Asset Purchase Form Irs In Massachusetts

Category:

State:

Multi-State

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

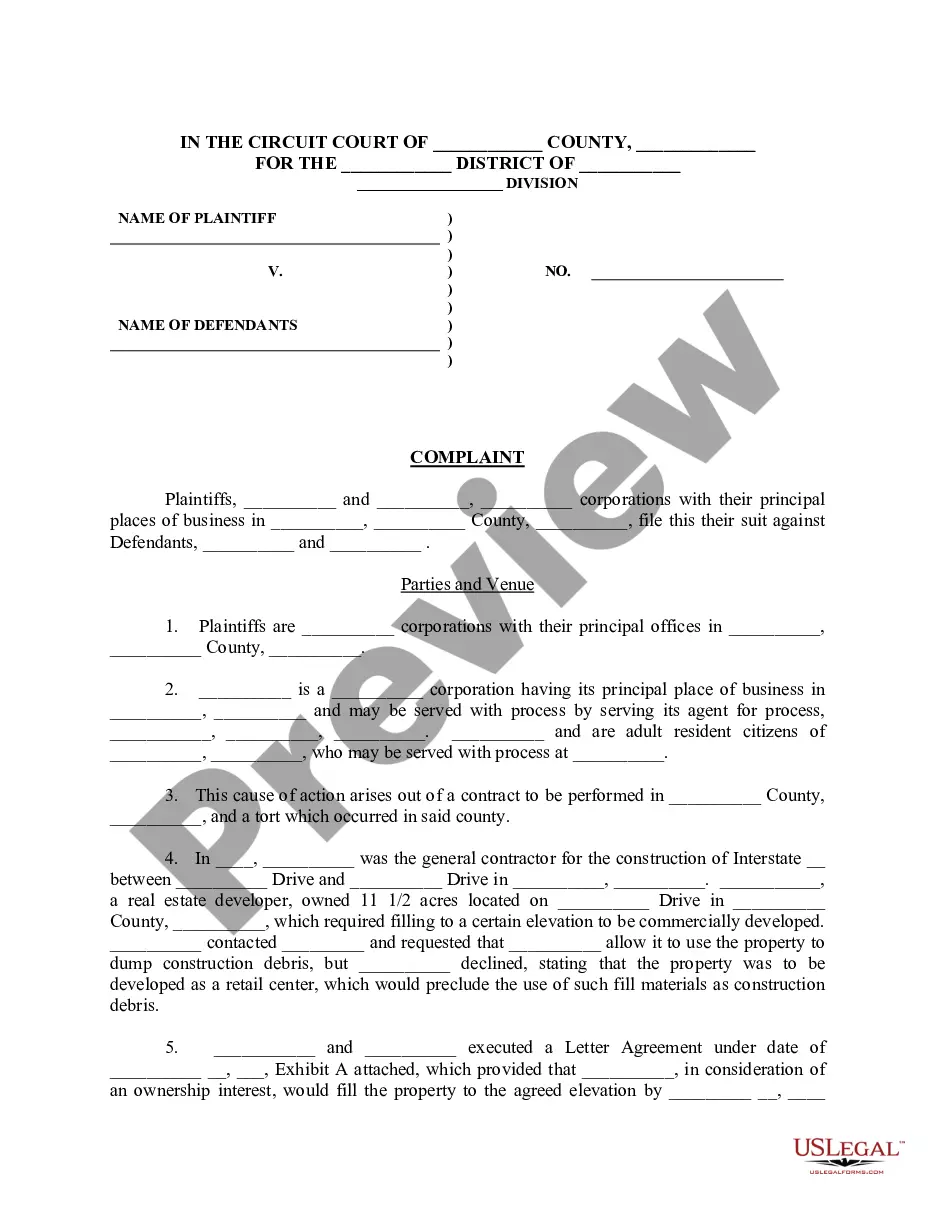

The Asset Purchase Form IRS in Massachusetts is a crucial legal document used in the buying and selling of a business's assets. It outlines the terms of the sale, including the specific assets being sold, the purchase price, and any liabilities that the buyer will not assume. The form provides a structured agreement between the seller and buyer, ensuring that both parties understand their rights and obligations throughout the transaction. Key features include sections on the assets being purchased, payment terms, and the necessary representations and warranties from both parties. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form to ensure compliance with state-specific laws while facilitating smooth transactions. It's essential for users to carefully fill out the form, noting details regarding asset valuation and any required financial disclosures. Editing the form is straightforward, allowing users to specify terms based on their unique transaction needs. Overall, this document not only serves legal and financial purposes but also holds significance in preserving the integrity of business operations.

Free preview