Payment For Due Course In Ohio

Description

Form popularity

FAQ

“Payment in due course” means payment in ance with the apparent tenor of the instrument in good faith and without negligence to any person in possession thereof under circumstances which do not afford a reasonable ground for believing that he is not entitled to receive payment of the amount therein mentioned.

Phrase. If you say that something will happen or take place in due course, you mean that you cannot make it happen any quicker and it will happen when the time is right for it. In due course the baby was born. The arrangements will be published in due course.

Payment in due course. n. the giving of funds to the holder of a promissory note or bill of exchange when due, without any knowledge that the document had been acquired by fraud or that the holder did not have valid title.

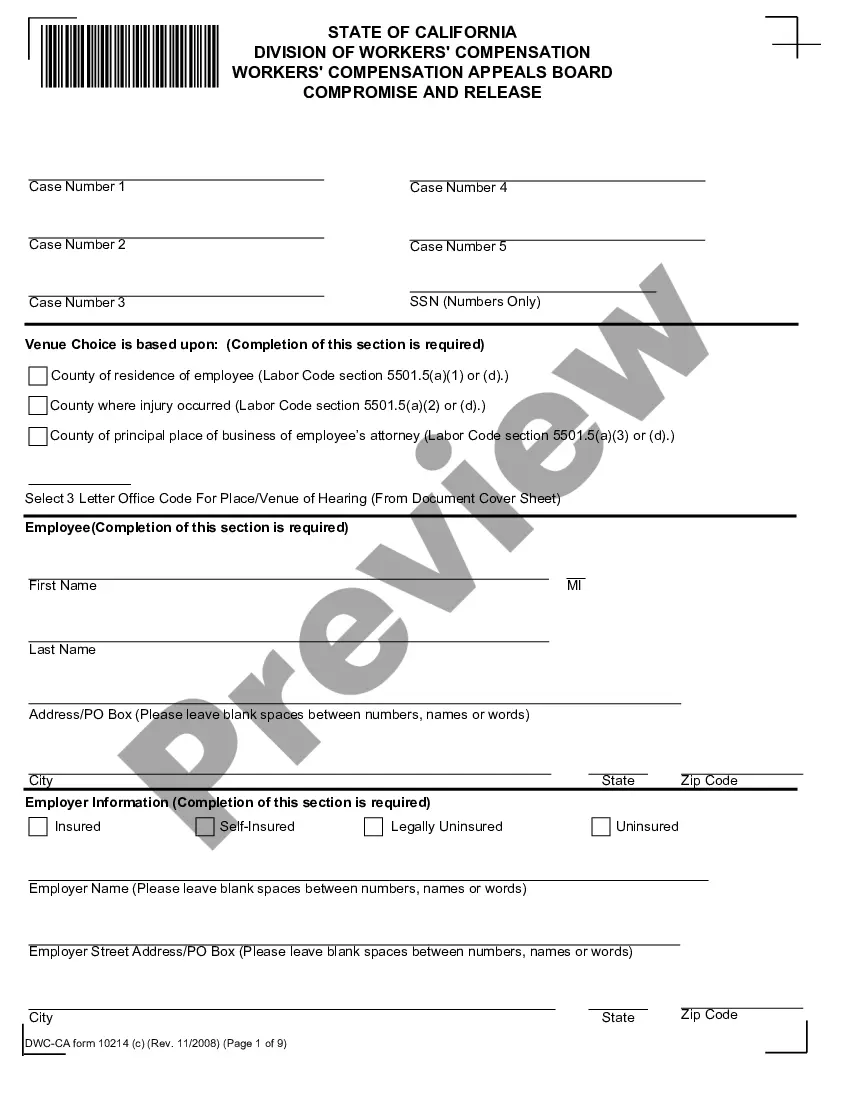

Statute of Limitations It is generally filed for any taxes owed that has been certified to them by the Department of Taxation. The AG's office has seven years from the date of the original tax assessment to begin legal proceedings to collect the taxes.

