Asset Purchase In Business In Minnesota

Description

Form popularity

FAQ

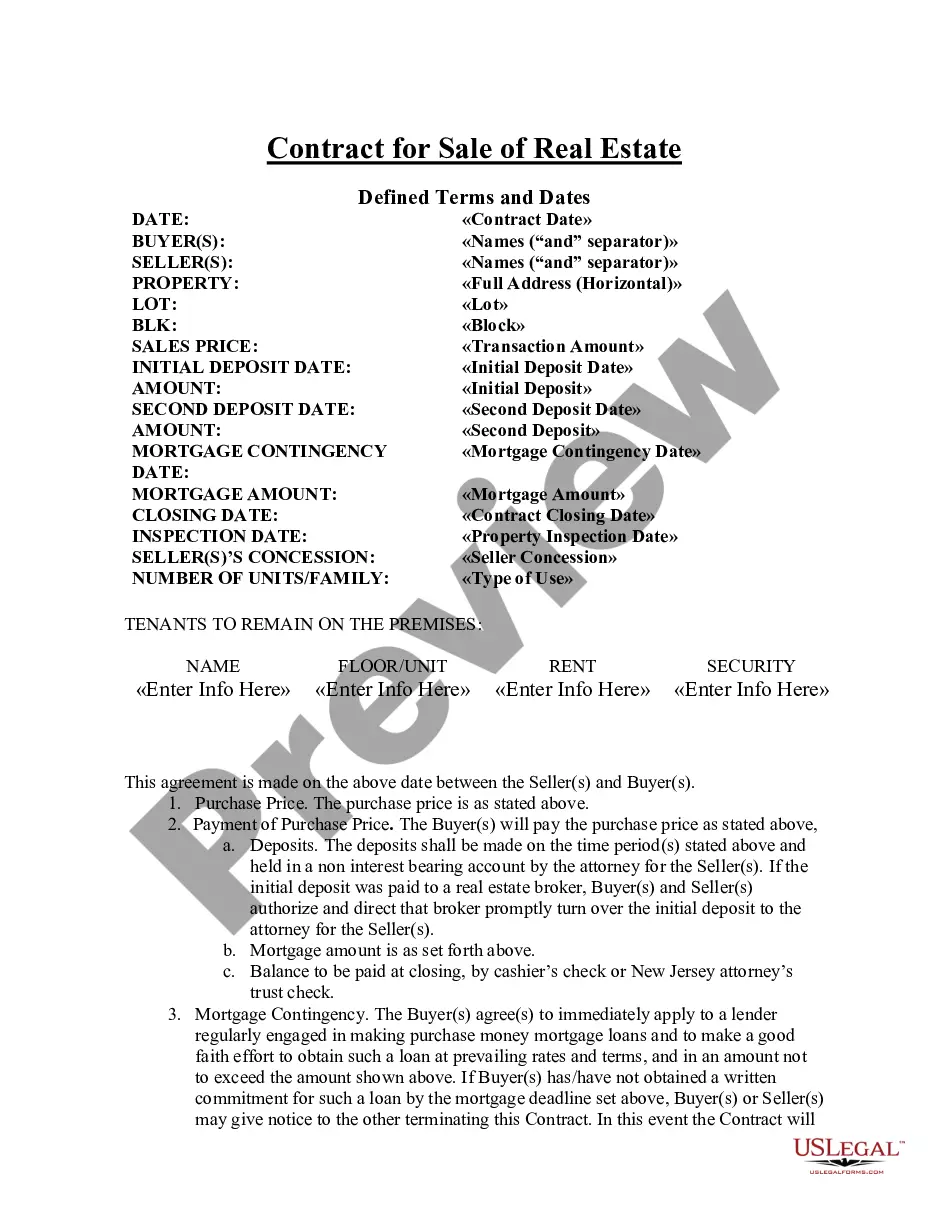

Purchasing assets When you buy a company's assets, you buy the property it owns. Because you are not buying the company itself, you will not assume responsibility for its obligations. In this case, the vendor or the company itself will remain responsible for the lease after the sale.

Explore the three types of business buying behavior: Straight Rebuy, Modified Rebuy, and New Task. Learn how they influence B2B purchasing decisions. Understanding how businesses make purchasing decisions is more complex than it seems.

The Procurement process provides a basic Asset Management lifecycle for procuring assets. It uses related actions on a corresponding Configuration Management process, so you need to ensure that the default process for each CI type you want to use with this process includes these actions.

