Sample Claim Statement With Debt Recovery In Montgomery

Description

Form popularity

FAQ

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

``TO WHOM IT MAY CONCERN: This letter serves to inform you that I dispute the validity of this debt. I expect, as a result of my informing you of this dispute, that I will be mailed a copy of verification of this debt. I also request that you provide the name and address of the original creditor.

Overdue payments on credit cards, phone bills, auto loans, utility bills, and back taxes are examples of debts for which collectors may be responsible.

The creditor will sell your debt to a collection agency for less than face value, and the collection agency will then try to collect the full debt from you. If you owe a debt, act quickly — preferably before it's sent to a collection agency.

Unfortunately, my circumstances are unlikely to improve in the foreseeable future and I have no assets to sell to help clear my debt. I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons.

The debt collection extract is an official document issued by the competent debt collection office. It shows whether a person has been the subject of debt collection proceedings since they moved to their current address or in the past five years at the most.

The debt collection extract is an official document issued by the competent debt collection office. It shows whether a person has been the subject of debt collection proceedings since they moved to their current address or in the past five years at the most.

Developing a Debt Revenue Recovery Strategy Be clear about the rights and obligations of debtors from the beginning. Be proactive rather than reactive. Give debtors options. Make debt collection friendlier. Offer multiple payment options. “ ... Utilize automated reminder systems.

To file online, go to E-File Texas ( ) 11 and follow the instructions. To file in person, take your answer (and copies) to the district clerk's office in the county where the plaintiff filed the case. At the clerk's office: Turn in your answer form (and copies).

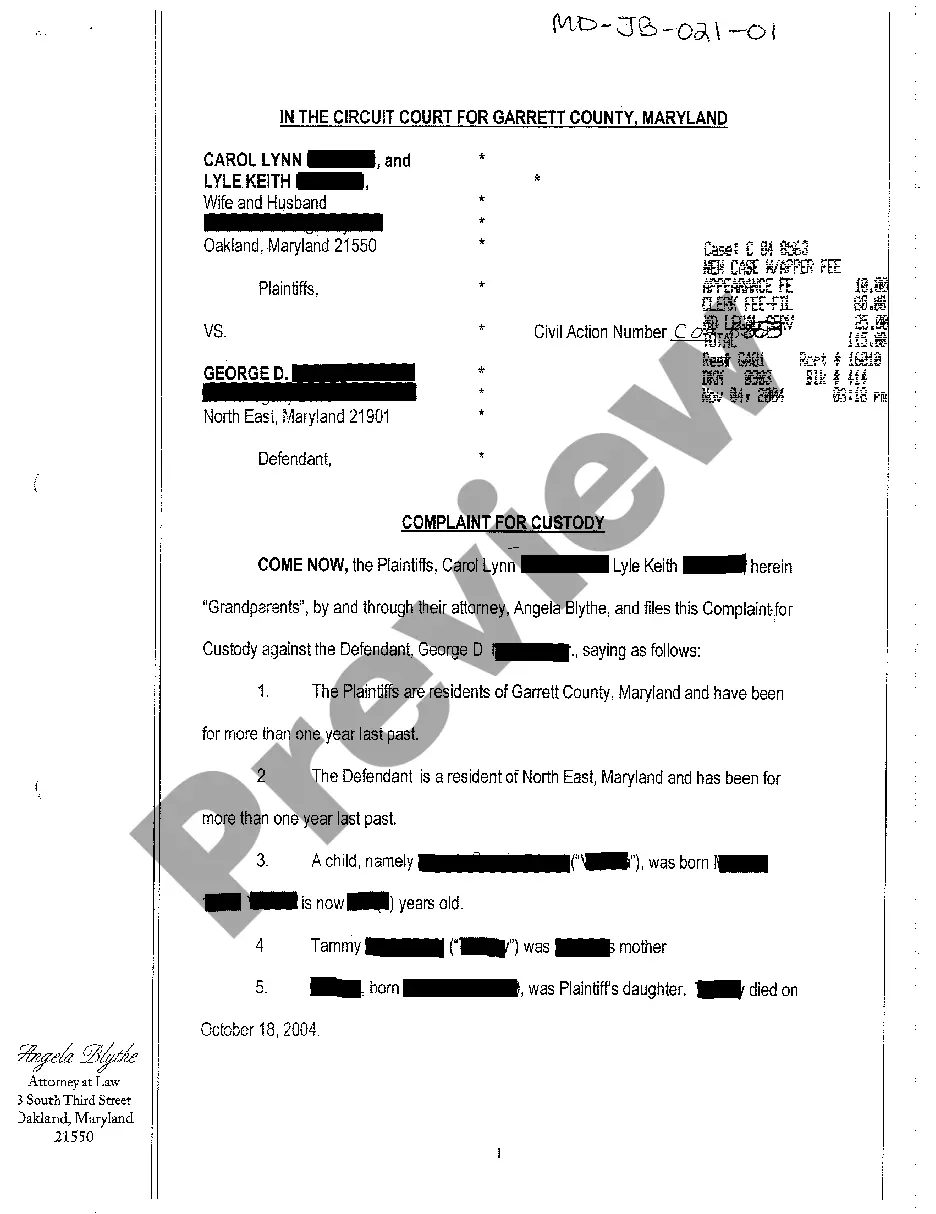

The federal Fair Debt Collection Practices Act (FDCPA) requires that they treat you fairly and prohibits certain methods of debt collection. Maryland has also passed the Maryland Consumer Debt Act that further protects you from abusive debt collection practices.