Balloon Note Example In Palm Beach

Category:

State:

Multi-State

County:

Palm Beach

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

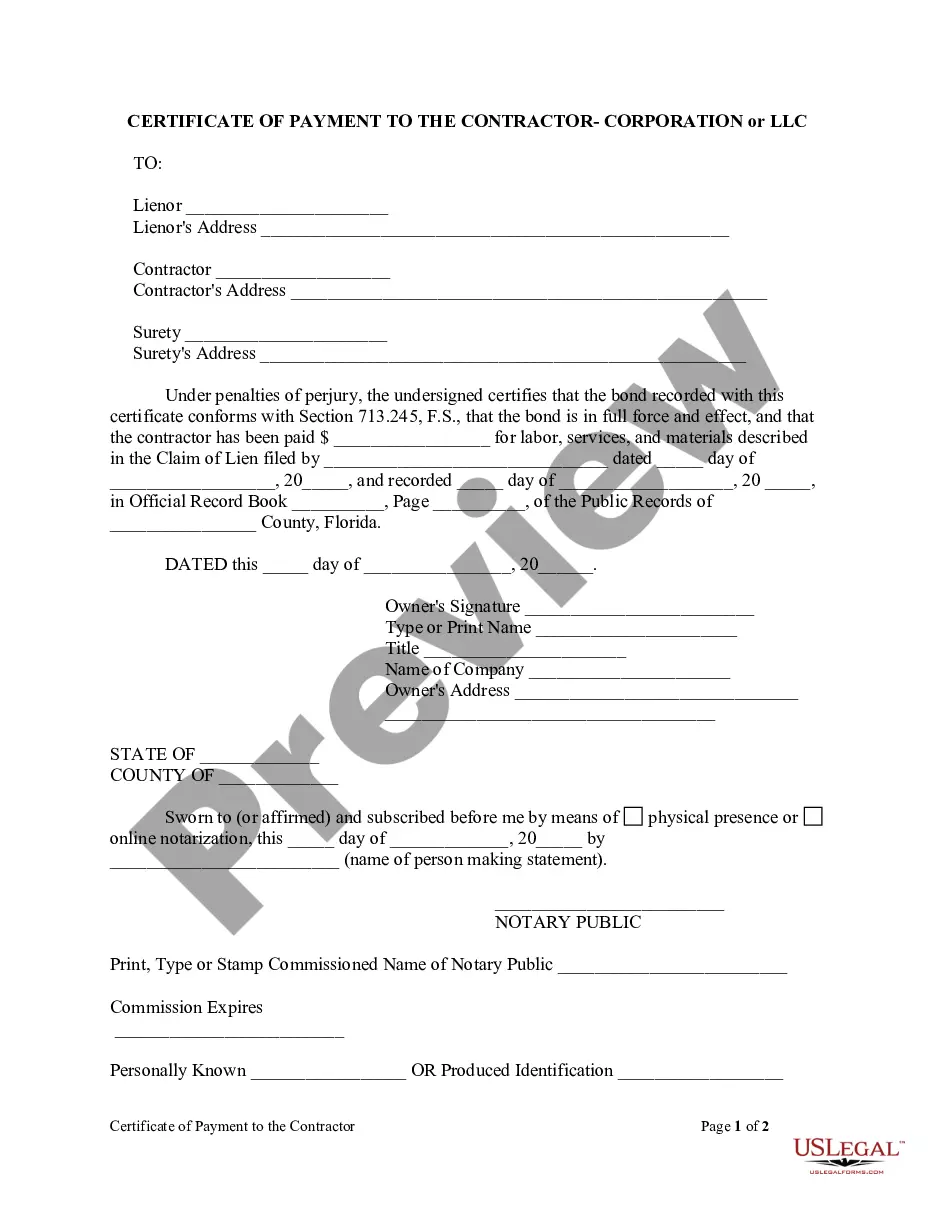

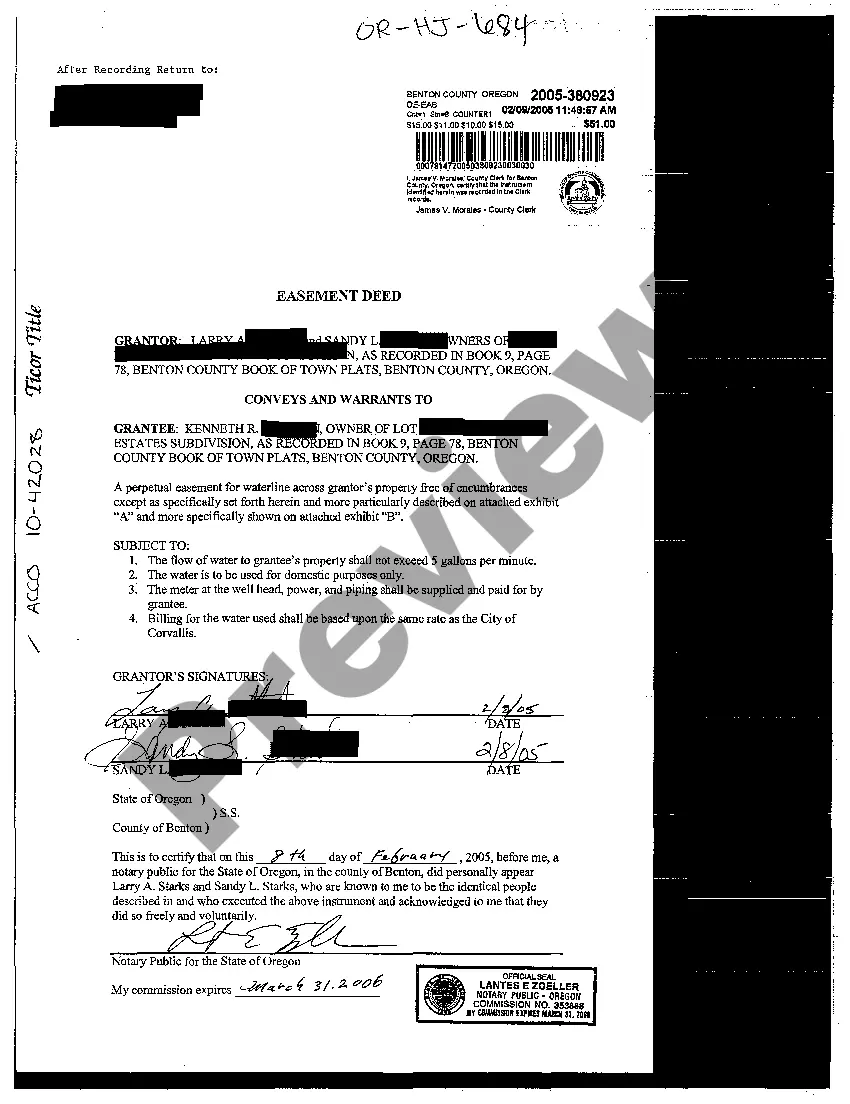

The Balloon Note example in Palm Beach is a financial instrument where the borrower agrees to repay a specific amount to the lender, structured with monthly installments followed by a final balloon payment. This document outlines key elements including the total loan amount, interest rate, payment schedule, and consequences of default. Specifically, it details that monthly payments are amortized over a set term, concluding with a larger balloon payment due at the end of the loan period. It also allows for additional principal payments, subject to a prepayment penalty during the initial year. The form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who need to document lending agreements clearly and ensure all legal requirements are met. Furthermore, the Balloon Note helps clarify the borrower’s obligations and the rights of the lender, providing necessary legal protections in case of default. Completing this form requires careful attention to all financial details and compliance with usury laws to avoid excess charges. Its clear structure supports effective communication between the involved parties, streamlining the lending process.

Free preview