Agreement Between Partnership For Restaurant Business In Texas

Description

Form popularity

FAQ

In order for a partnership to be properly created, the partners must go through several steps. Step 1: Select a business name. Step 2: Register the business name. Step 3: Complete required paperwork. Step 4: Determine if you need an EIN, additional licenses, or tax IDs. Step 5: Get your day-to-day business affairs in order.

The parties hereto hereby form a Partnership under the name and style of _______________________________________________ (hereafter referred to as "the Partnership") to own real property, develop real property, and thereafter to manage, operate, develop, mortgage, lease or sell real property and do all other lawful ...

Kickstart your new business in minutes There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

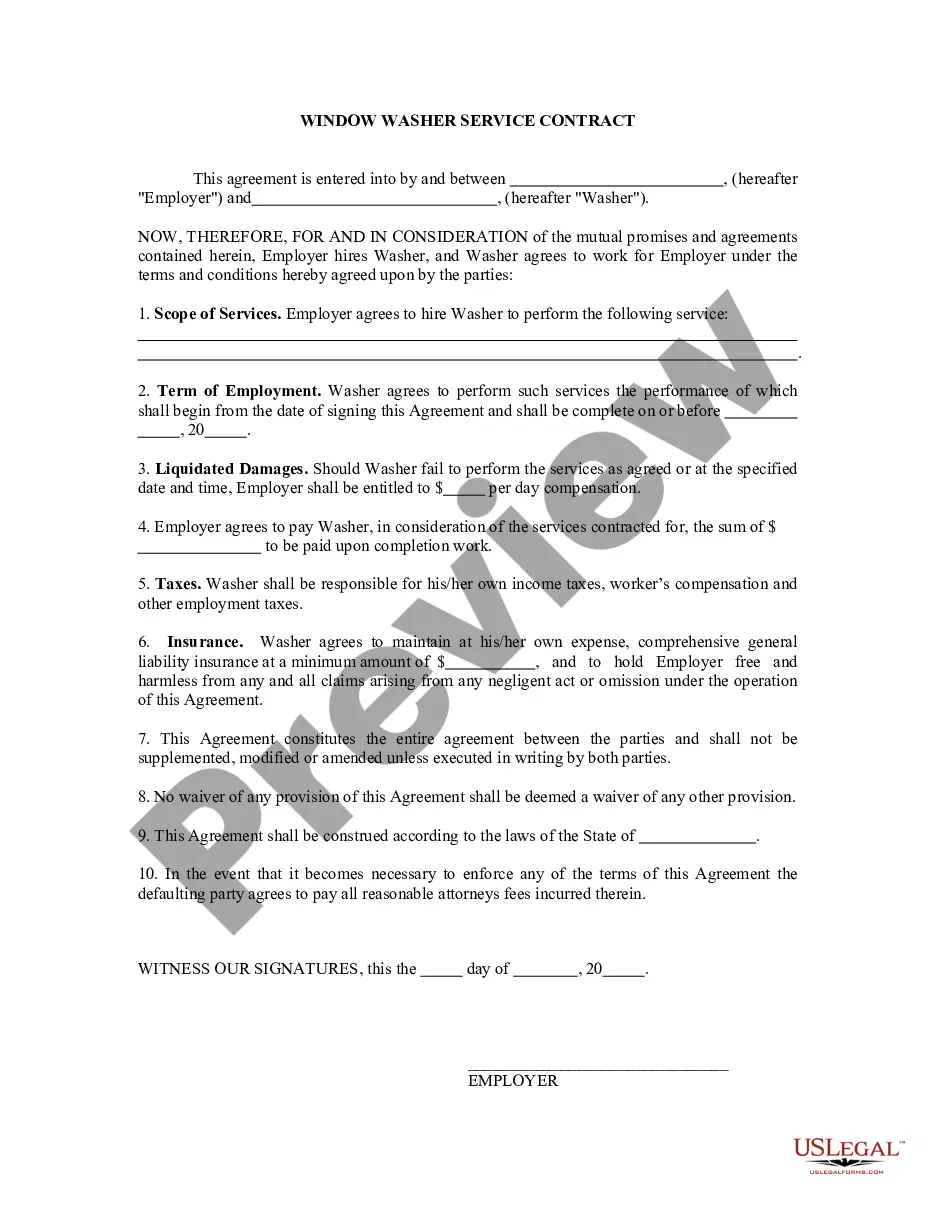

How to write an effective business contract agreement #1 Incorporate details about relevant stakeholders. #2 Define the purpose of the contract. #3 Include key terms and conditions. #4 Outline the responsibilities of all parties. #5 Review and edit. #6 Provide enough space for signatures and dates.

A comprehensive guide on how to draft a contract Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

A partnership deed is a written agreement which specifies the terms and conditions that govern the partnership.

In Texas, most partnerships are subject to the franchise tax. Generally speaking, the only exception is a general partnership directly and solely owned by natural persons. Regardless of the type of partnership, individual partners personally owe no state tax on partnership income distributed to them.

A Texas limited partnership that also registers with the secretary of state as a limited liability partnership (LLP) must file an annual report with the secretary of state no later than June 1 of each year. The report is due following the calendar year in which the application for registration takes effect.

Kickstart your new business in minutes There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

In a General Partnership, you and at least one other person agree to form a partnership; there is no filing necessary with the Texas secretary of state. There is no corporate protection for any liability and the partners are jointly and severally liable for the debts and liabilities of the partnership.