Balloon Note In Mortgage In Collin

Category:

State:

Multi-State

County:

Collin

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

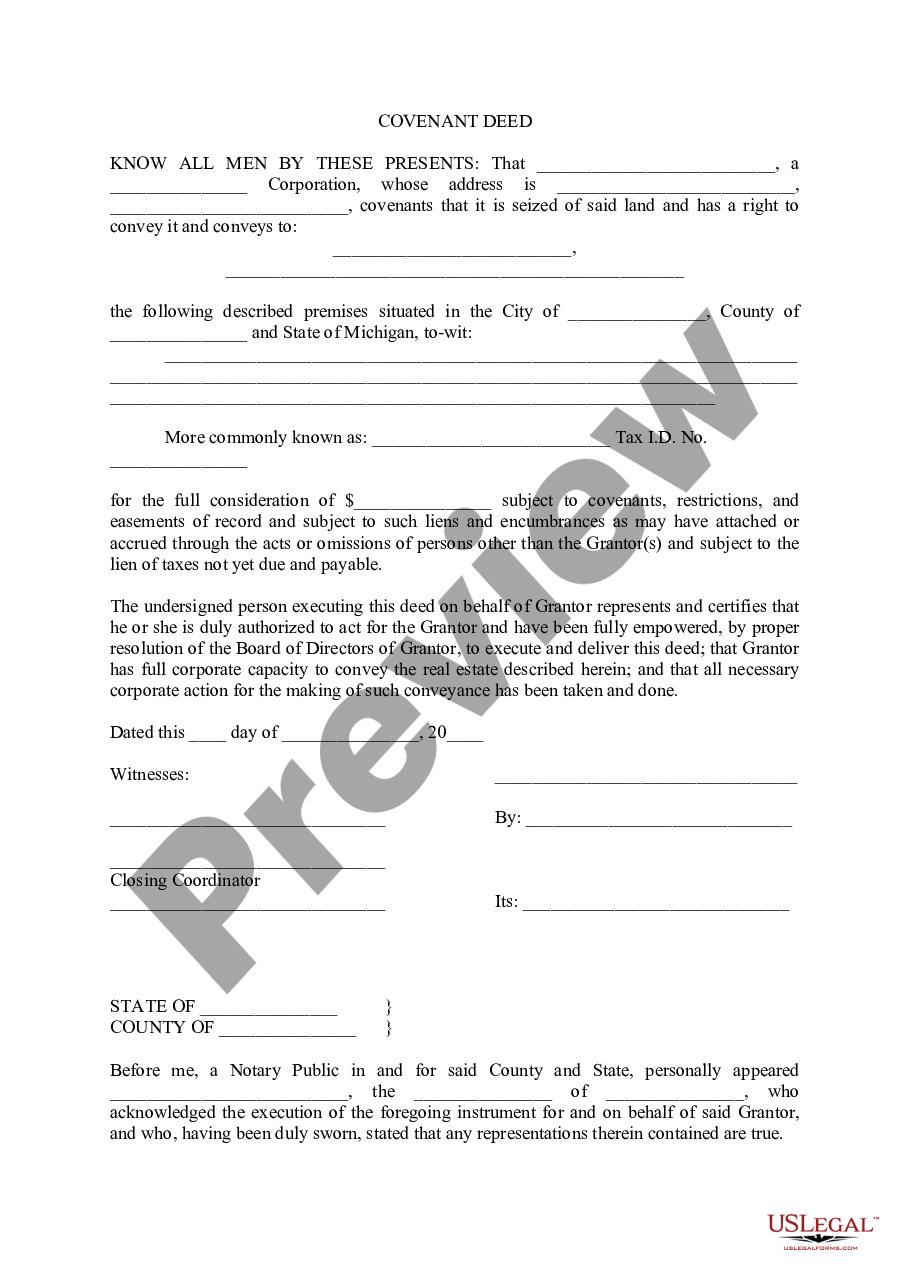

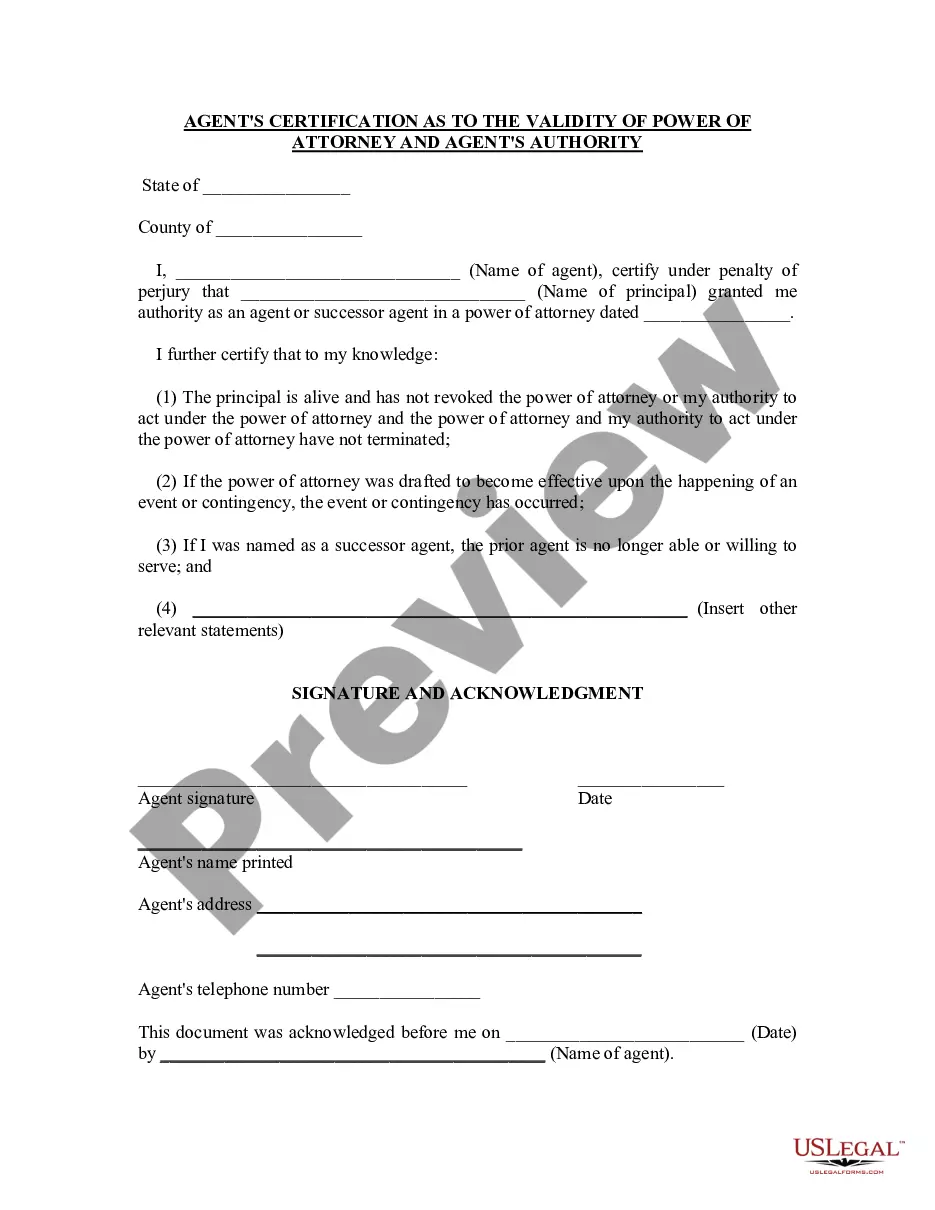

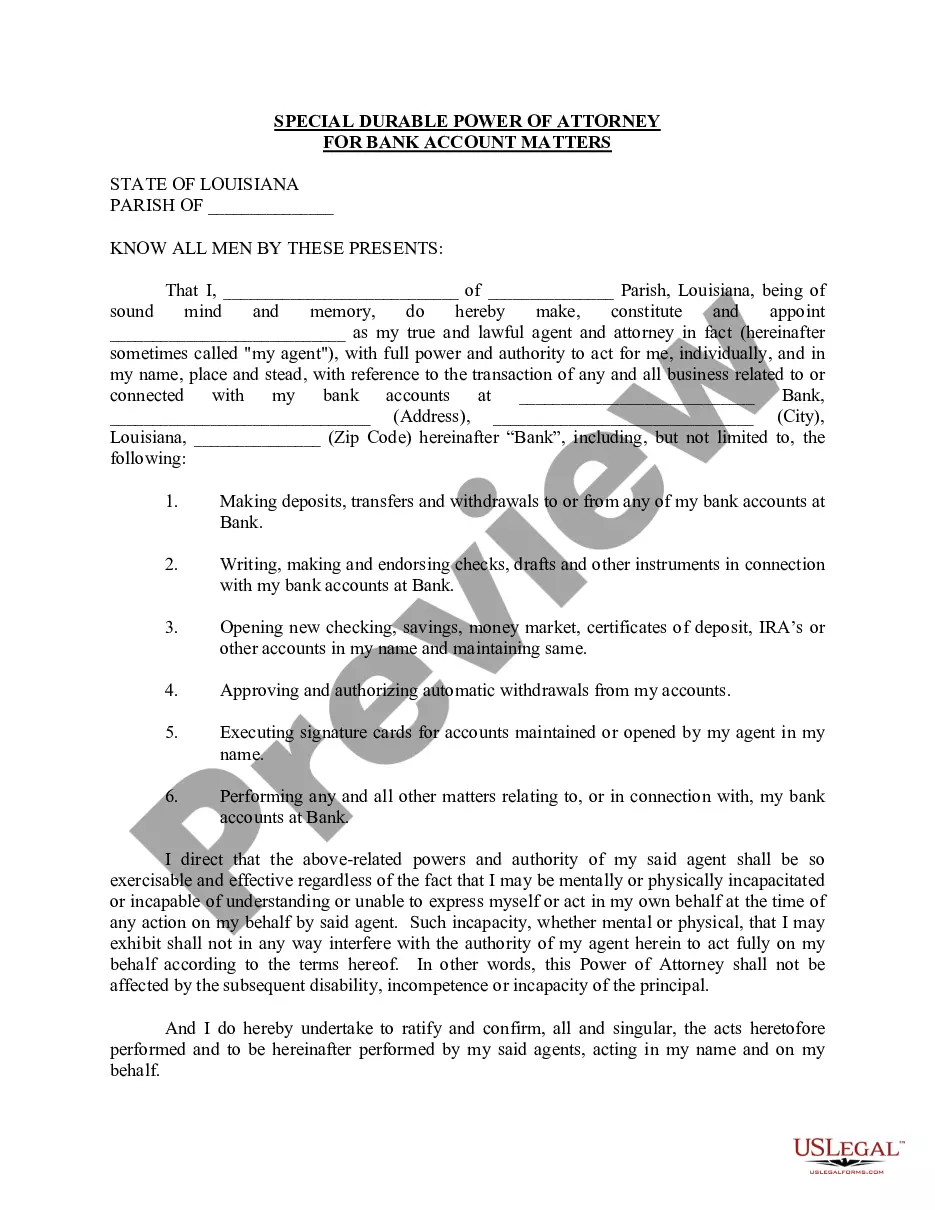

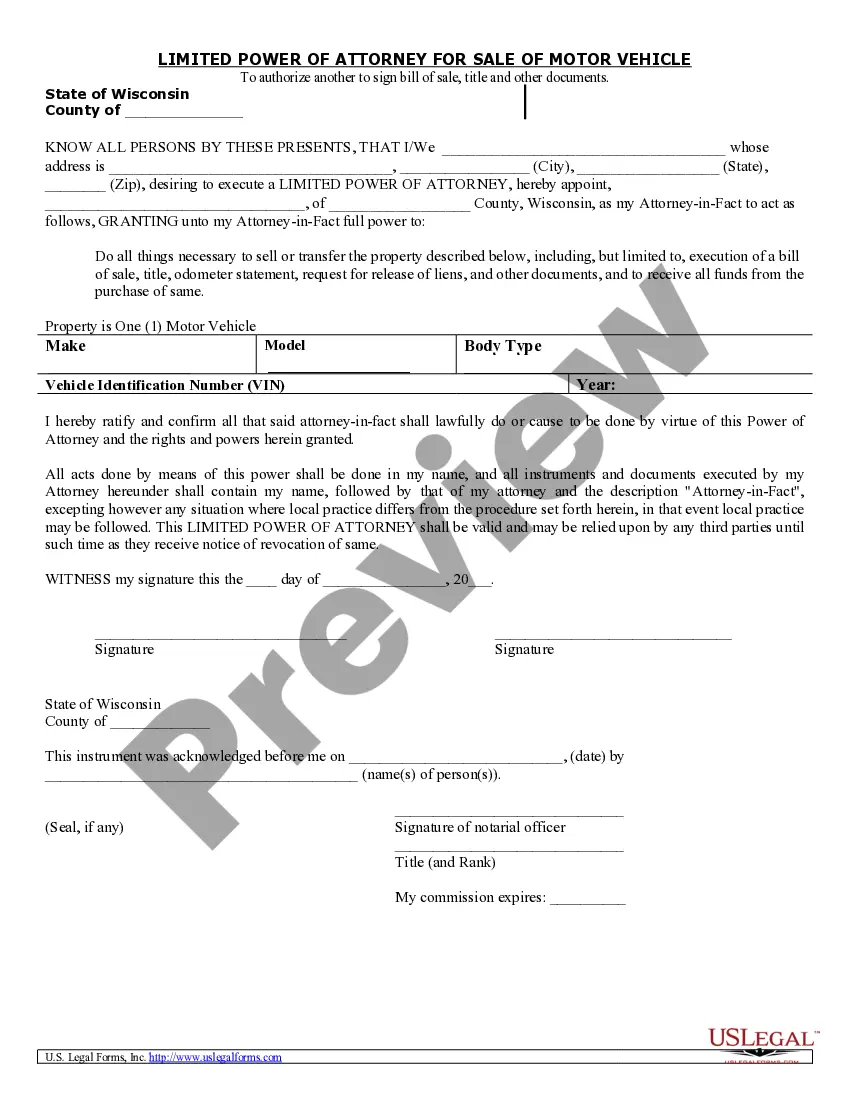

The Balloon Note in Mortgage in Collin is a financial instrument that outlines the terms of a loan where the borrower agrees to make regular monthly payments for a set period, culminating in a final 'balloon' payment of the outstanding principal amount. This form is essential for parties involved in real estate transactions, particularly for those looking to structure their mortgage with periodic payments followed by a lump sum payment, often beneficial for short-term financing needs. Key features of the form include detailing the loan amount, the interest rate, the amortization period, and the schedule of monthly installments. Filling and editing instructions emphasize accuracy in entering all loan details, along with clear identification of parties involved. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form for creating tailored mortgage documents that reflect the specific financial arrangements between lenders and borrowers. It's vital to ensure compliance with state regulations regarding usury laws and loan charges as stated in the form. The document also provides for additional obligations and rights of the lender and borrower in cases of default, which is crucial for any legal professionals in the field. Overall, this form supports users in efficiently managing their financial agreements with clarity and legal integrity.

Free preview