Asset Purchase Form Irs In Middlesex

Category:

State:

Multi-State

County:

Middlesex

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

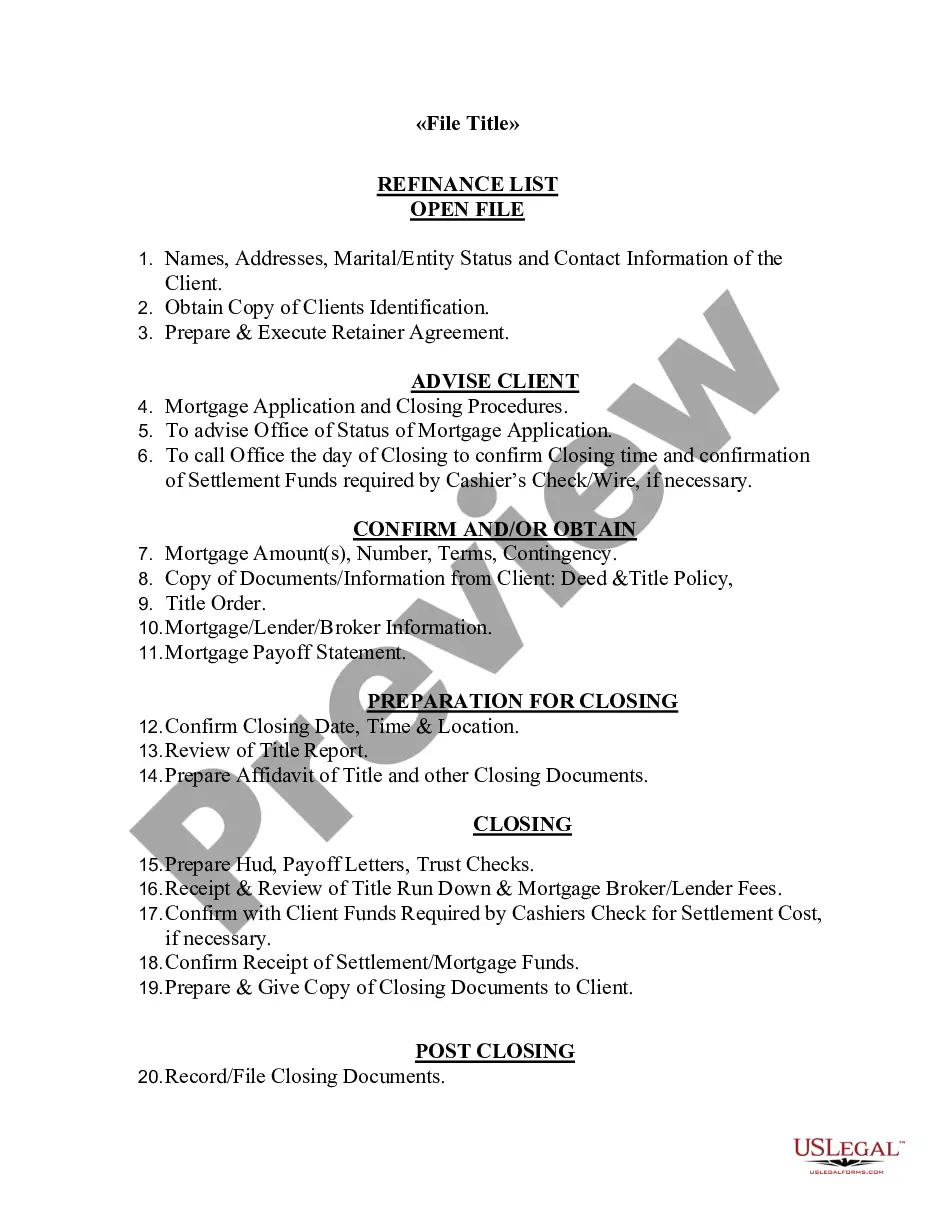

The Asset Purchase Agreement is a legal document essential for the transaction of assets between a seller and a buyer, specifically in Middlesex. This form delineates the assets being sold, the purchase price, and the obligations of both parties. Key features include detailed descriptions of the purchased assets, exclusions of certain liabilities, and payment terms outlined clearly for both immediate and future payments. Filling instructions involve completing sections regarding asset identification, purchase price allocation, and the conditions of sale. The form is applicable in various scenarios, such as business acquisitions or mergers, making it vital for attorneys, partners, owners, associates, paralegals, and legal assistants involved in corporate transactions. Each target audience can utilize this document to ensure compliance with legal standards and protect the interests of the parties involved. Legal assistants can aid in drafting while paralegals can manage compliance and documentation processes. Moreover, owners and partners can leverage this agreement to accurately reflect their business arrangements and manage asset transfers efficiently.

Free preview