Asset Purchase Agreement Irs Form In Broward

Category:

State:

Multi-State

County:

Broward

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

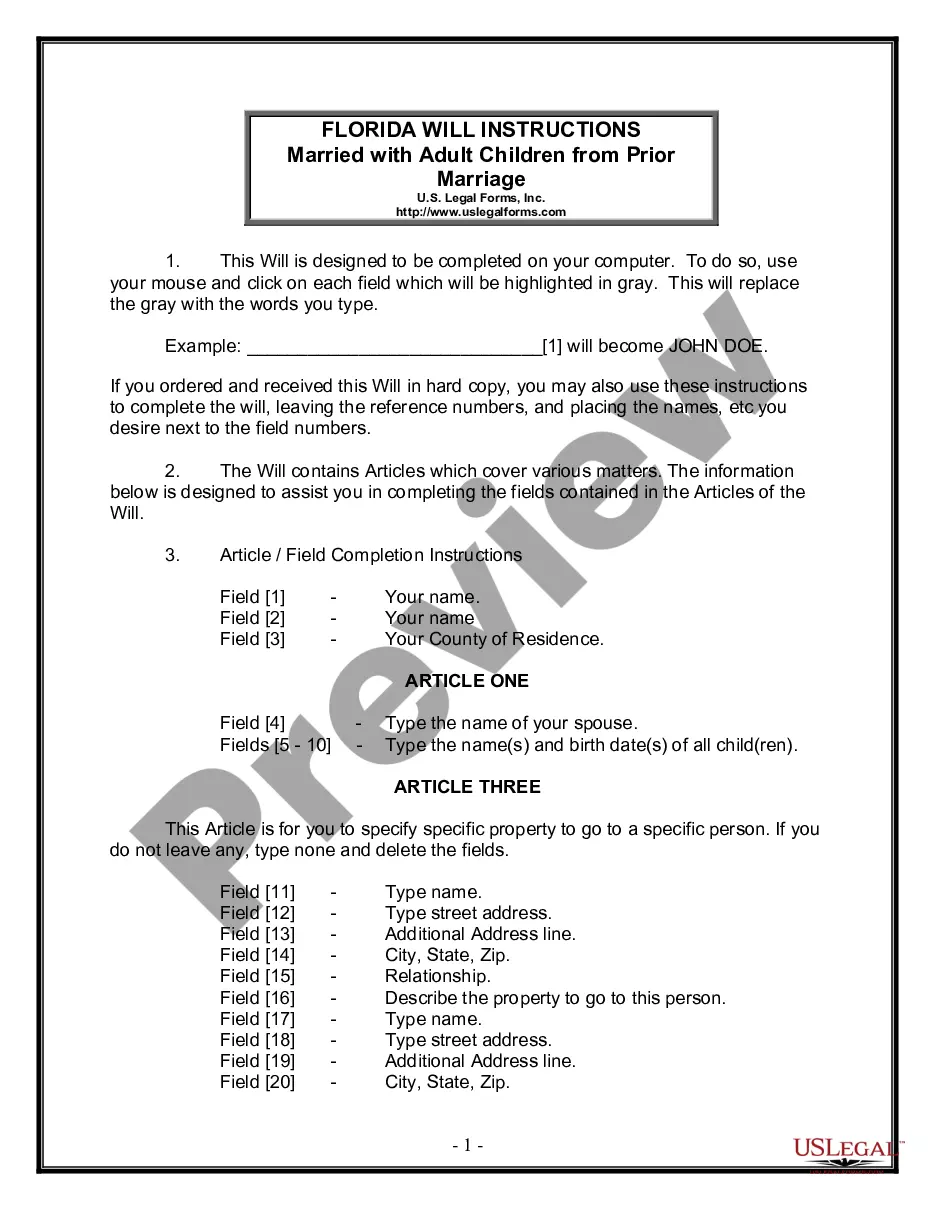

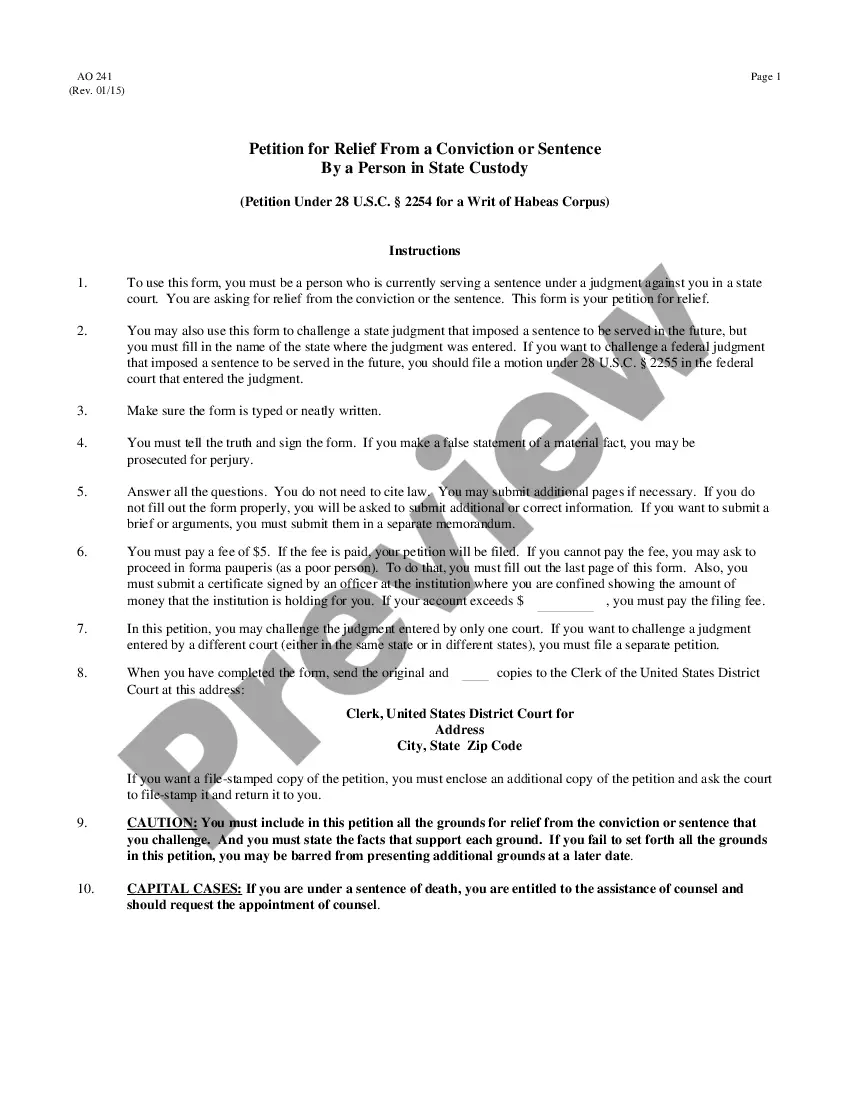

The Asset Purchase Agreement IRS form in Broward serves as a vital document for buyers and sellers involved in the transfer of business assets. This detailed agreement outlines the roles of both parties, specifically the Seller and Buyer, detailing the assets being sold, including equipment, inventory, and goodwill, as well as any liabilities assumed by the Buyer. Key features include sections addressing the purchase price allocation, security interests, representations, and warranties from both parties, which protect their interests throughout the transaction. The form provides crucial instructions for filling out specific information, such as asset descriptions and payment terms, while allowing for customization based on the specific transaction. It is essential for attorneys, partners, owners, associates, paralegals, and legal assistants to understand the form's structure and legal implications, as it can define their responsibilities and rights during the sale process. This form is particularly beneficial for businesses in Broward seeking a clear and structured approach to asset transfers, ensuring compliance with local and federal regulations. Furthermore, it outlines the procedure for closing the sale and addresses potential contingencies, making it a comprehensive tool for legal professionals navigating asset transactions.