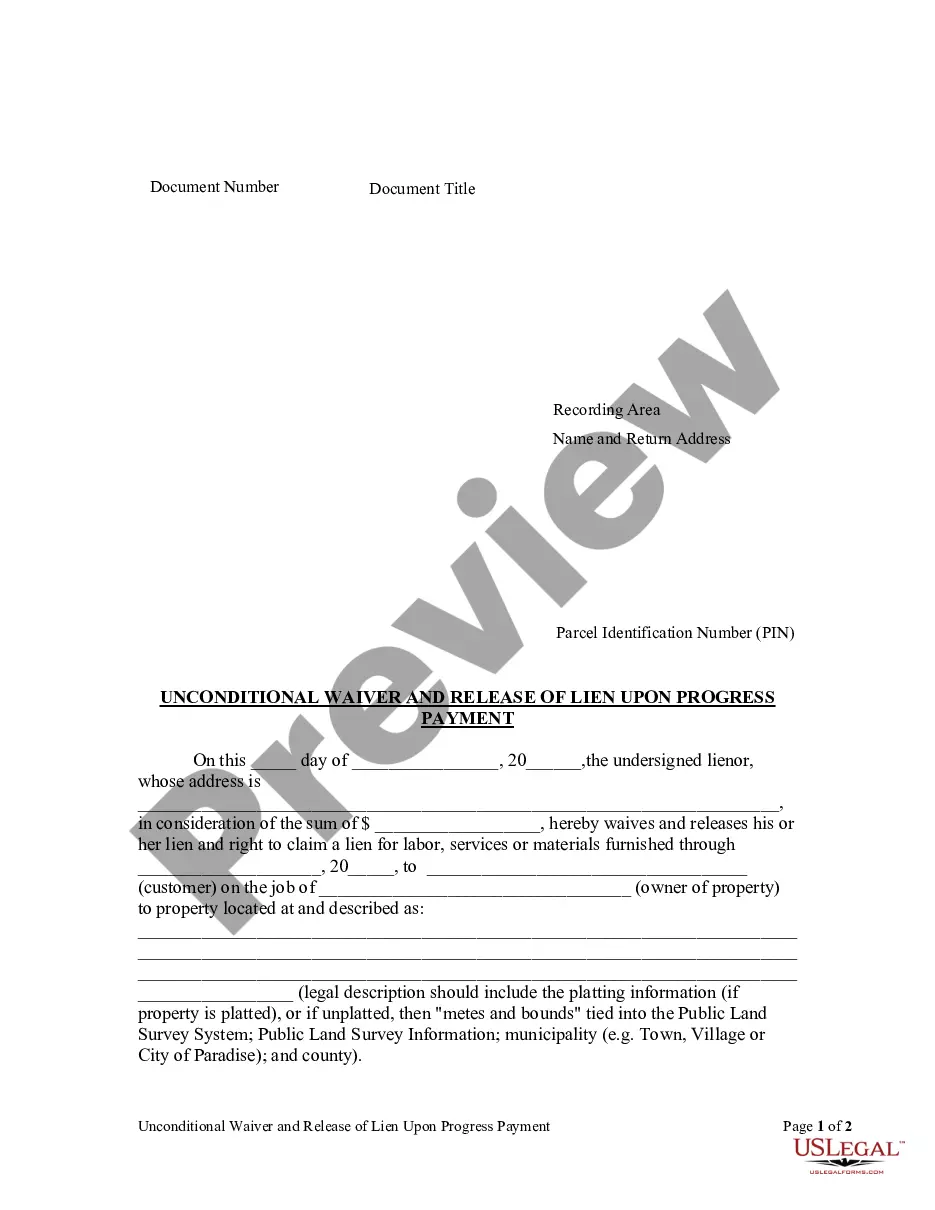

Upon timely filing of a notice of continuation of lien, the effectiveness of the original lien is continued for fifteen years after the last date on which the lien was effective, whereupon it lapses, unless another notice of continuation of lien is filed prior to the lapse.

Tax lien: The statute of limitations for a tax lien in Ohio is 15 years from the date the tax liability was assessed. This means that the government has 15 years to collect the taxes owed before the lien expires. Judgment lien: In Ohio, a judgment lien can be valid for up to 5 years.

Statute of Limitations It is generally filed for any taxes owed that has been certified to them by the Department of Taxation. The AG's office has seven years from the date of the original tax assessment to begin legal proceedings to collect the taxes. This is different from the IRS.

Ohio Judgment Law Attorney General's Office need only refile a tax lien every 15 years in Common Pleas Court to keep the lien operative against the tax debtor. A lien must be canceled after 40 years, per Oh. Rev. Code Sec.

(A) Except as otherwise provided in section 4123.37, section 5703.061, and division (K) of section 4123.511 of the Revised Code, whenever any amount is payable to the state, the officer, employee, or agent responsible for administering the law under which the amount is payable shall immediately proceed to collect the ...