Florida Homestead Exemption For Teachers In Texas

Instant download

Description

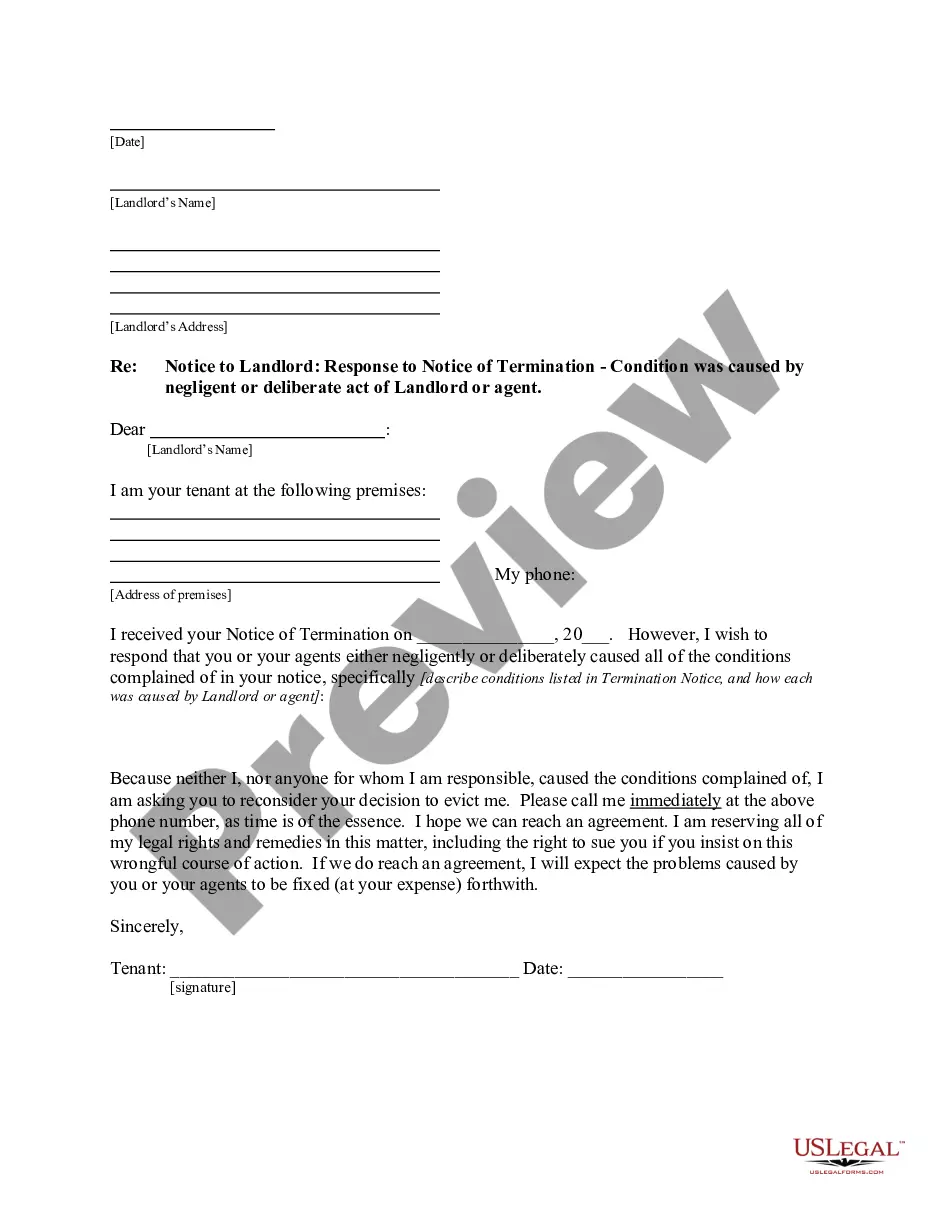

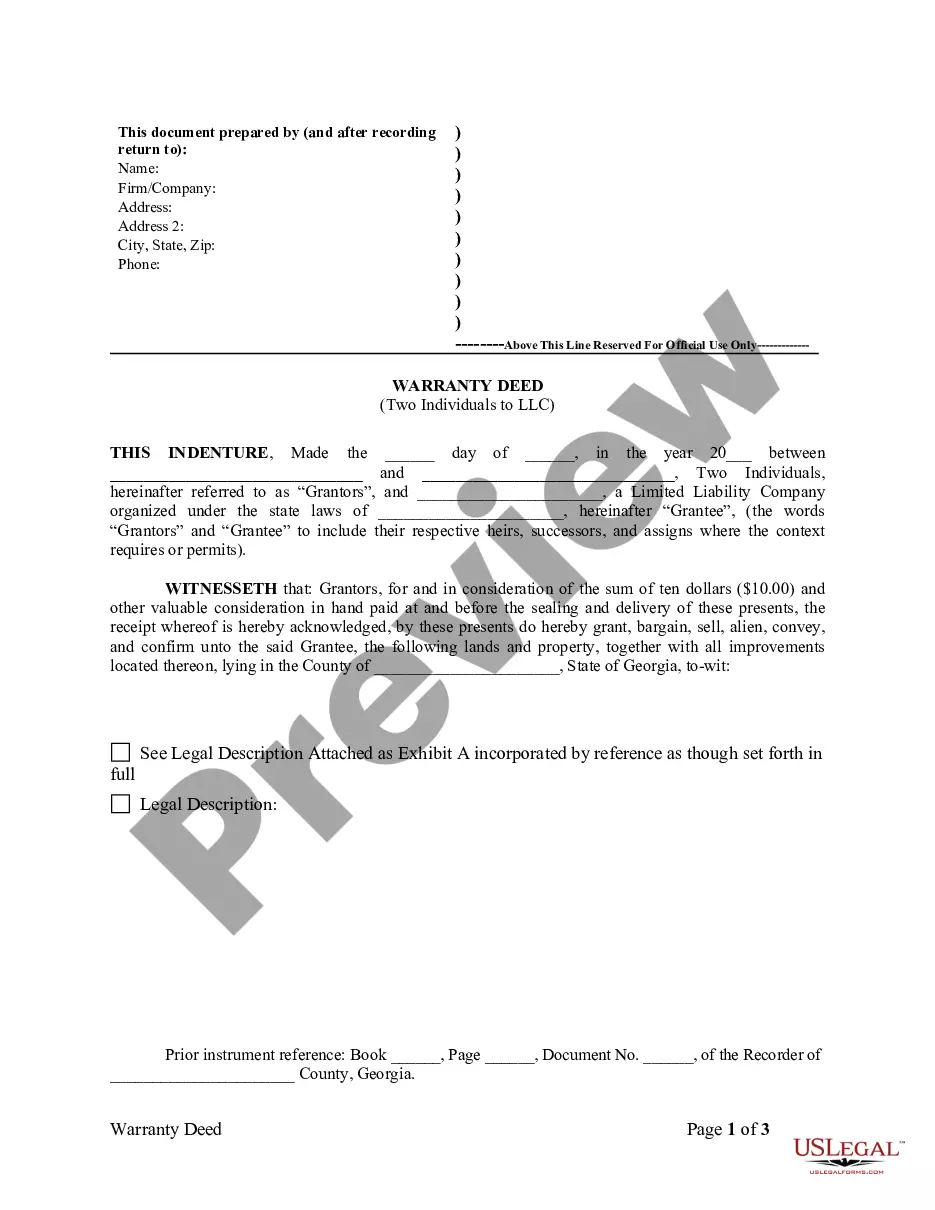

The Florida homestead exemption is a significant benefit for teachers working in Texas, allowing them to protect a portion of their home from property taxes and creditors. This form serves as a model letter to initiate communication regarding the requirements needed to process an affidavit for a homestead exemption, ensuring teachers can take advantage of this legal benefit. Key features include the need to specify the resident's county and provide documentation outlining the homestead status, which can enhance a teacher's financial stability. For the target audience, such as attorneys, partners, owners, associates, paralegals, and legal assistants, understanding the nuances of this exemption is critical when advising clients on property tax relief options. Filling out and editing this form requires attention to detail, particularly in customizing it to fit individual circumstances before sending it to the appropriate parties. Specific use cases include assisting clients in obtaining necessary documentation and ensuring procedural compliance for property tax exemption claims. By utilizing this form, legal professionals can streamline communications, effectively manage cases involving homestead exemptions, and ultimately facilitate a smoother process for teachers benefiting from this financial protection.