Asset management is the process of planning and controlling the acquisition, operation, maintenance, renewal, and disposal of organizational assets. This process improves the delivery potential of assets and minimizes the costs and risks involved.

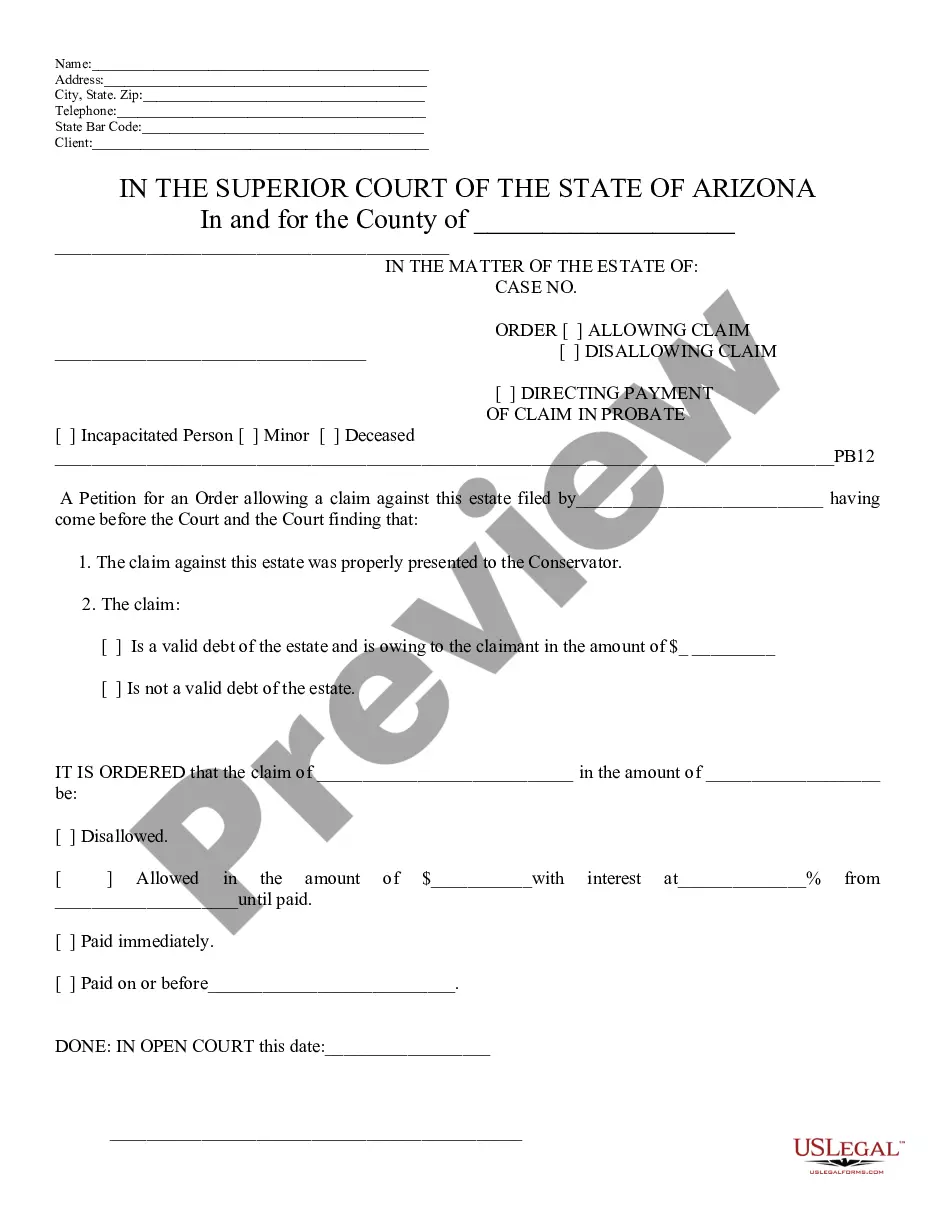

An individual (sole trader) and a company are legal entities as they can own assets, be sued and enter into contracts with other legal entities.

Disposal of assets The disposal of fixed assets involves removing assets from the accounting records. This process is known as derecognition. Derecognition may require recording of a gain or loss on the sale, exchange or transfer of the asset when the disposal occurs.

The biggest difference is that an SPA is the sale of all shares, and an APA is the sale of selected assets. Therefore, they are both different transactions and have different procedures.