Buy Sell Agreement Purchase With Bitcoin In Illinois

Description

Form popularity

FAQ

Illinois has a flat tax rate system, meaning all income including capital gains is taxed at the same rate of 4.95%, regardless of the amount earned.

Yes, the IRS requires that you report cryptocurrency rewards or earnings even if you don't receive a Form 1099-MISC or Form 1099-NEC. Companies are not required to send you a Form 1099-MISC or Form 1099-NEC unless the income is $600 or more.

Use cryptocurrency tax accounting software if you have lots of trades. Illinois has a flat tax rate of 4.95% that applies to both short-term and long-term capital gains.

There are several exchanges offering Bitcoin in Illinois, and you can easily select one based on your requirements and preferences using our guide. Different exchanges have different transaction fees, withdrawal limits, payment modes, and verification processes that need to be kept in mind before users select one.

Crypto transactions are taxable, and the IRS requires you to report them accurately. Whether you're buying, selling, or exchanging, use this guide to learn which tax forms to use, how to calculate gains or losses, and what steps to take to correctly file your crypto taxes.

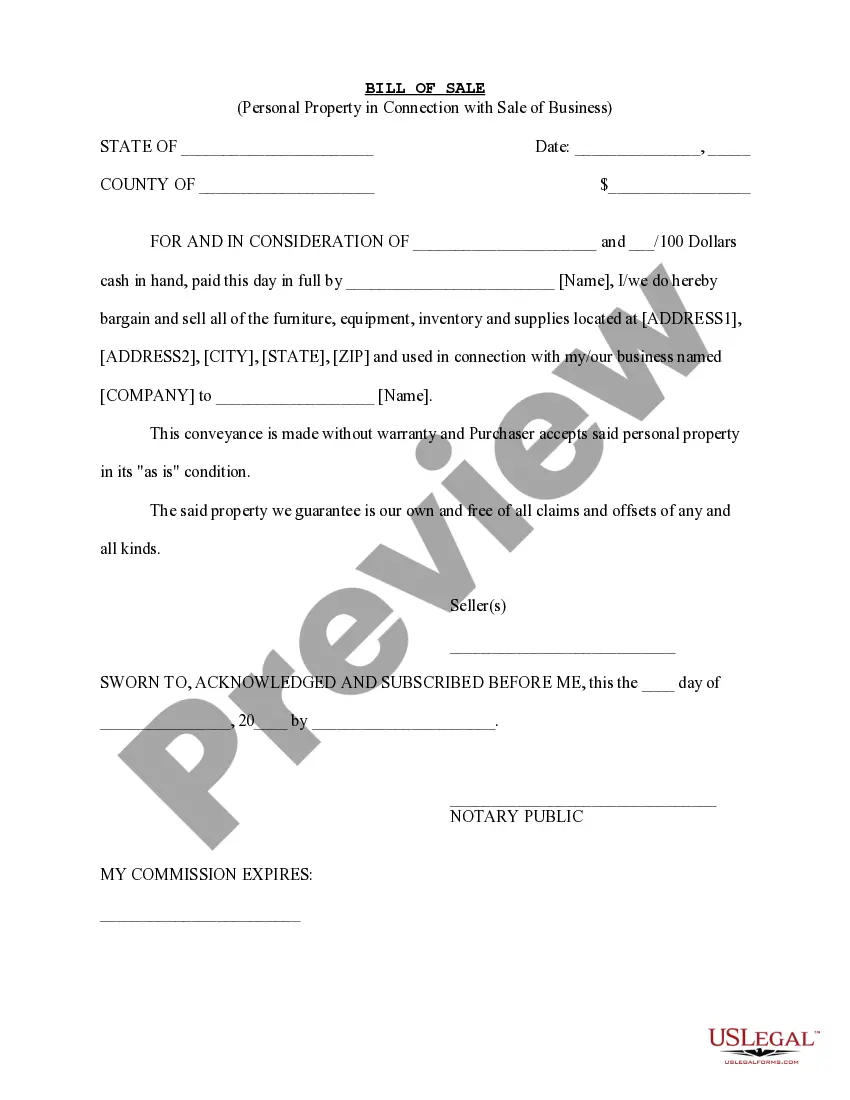

sell agreement is a written contract between two or more owners of a business, or among owners of the business and the entity.

Whether you're a long-term crypto holder or have recently started trading, you may wonder: does the IRS know about my crypto? The short answer is: Yes, they do. The days of flying under the radar as a crypto user are well and truly over.

All crypto transactions, no matter the amount, must be reported to the IRS. This includes sales, trades, and income from staking, mining, or airdrops. Transactions under $600 may not trigger a tax form from exchanges, but they are still taxable and must be included on your return.

Ing to IRS Notice 2014–21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D and Form 8949 if necessary.