Suing An Estate Executor For Deceased Person In Collin

Description

Form popularity

FAQ

An estate beneficiary has a right to sue the executor or administrator if they are not competently doing their job or are engaged in fiduciary misconduct.

Section 304.003 - Persons Disqualified To Serve As Executor Or Administrator (a) Except as provided by Subsection (b), a person is not qualified to serve as an executor or administrator if the person is: (1) incapacitated; (2) a felon convicted under the laws of the United States or of any state of the United States ...

If you can prove to the court that the current executor is incompetent or is mishandling the affairs of the estate, the court will relieve that executor and choose a replacement. If the will names an alternate executor, that will likely be the court's choice.

Submit your claim directly to the probate court and serve a copy on the personal representative. If you file a formal claim and the personal representative rejects it, you can file suit against the estate within three months of the rejection.

Understanding the Deceased Estate 3-Year Rule The core premise of the 3-year rule is that if the deceased's estate is not claimed or administered within three years of their death, the state or governing body may step in and take control of the distribution and management of the assets.

Under the LRPMA 1934, eligibility very much depends on if the deceased left a Will. If they did, then the Executor of their Estate, named in the Will, is eligible to bring or continue a claim. If the deceased did not leave a Will, then a set list is followed as outlined in the Administration of Estates Act 1945.

What does an executor do? applying to admit the will to probate. applying for letters testamentary or letters of administration. helping with burial arrangements. notifying the heirs and beneficiaries. filing legal paperwork. collecting, securing, and appraising property. managing bank accounts, insurance, etc.

Can You Sue an Estate After Probate? Typically, no. Texas law states that claimants must make their claims on an estate before probate closes. However, many claimants can still seek payment from beneficiaries who received assets from the estate during distribution.

If the executor dies during the probate process, a successor executor can complete the estate settlement. However, if there's no successor executor named in the decedent's will, someone else will have to come forward to do it.

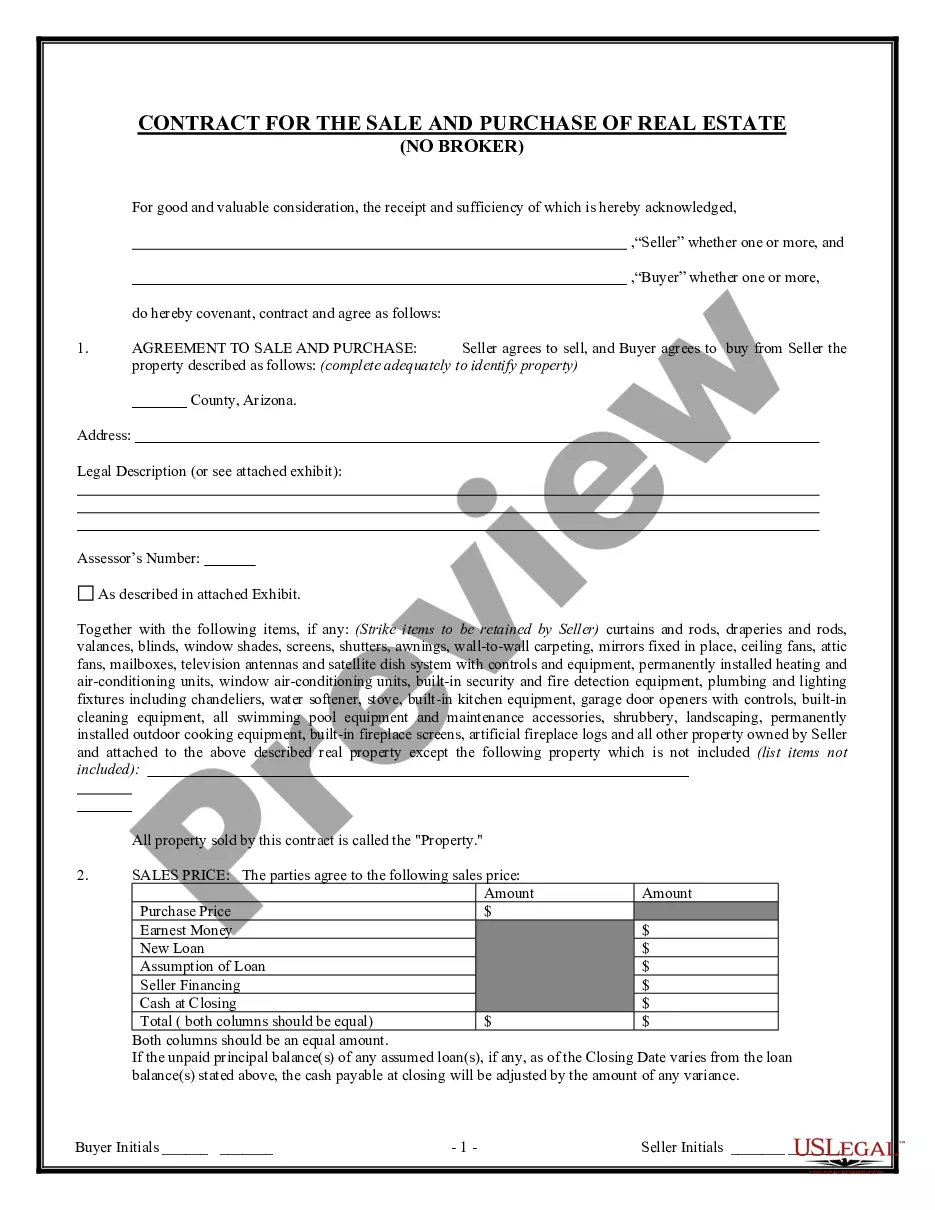

Texas law allows executors to sell property without the beneficiaries' approval, which can be necessary to keep the estate solvent. However, this authority comes with the responsibility of ensuring that the sale is conducted in the best interest of the estate.