Form 8594 For Stock Purchase In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

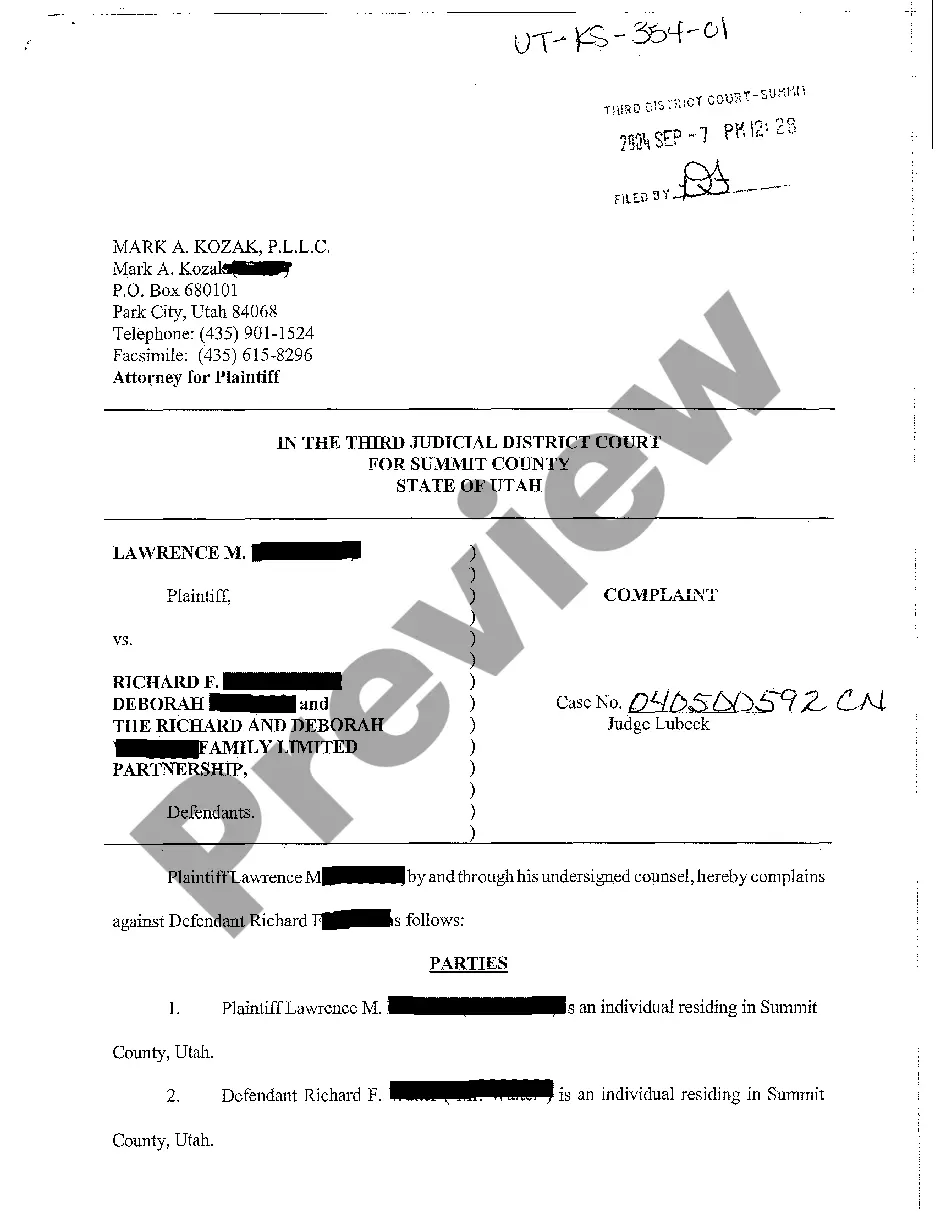

Form 8594 for stock purchase in Fairfax is a crucial legal document used in asset transactions, particularly for the sale of a business. This form outlines the agreement between the buyer and seller concerning the purchase of business assets, including equipment, inventory, and goodwill. It serves to allocate the purchase price across various asset categories, ensuring clarity during the transaction process. Users must fill out the form carefully, noting the specific assets being sold and any liabilities being assumed or excluded. For attorneys, it provides a structured guideline to draft agreements, while business partners and owners can use it to facilitate clear communications about the sale terms. Associates and paralegals can utilize the form in preparing documentation for client transactions, ensuring compliance with legal standards. Legal assistants can aid in gathering necessary information for completion and filing, contributing to a streamlined transaction process that can minimize disputes.

Free preview