Balloon Note Example In Houston

Category:

State:

Multi-State

City:

Houston

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

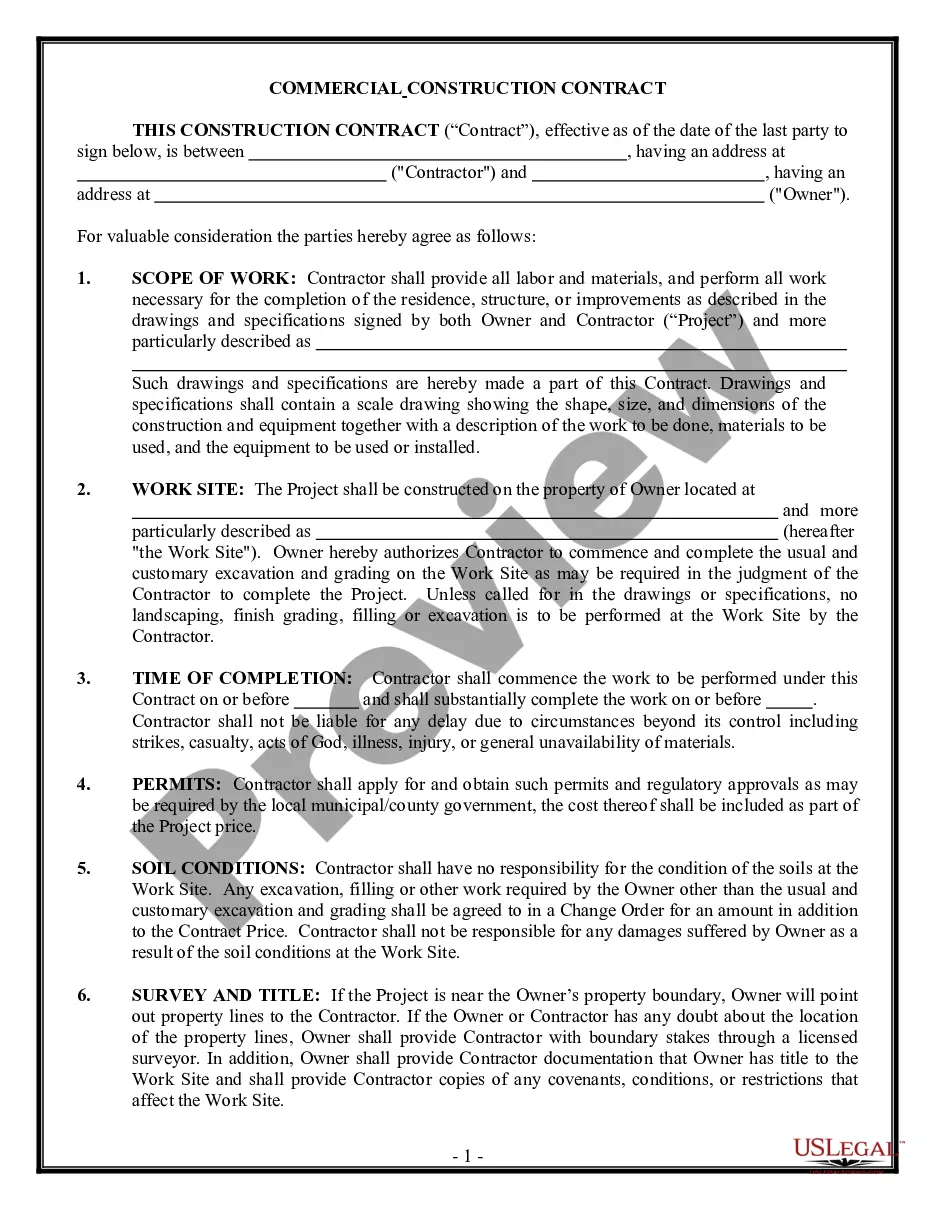

The Balloon Note example in Houston is a legal form that outlines a promissory note agreement where the borrower agrees to repay a specific amount owed to the lender in scheduled monthly installments, followed by a final balloon payment at the end of the term. This document is highly structured, detailing the amount to be financed, interest rates, payment schedules, and conditions for default. It emphasizes the timeline for both regular and balloon payments, ensuring clarity on the financial obligations involved. The form includes provisions for additional fees in case of default and allows for partial prepayments under specified conditions. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form useful for structuring loan agreements, as it provides a clear outline of terms that protect both lenders and borrowers. The correct filling and editing of the form are crucial; users must ensure all financial figures are accurate and that all parties' information is correctly represented. The Balloon Note is suited for scenarios such as real estate transactions or business loans where large sums are financed over time with a significant final payment.

Free preview