Sell Of Partnership In Texas

Description

Form popularity

FAQ

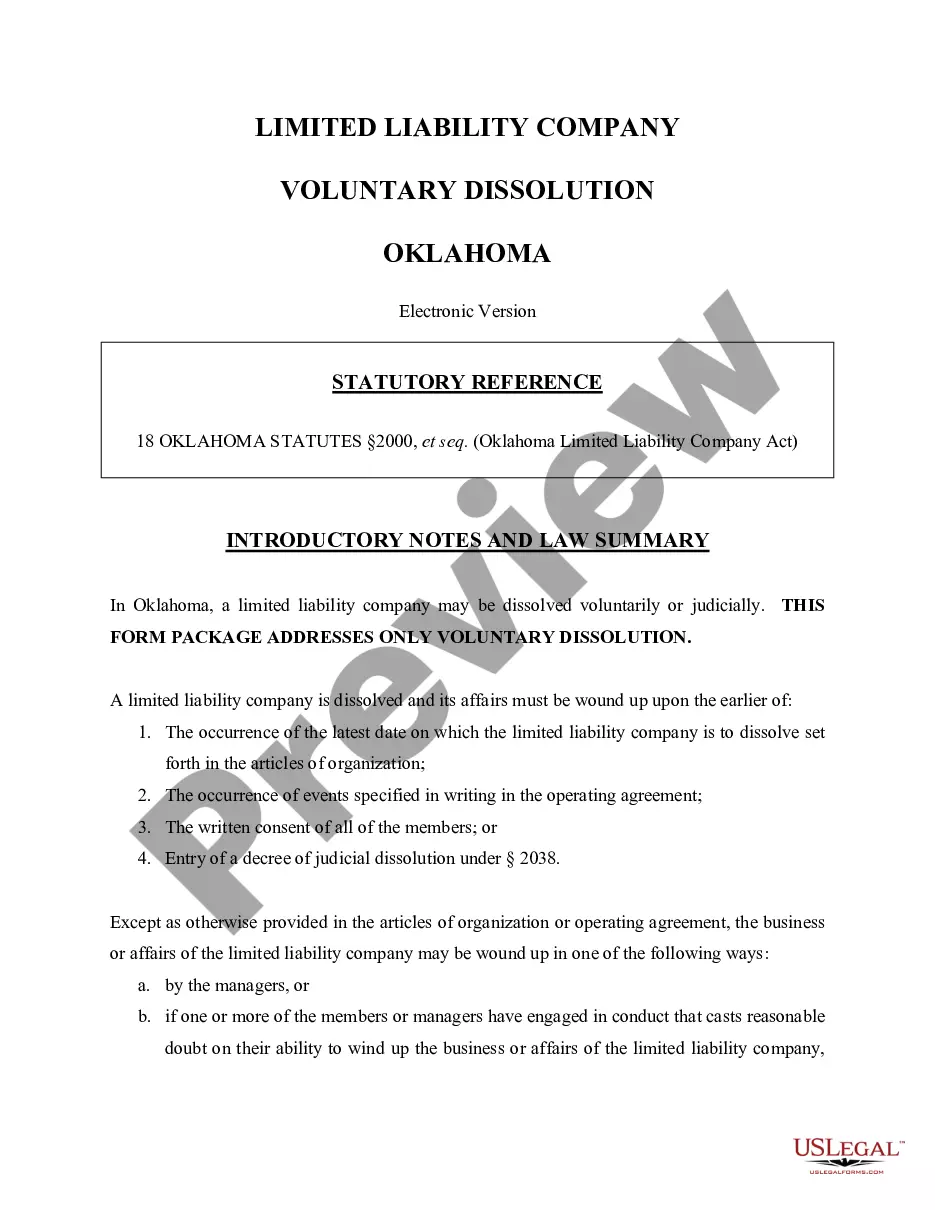

Ways of Dissolving a Partnership Firm When partners mutually agreed. Compulsory dissolution. Dissolution depending on certain contingent events. Dissolution by notice. Dissolution by Court. Transfer of interest or equity to the third party.

5 steps to dissolve a partnership Review your partnership agreement. Prepare and approach your partner to discuss the current business situation. Prepare dissolution papers. Close all joint accounts and resolve finances. Communicate the change to clients, customers, and suppliers.

In Texas, most partnerships are subject to the franchise tax. Generally speaking, the only exception is a general partnership directly and solely owned by natural persons. Regardless of the type of partnership, individual partners personally owe no state tax on partnership income distributed to them.

Can Form 05-102, Public Information Report, be electronically filed separately for a Texas Franchise Tax return in CCH Axcess™ Tax or CCH® ProSystem fx® Tax? For REPORT YEARS 2023 and prior, the Form 05-102 can only be e-filed as part of the Texas Franchise Tax return.

If a partner's departure triggers an end to the partnership, the partners will need to follow a dissolution procedure. In this case, the partnership will settle its debts and distribute any remaining assets to the partners—including the withdrawing partner—ing to their capital accounts.

This could involve filing for a court injunction, initiating a buy-sell agreement, or pursuing litigation. Evaluate Your Options: Depending on the severity of the situation, you may need to consider your long-term options, including selling your share, buying out your partner, or dissolving the partnership altogether.

The process of dissolving your partnership Discuss the terms and issues. Draft a dissolution agreement. Double-check the terms. Check your state's business laws. File a statement of dissolution with your state. Notify all of your customers, clients and suppliers directly. Divide the remaining assets.

Dissolution of the Business File a Partnership Dissolution Form. Notify the Parties Associated with the Business. Settle all Debts and Liabilities. Divide Assets. Close All Company Accounts. Strategies for Resolving Conflicts Amicably.

There are a range of ways in which a business partnership can be dissolved, each with its own circumstances and implications. Termination by agreement. Dissolution by notice. Expiry. Death or bankruptcy. Court order. Review partnership agreement. Legal requirements. Partnership dissolution agreement.

No, under Texas law, an LLC member cannot voluntarily withdraw or be expelled from an LLC. There are three primary ways a member can be removed from a Texas LLC—by complying with the operating agreement or by seeking voluntary or involuntary dissolution.