Appointed Director Without Consent In Franklin

Description

Form popularity

FAQ

Required information to appoint a director Date of appointment. Full name of new director. Former name(s), if used for business purposes within the past 20 years. Nationality. Date of birth (only the month and year will be disclosed on public record) Business occupation (if any). Service address.

The company should hold a general meeting at the time and date fixed in the board meeting and obtain shareholders' approval for the appointment of the managing director through a resolution.

Is it necessary to get a shareholder as a director of a company? No, the director is not required to hold the company shares. A person with no company shares can also be appointed as a director unless the AOA specifies that the company director must have shares in the company.

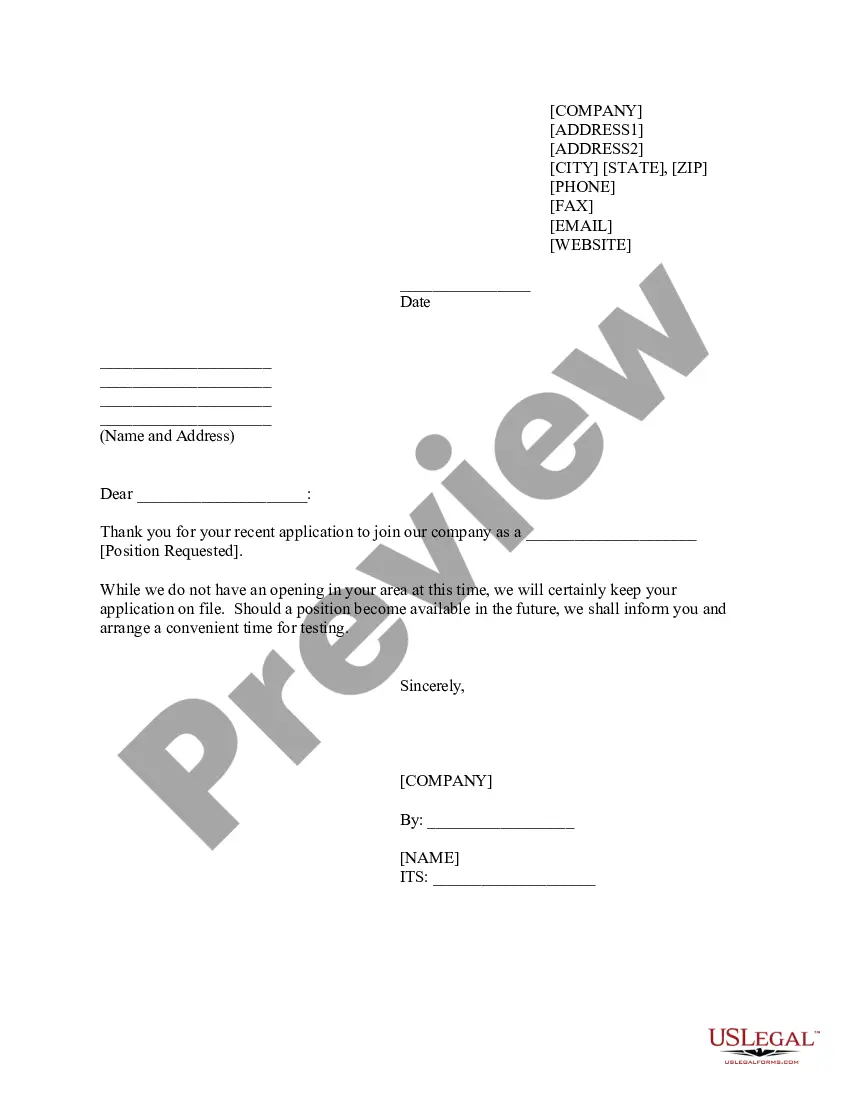

What is a director's consent? In a director's consent an individual agrees in writing to be a director of a nonprofit. Every director who is elected or appointed needs to sign a consent. The consent needs to be signed within 10 days of being elected or appointed as a director.

Shareholders own the company by owning its shares and are often referred to as 'members'. Directors on the other hand, manage the business and its operations. Unless the articles of association state so, a director isn't required to be a shareholder, and a shareholder has no legal right to be a director.

Appointing a director A company's shareholders can appoint directors. This is usually done by passing an ordinary resolution in favour of the appointment (ie a majority of the shareholders agree to the appointment).

Section 168 provides that a company can remove a Director by passing an ordinary resolution at a meeting. Special notice is however required. On receipt of notice of an intended resolution to remove a Director, the company must send a copy of the notice to the Director concerned.

For an ordinary resolution to be passed at the meeting to appoint a director, or directors, such resolution must be supported by more than 50% of the shareholders who are eligible to vote at the meeting.

I, the undersigned, give my consent to act as an Independent Director of M/s_____________________ (Company Name) pursuant to section 149, 164, 197, 198 of the Companies Act, 2013 and the rules made thereunder, hereby certify that I am not disqualified to act as an Independent Director of the company and hereby give my ...

IN LIGHT OF THE ECONOMIC CRIME & CORPORATE TRANSPARENCY ACT 2023, THIS TEMPLATE IS CURRENTLY UNDER REVIEW. This Director's Consent to Act allows a prospective director to confirm that he/she is a fit and proper person to act as a director of a company.