Form 8594 And Instructions In Chicago

Category:

State:

Multi-State

City:

Chicago

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

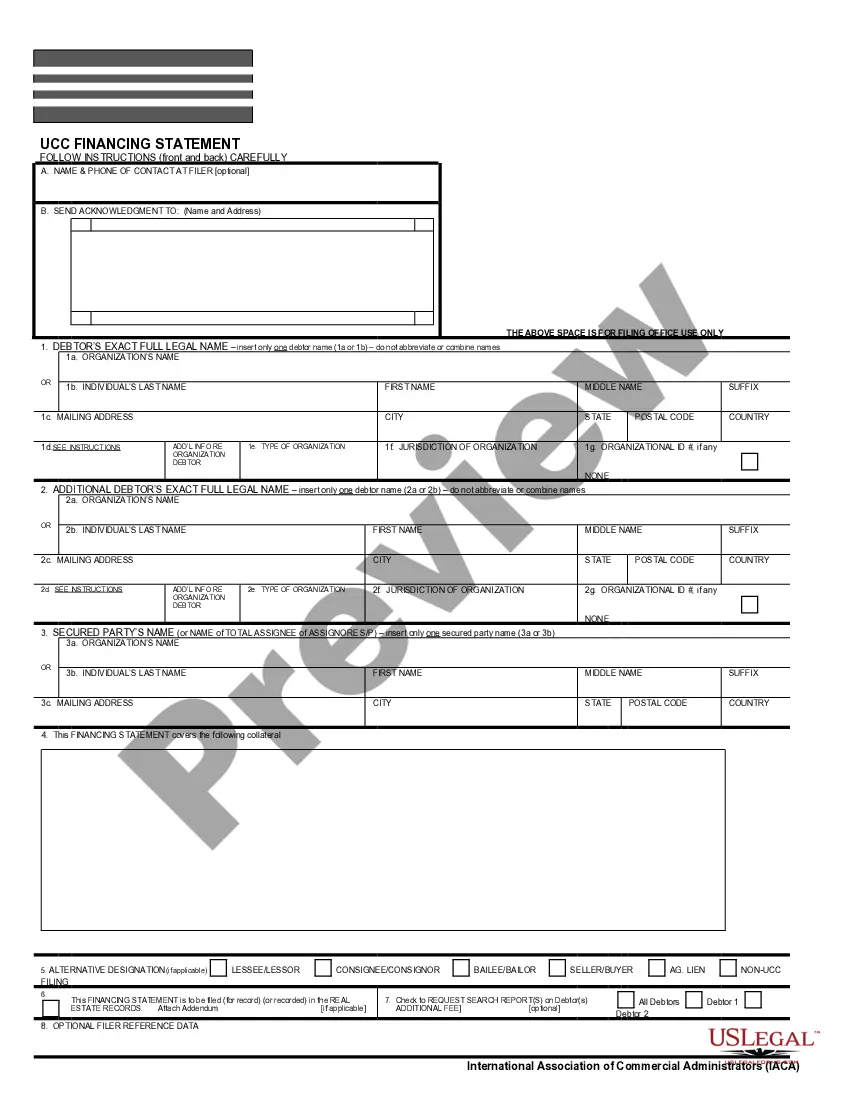

Form 8594 is a crucial document used in asset purchase transactions, particularly in the context of business sales in Chicago. It provides a structured way to report the allocation of purchase price among various assets being sold, which is essential for tax purposes. The form delineates the individual assets involved, ensuring that both the buyer and the seller align on the values attributed to each asset category. Key features include sections for detailing the assets purchased, liabilities assumed, excluded assets, and the purchase price allocation. Filling and editing instructions emphasize accuracy and clarity, guiding users to complete each section thoroughly. This form is particularly beneficial for attorneys, partners, owners, associates, paralegals, and legal assistants involved in business transactions, as it helps in compliance with IRS guidelines and facilitates smooth negotiations. Legal professionals may also use the insights provided by this form to advise clients on the tax implications of their asset sales.

Free preview