Bill Of Sale In Spanish With Payment Plan In Philadelphia

Description

Form popularity

FAQ

What Is the Process for Creating a Tax Payment Plan in Pennsylvania? Anyone seeking a tax payment plan from the Pennsylvania DOR can either call the DOR Collection Unit or visit a district office in person to request a DPP. For individual taxpayers, the DOR Collection Unit number is 717-783-3000.

Streamlined Installment Agreements allow you to set up a monthly payment plan on your tax debt, without providing the IRS with any details about your financial situation.

Clarified the guidance in paragraph (5) to align with existing programming, indicating that when establishing the first payment on the DDIA, it should fall between 5-8 weeks from the DDIA origination date.

Payment Options You have the option for credit/debit card or ACH withdrawal using your routing number and account number.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

If a taxpayer has been approved an extension of time to file his/her federal income tax return and does not owe PA income tax with the state return, the Department will grant the same extension for filing the PA tax return. Such taxpayers do not have to submit PA Form REV-276 or federal Form 4868.

If the failure is for more than 1 month, an additional 5% for each additional month or fraction thereof shall be added during which the failure continues, not to exceed 25% in the aggregate. In no case may the amount added be less than $5.

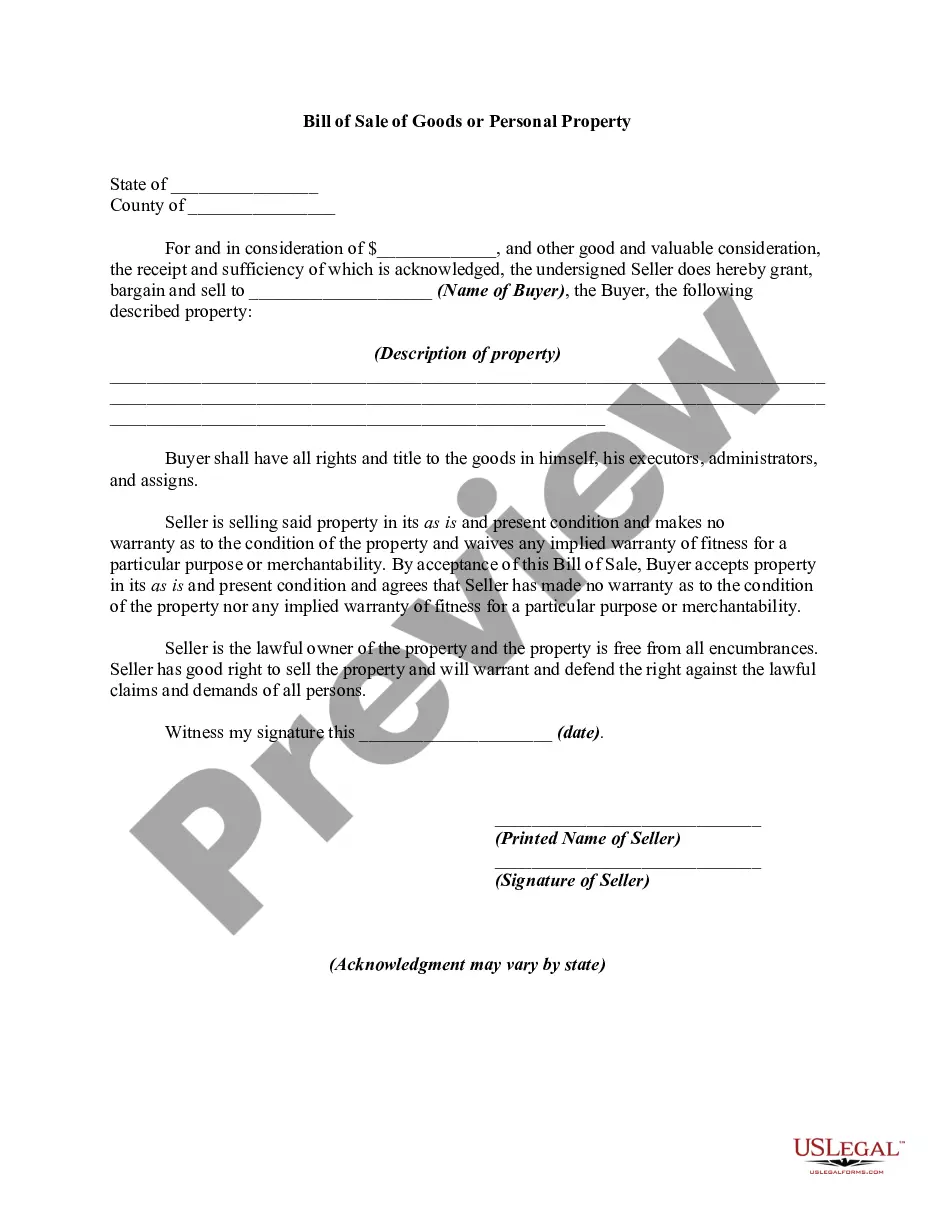

The seller's signature is required to be notarized or verified on the Pennsylvania title. The seller's signature may be required to be notarized on some out-of-state titles. The seller will need to provide the authorized PennDOT agent with proper proof of identification(opens in a new tab) (PDF).

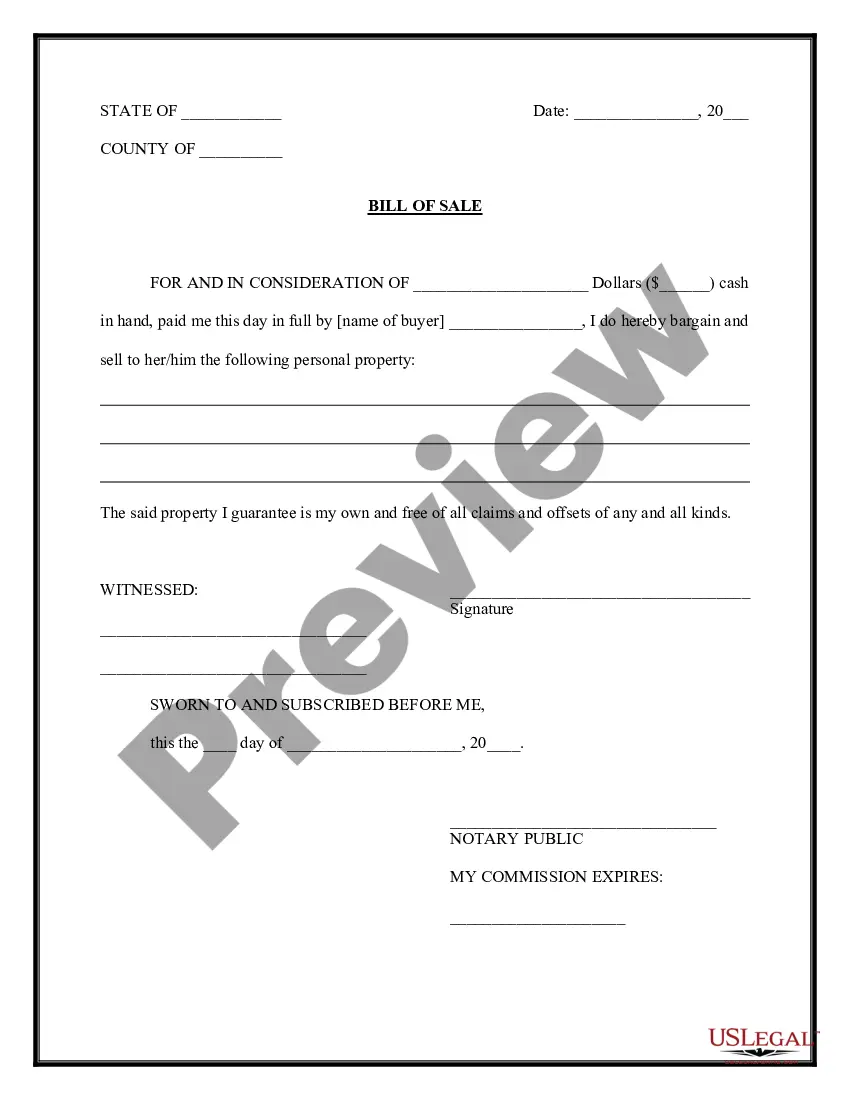

Complete a Bill of Sale While a Bill of Sale is not legally required by the state of Pennsylvania, it protects you legally and gives the buyer added peace of mind.