New York State Deferred Compensation Plan Terms Of Withdrawal In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

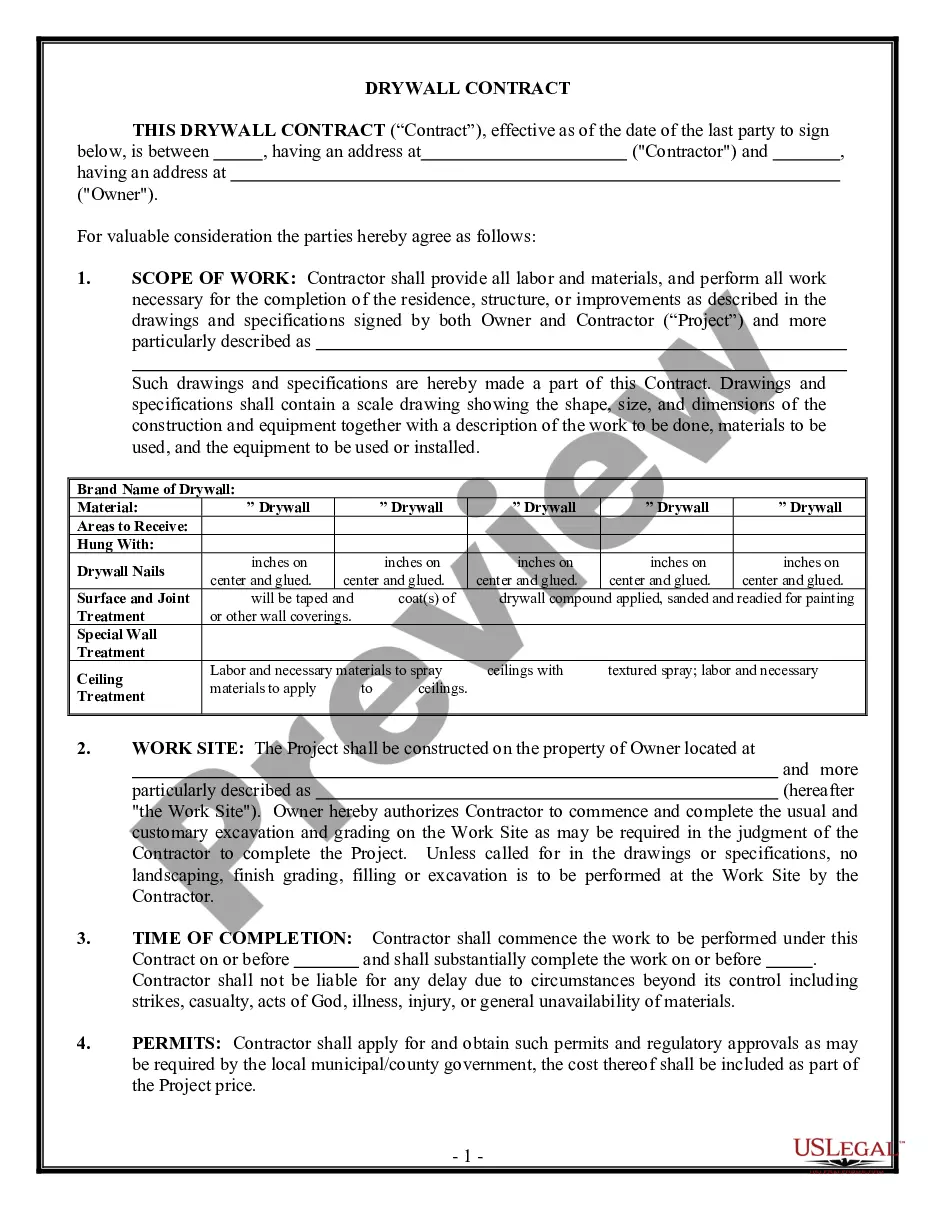

The New York State Deferred Compensation Plan terms of withdrawal in Fulton outline the conditions under which employees can access their deferred compensation upon retirement, disability, or death. Key features include monthly payments calculated based on the National Consumer Price Index and contingent upon the employee not engaging in competitive employment post-retirement. If the employee passes away after retirement, the remaining payments are directed to beneficiaries, while simultaneous death before retirement triggers a similar payout. The form requires specific filling instructions, including designations of beneficiaries and adherence to noncompetition clauses. It serves various use cases such as establishing clear post-retirement income provisions, ensuring financial security for beneficiaries, and facilitating legal compliance. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form to craft legally sound agreements that protect corporate interests and employee rights, ensuring proper management of deferred compensation agreements.

Free preview