as an S Corp in Arizona in 7 Steps Step 1: Choose a Business Name. Step 2: Appoint Directors and a Registered Agent. Step 3: File Articles of Organization. Step 4: Create an S Corp Operating Agreement. Step 5: Publish Articles of Organization. Step 6: File Form 2553 for S Corporation Election.

If you want to file an annual report, please log into or create an eCorp account and file online. All documents must be submitted with a Cover Sheet. The Cover Sheet is a Miscellaneous form. All forms are in PDF format and are fillable (you can type in them).

The corporation is required by law to adopt bylaws. Bylaws are written rules that govern how the corporation operates internally, such as how the Board of Directors will be elected and what votes are required for a particular action. Bylaws can have any provision in them that is not prohibited by law. See A.R.S.

Arizona requires LLCs to publish notice of the incorporation within 60 days of incorporation in a publication (i.e. newspaper) in the known place of business for three consecutive publications.

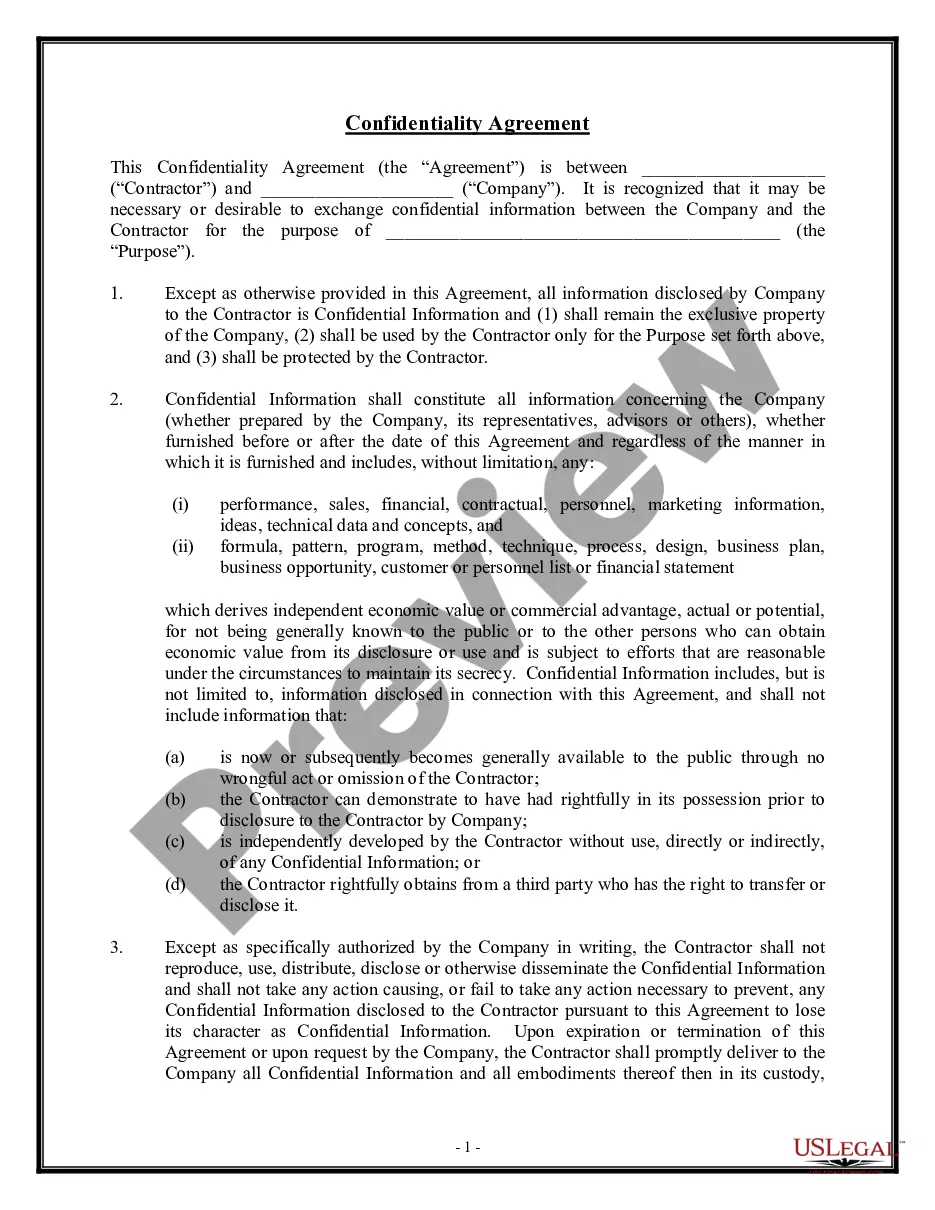

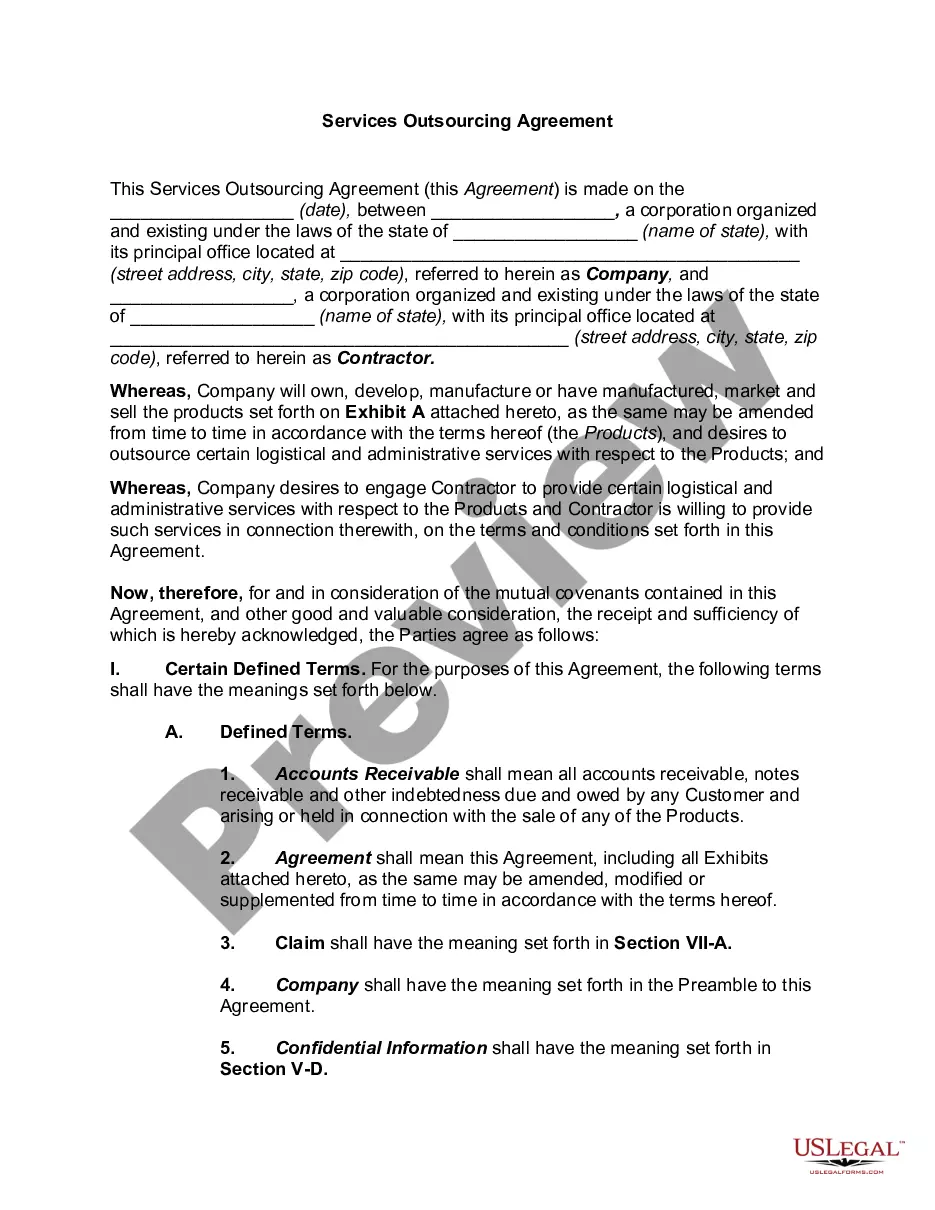

Corporate bylaws are a company's foundational governing document. They lay out how things should run day-to-day and the processes for making important decisions. They serve as a legal contract between the corporation and its shareholders, directors, and officers and set the protocol for how the organization operates.

The law in Arizona for LLCs is different than for corporations: An Arizona LLC MUST have a Business Address, but it may be: A physical street address in Arizona OR not in Arizona. A post-office box in Arizona OR not in Arizona.

Is using a virtual address legal for corporations, LLCs, or LPs in Arizona? Yes, if you own an Arizona-based corporation, LLC, or LP, you can use a virtual address as your business address in compliance with Arizona law.