Agreement Between Partnership Form In Franklin

Description

Form popularity

FAQ

A partnership agreement is an agreement between two or more individuals who sign a contract to start a profitable business together. In the Partnership agreement, the partners are equally responsible for the debt of an organisation.

In California, like every other state, there are no formal filing or registration requirements needed to create a general partnership. However, you must still comply with registration, filing, and tax requirements applicable to any business.

Partnership Agreements are formal documents that clearly define goals, activities, and responsibilities of each partner. They are non-binding agreements anchored in common goals, responsibilities, and values to produce measurable outcomes related to programmatic objectives and/or operational needs.

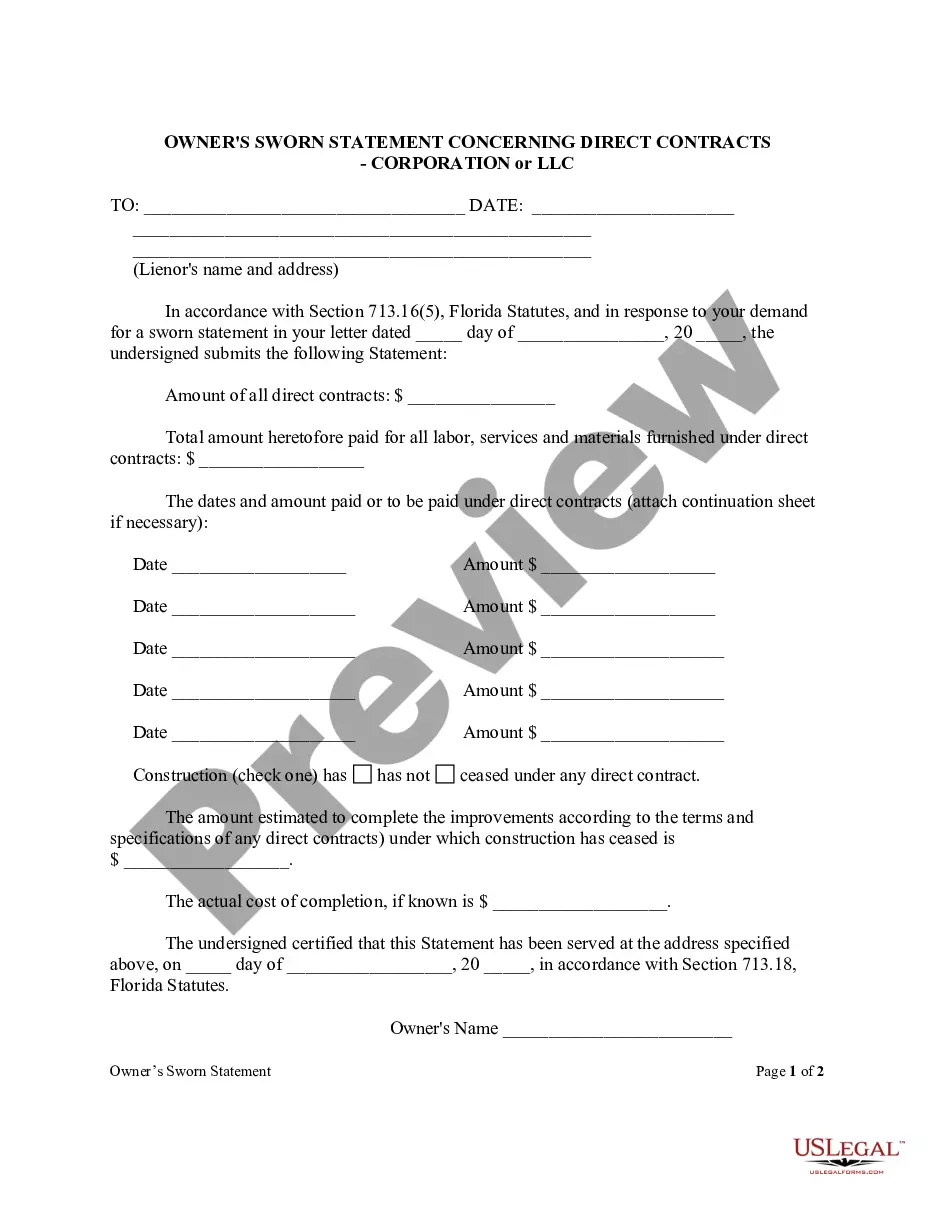

Deeds often need signatures from all partners or an authorised individual, depending on the partnership agreement, and must be witnessed to meet legal standards.

Although notarization might not be mandatory everywhere, it's a crucial step to make sure your partnership agreement is legal and can be enforced. Working with a notary public to notarize the document provides peace of mind and reduces the risk of future legal disputes.

