Hoa Bylaws Template For Corporation In Illinois

Description

Form popularity

FAQ

Corporate bylaws are legally required in Illinois. Illinois statute §805 ILCS 5/2.20 requires that bylaws be adopted either by shareholders at the first shareholder meeting or by directors at the initial director meeting.

To determine fees, board members take all their expenses and divide them proportionally among unit owners. The resulting amount is your HOA assessment. Worth noting, there is a limit to how much condo association assessments can increase in Illinois and that number is 15%.

Despite smart planning, however, there are situations that may warrant a special assessment or an assessment increase for the upcoming year. When that happens, is there a maximum assessment threshold the board can impose? The short answer is yes, and the magic number is 15%.

The administration and functioning of HOAs in the state are governed by the Illinois Common Interest Community Association Act. In homeowner's associations with detached or attached townhouses, single-family houses, or villas, this provision is applicable.

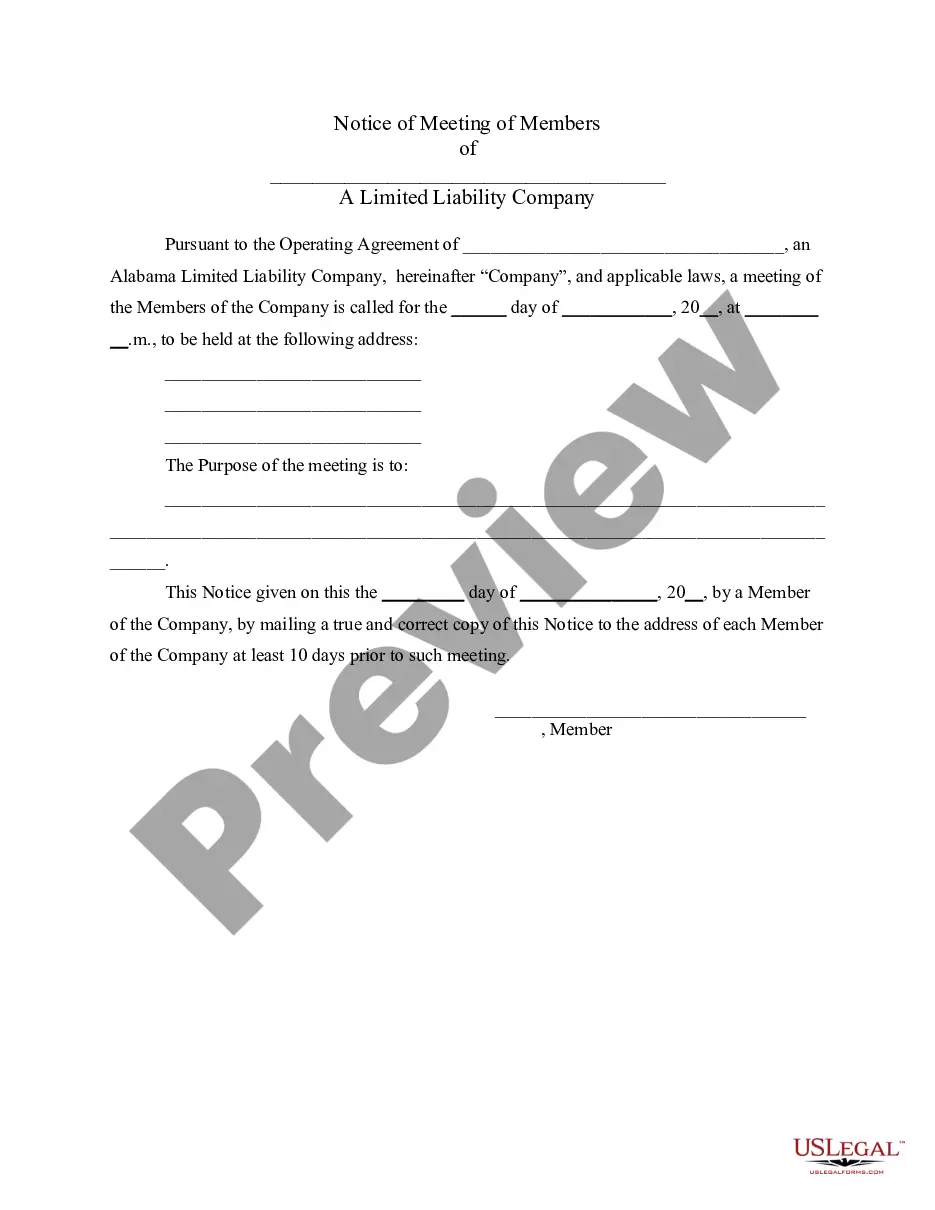

Annual Meeting Attendance of 20% of the voting power constitutes a quorum. Notice of association meetings must be given at least 10 days before a meeting but no more than 30 days, and at least 48 hours' notice must be given for meetings of the board of directors.

Once you buy a home that's part of an HOA, you automatically become a member of the HOA. HOA rules are legally binding, and you must adhere to all rules and regulations in the governing document. Yes, there are bylaws that you may not like, but there are no HOA loopholes.

Understanding Illinois Homeowners' Association Law AspectKey Takeaway HOA Powers Power to regulate common areas, collect charges, levy fines, and foreclose on homes for unpaid liens. Entry to Property Most governing documents allow HOA entry to homes for maintenance under certain conditions.6 more rows

The Illinois General Not for Profit Corporation Act, which governs the vast majority of associations, requires that the board of directors of a corporation consist of three or more directors with the number of directors established in the bylaws.

To legally establish an HOA in Illinois, the organization must submit Articles of Incorporation to the Illinois Secretary of State. The Illinois General Not For Profit Corporation Act of 1986 governs nonprofit corporations.