Form 8594 Vs Form 8883 In Wayne

Category:

State:

Multi-State

County:

Wayne

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

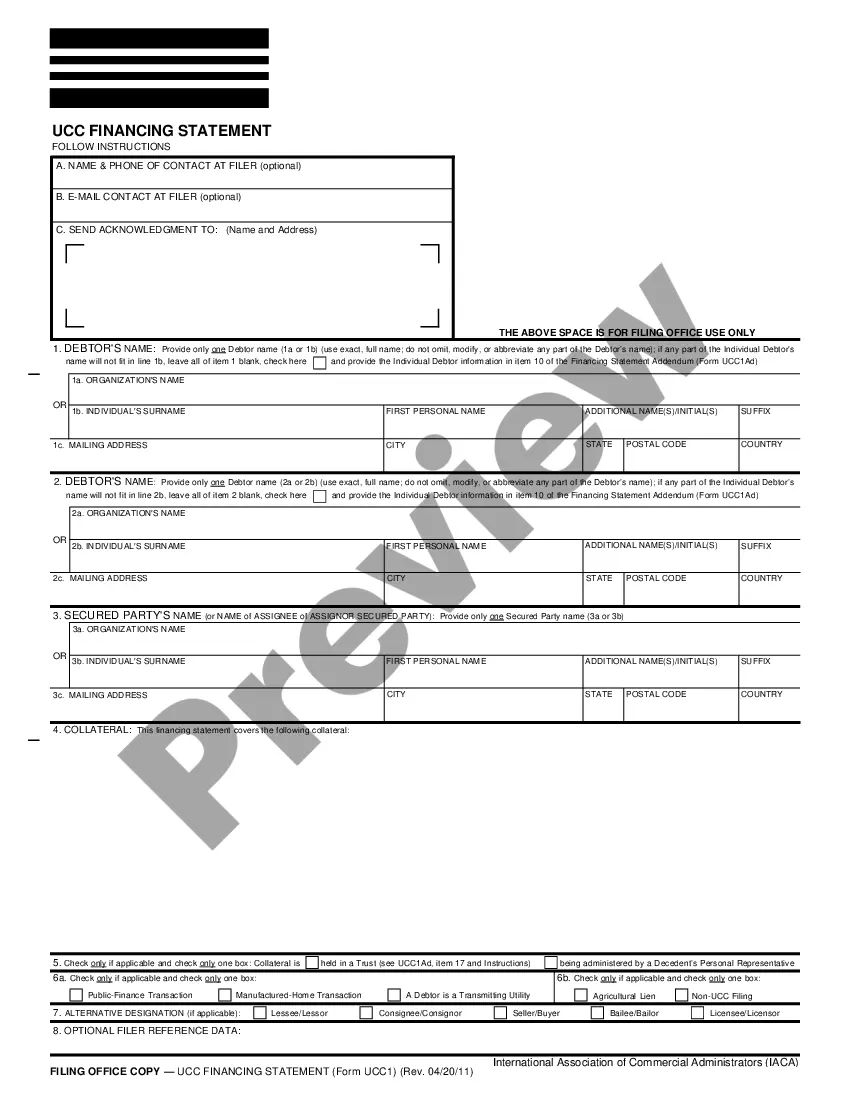

Form 8594 and Form 8883 are pivotal in asset acquisition situations, particularly in Wayne. Form 8594 is used for reporting the sale of a business asset, ensuring both buyer and seller allocate the purchase price among assets, while Form 8883 pertains specifically to the allocation of basis to assets acquired in a non-taxable exchange. This document is essential for attorneys, partners, owners, associates, paralegals, and legal assistants engaged in business transactions. It aids in properly structuring deals, determining tax liabilities, and capturing asset transfers accurately. Key features include guidelines for filling out, such as defining asset categories and intruding potentially applicable taxes. Both forms require careful consideration and editing based on the specific transaction details to ensure compliance with legal standards. Use cases extend to business purchases, mergers, and sales where asset allocations are a significant concern, highlighting the importance of accurate documentation for tax and legal purposes.

Free preview