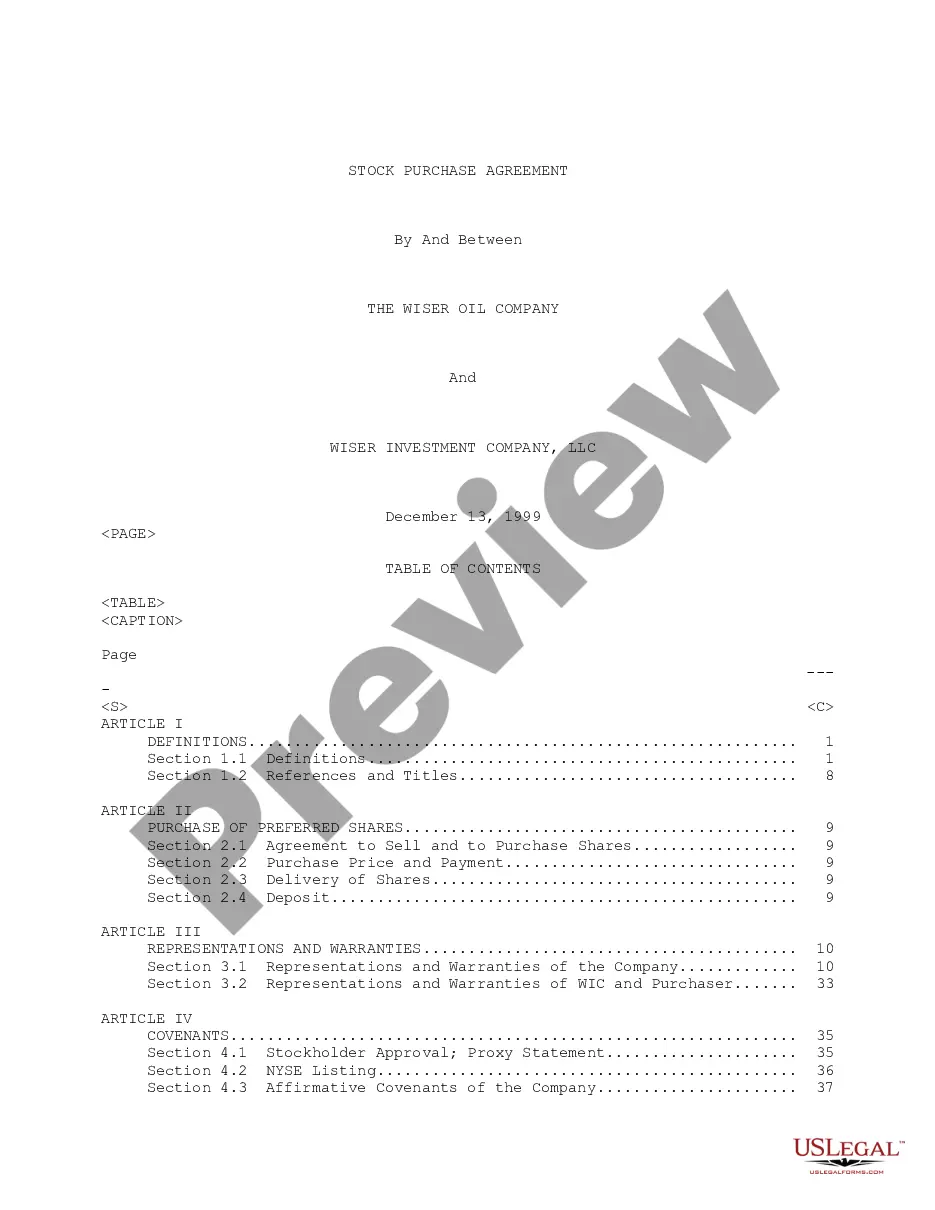

Articles of partnership is a contract that forms an agreement among business partners to pool labor and capital and share in profit, loss, and liability. Such a document acts as a rule book for limited partnerships by outlining all the conditions under which parties enter into a partnership.

In most cases, a contract does not have to be notarized since the signed contract itself is enforceable and legally binding in state or federal courts. Many types of written contracts don't require a notary public to be valid.

Franklin Templeton Asset Management (India) Private Limited (the AMC) has declared its Email server as an Official Point of Acceptance of Transaction (OPAT). Thus, transaction requests can be sent to transaction@franklintempleton (the said email id) which will be dedicated for receiving transaction requests.

Fund Performance: The fund's annualized returns for the past 3 years & 5 years has been around 13.31% & 13.57%. The Franklin India Dynamic Asset Allocation Fund comes under the Hybrid category of Franklin Templeton Mutual Funds.