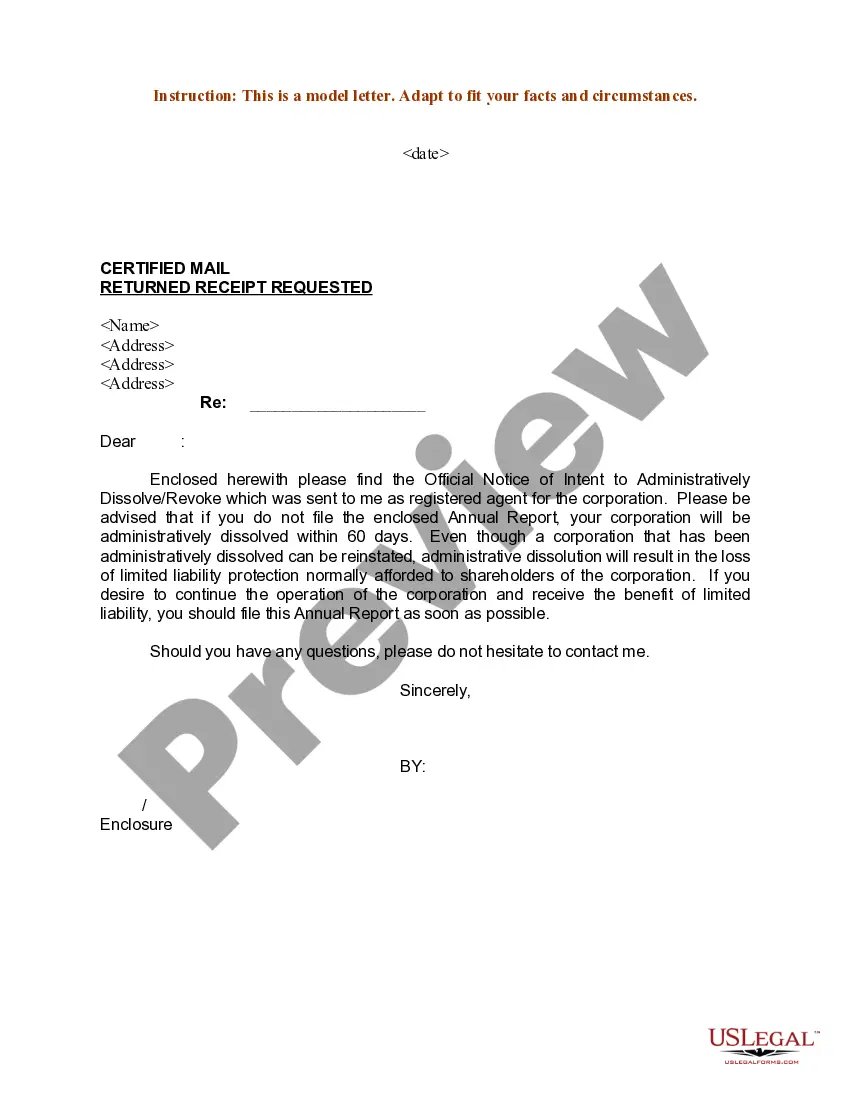

This form is a sample letter in Word format covering the subject matter of the title of the form.

Date Of Death Balance Letter With Irs In Utah

Description

Form popularity

FAQ

Yes, as the executor of the estate you can get copies of tax returns filed by a deceased taxpayer by completing and mailing a Form 4506-T. You will need to include a copy of the death certificate and a court document naming you as the executor.

For those who wish to continue to receive estate tax closing letters, estates and their authorized representatives may call the IRS at (866) 699-4083 to request an estate tax closing letter no earlier than four months after the filing of the estate tax return.

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. You must file Form 1310 if the description in line A, line B, or line C on the form above applies to you.

To get details on an IRS notice or letter, search for it by number or topic. You can find the CP number and subject under the “Notices and Letters” section of your online account.