Fixed Asset Purchase With Gst Entry In Bronx

Category:

State:

Multi-State

County:

Bronx

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

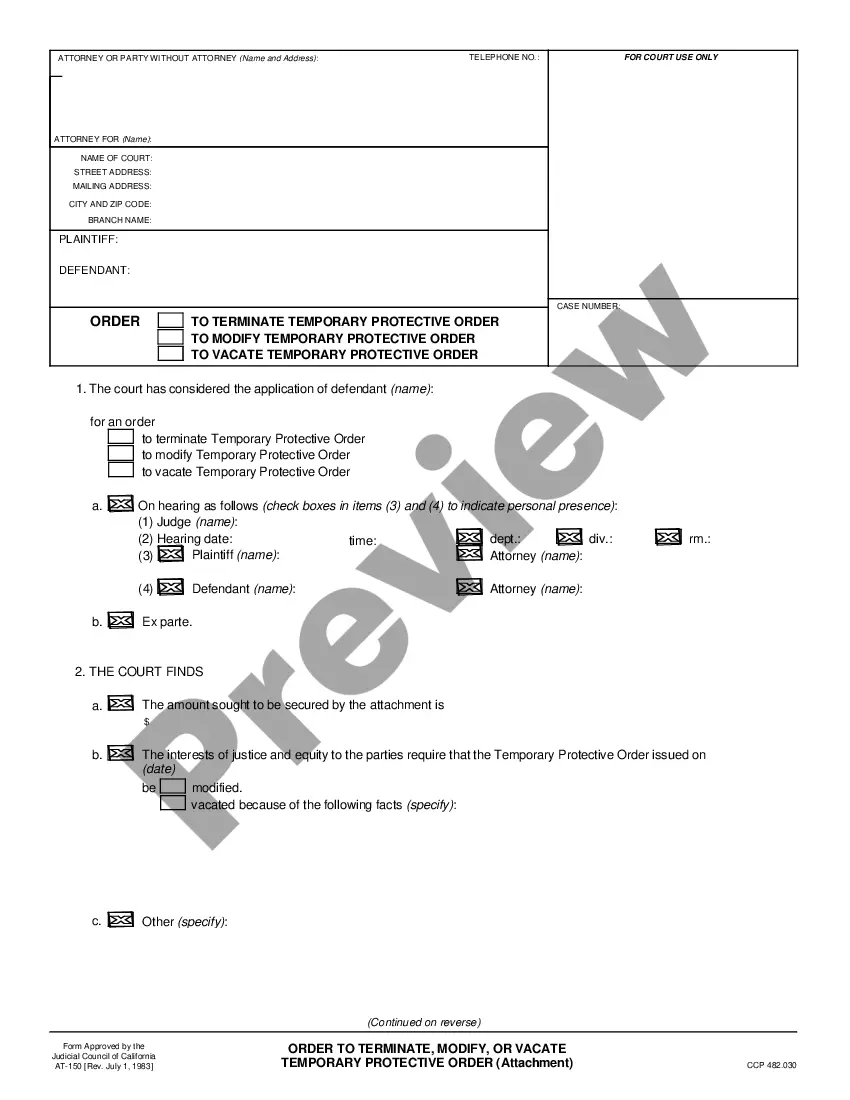

The Asset Purchase Agreement is a legal document focused on the purchase of fixed assets with GST entry in Bronx. It outlines the agreement between the Seller, Selling Shareholder, and Buyer regarding the sale of equipment, inventory, and goodwill, while stipulating that the Buyer does not assume any liabilities of the Seller. The form includes sections detailing the assets purchased, excluded assets, the purchase price allocation, payment terms, conditions precedent, and indemnification obligations. It serves as a comprehensive guideline for real transactions, emphasizing the importance of ensuring all necessary authorizations, disclosures, and inspections are conducted prior to closing. Target audiences, such as attorneys, partners, owners, associates, paralegals, and legal assistants, will find this form crucial for documenting asset transactions, protecting their legal interests, and ensuring compliance with local laws and financial regulations. The clear structure of the agreement facilitates easy filling and editing, enabling users to customize it according to their specific needs.

Free preview

Form popularity

FAQ

? 1️⃣ Sale of Immovable Fixed Assets (Land & Buildings) ✅ Sale of an under-construction building → GST @18% applies (Treated as a supply of services).

Capital goods under GST are defined as assets used or intended for use in business activities, which are capitalized in the taxpayer's books of accounts. This includes machinery, equipment, and furniture used in the production of taxable goods or services.