Rental Application With Guarantor In Clark

Category:

State:

Multi-State

County:

Clark

Control #:

US-00415

Format:

Word;

Rich Text

Instant download

Description

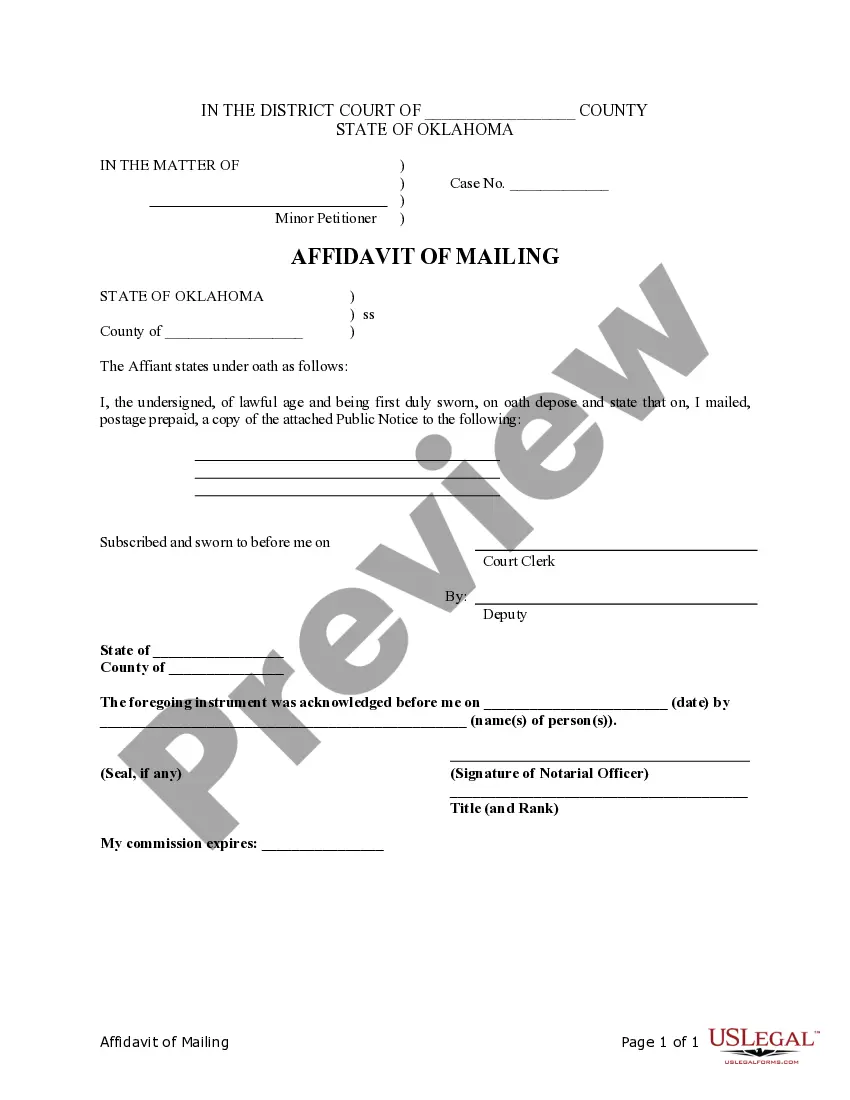

The Rental Application with Guarantor in Clark is a comprehensive form designed for individuals seeking rental housing, specifically allowing for a guarantor's support. This form collects essential information about the applicant, including personal details, current address, employment status, and financial information, which assists landlords in evaluating the applicant's suitability. It includes sections for references and a statement affirming the truthfulness of the provided information. Users should fill out each section completely and accurately to facilitate the verification process by landlords. The form’s utility is significant for attorneys, partners, owners, associates, paralegals, and legal assistants, as it streamlines the rental process and ensures compliance with local rental laws. By utilizing this form, legal professionals can safeguard client interests while ensuring that potential renters are qualified to lease properties. Furthermore, it is pertinent for those representing landlords, as having a guarantor increases the likelihood of securing reliable tenants. Overall, this form simplifies documentation and enhances legal protection in rental agreements.

Free preview