Free preview

Form popularity

FAQ

The biggest difference is that an SPA is the sale of all shares, and an APA is the sale of selected assets. Therefore, they are both different transactions and have different procedures.

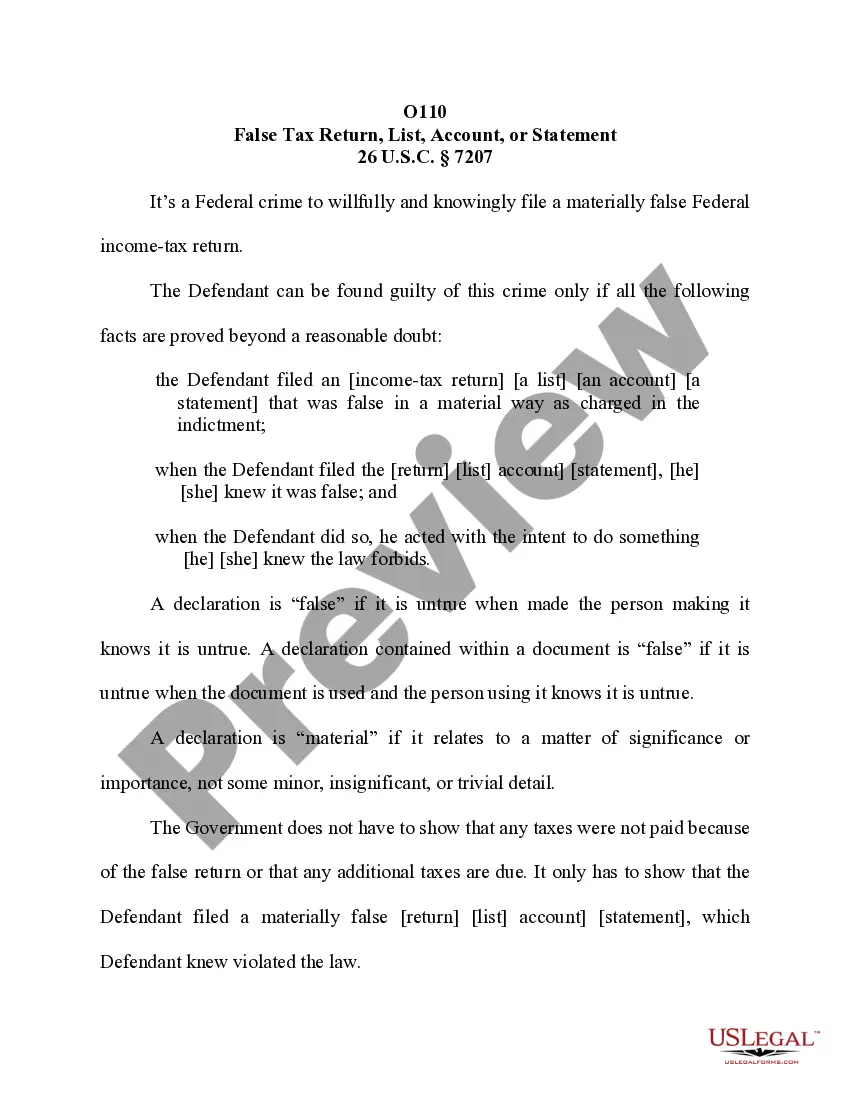

A penalty may be imposed for failure to file Form 8804 when due (including extensions). The penalty for not filing Form 8804 when due is usually 5% of the unpaid tax for each month or part of a month the return is late, but not more than 25% of the unpaid tax.

First and foremost, it is typically the buyer's responsibility — not yours as the seller — to draft the Definitive Agreement. This will not begin until both the buyer and the seller sign a Letter of Intent indicating their intention to buy/sell the business.