Director Consent Form Existing Company In Wake

Description

Form popularity

FAQ

Here's how to become the director of a company in six generalised steps: Finish your higher education. Undergo professional training. Gain relevant business experience. Seek industry mentors. Network with key investors. Consider upskilling your skill set.

Directors are empowered to act on a company's behalf by: the company's articles of association. the Companies Ordinance (Cap. 622) (CO)

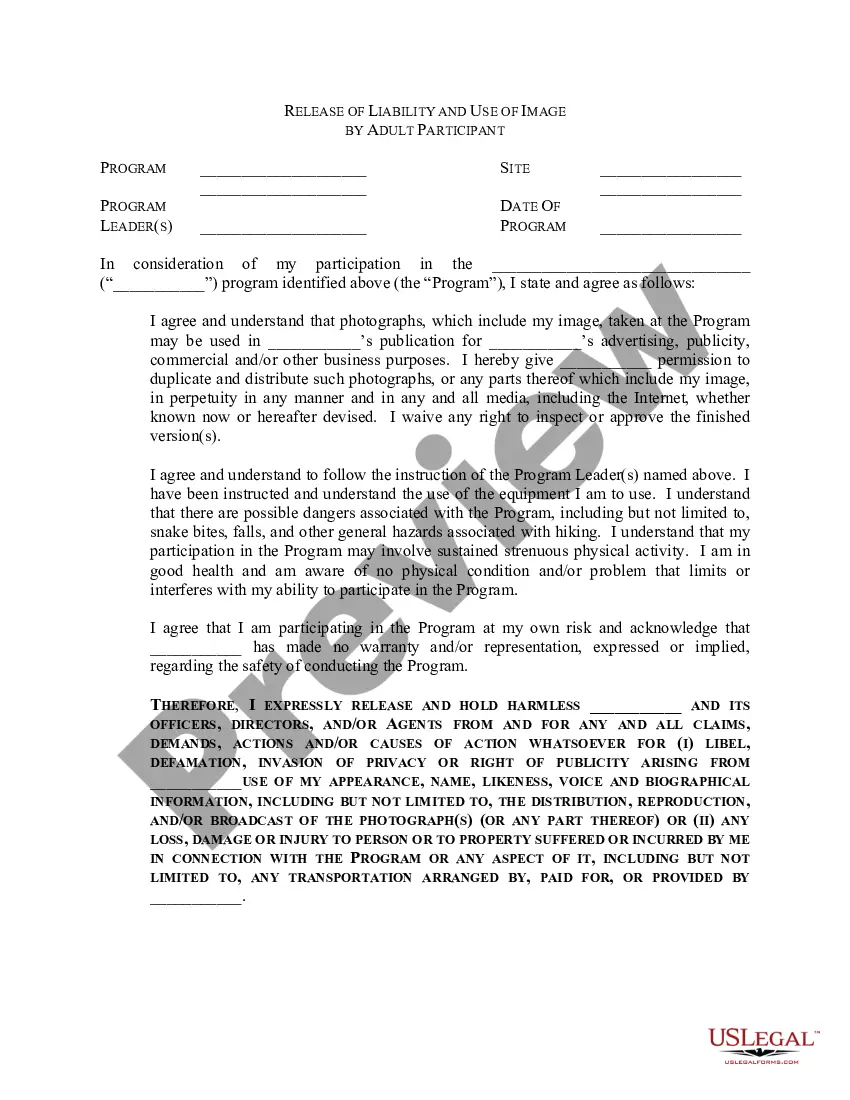

Subject: Consent to act as a director. I ………………………, hereby give my consent to act as director of ……….. (name of the company), pursuant to sub-section (5) of section 152 of the Companies Act, 2013 and certify that I am not disqualified to become a director under the Companies Act, 2013.

Log in to your online services account, enter a company name, company number or New Zealand Business Number (NZBN) and follow these steps. Select the Directors tab. Select Add new director. Enter all requested information. Select Submit.

To be properly appointed, a person must give written and signed consent to the company prior to appointment. The company must keep this consent (s 201D). Failure to give consent results in the appointment being void.

Step 1: The proposed director should obtain a DSC if they do not have a DSC. Step 2: The proposed director should obtain a DIN in Form DIR-3 if they do not have an active DIN. Step 3: The company should conduct a general meeting to pass a resolution for appointing the new director.

A company that has no directors can be struck off. This would have serious implications for the building, as there would be no management, and it could be hard to sell any flats in the building. The process for striking off does not occur immediately.

This can be done online via the Companies Office website. The new director will need to sign a form consenting to act as a director and certifying that he or she is not disqualified from acting as a director. The form can also be downloaded from the Companies Office website.